Key Takeaways:

- Goldman Sachs rebalances its Low Liquidity equity basket to manage market volatility.

- TFS Financial Corp. (TFSL, Financial) has a potential upside of 23.40% based on analyst price targets.

- Current brokerage consensus for TFSL is a "Hold" with a GF Value estimate indicating moderate upside.

Goldman Sachs has recently rebalanced its Low Liquidity (GSTHLLIQ) equity basket to better navigate current market fluctuations. This strategic move highlights the inclusion of companies like TFS Financial Corp. (TFSL), noted for its high illiquidity ratio and offering essential insights into investor strategies amid financial stress.

Wall Street Analysts Forecast

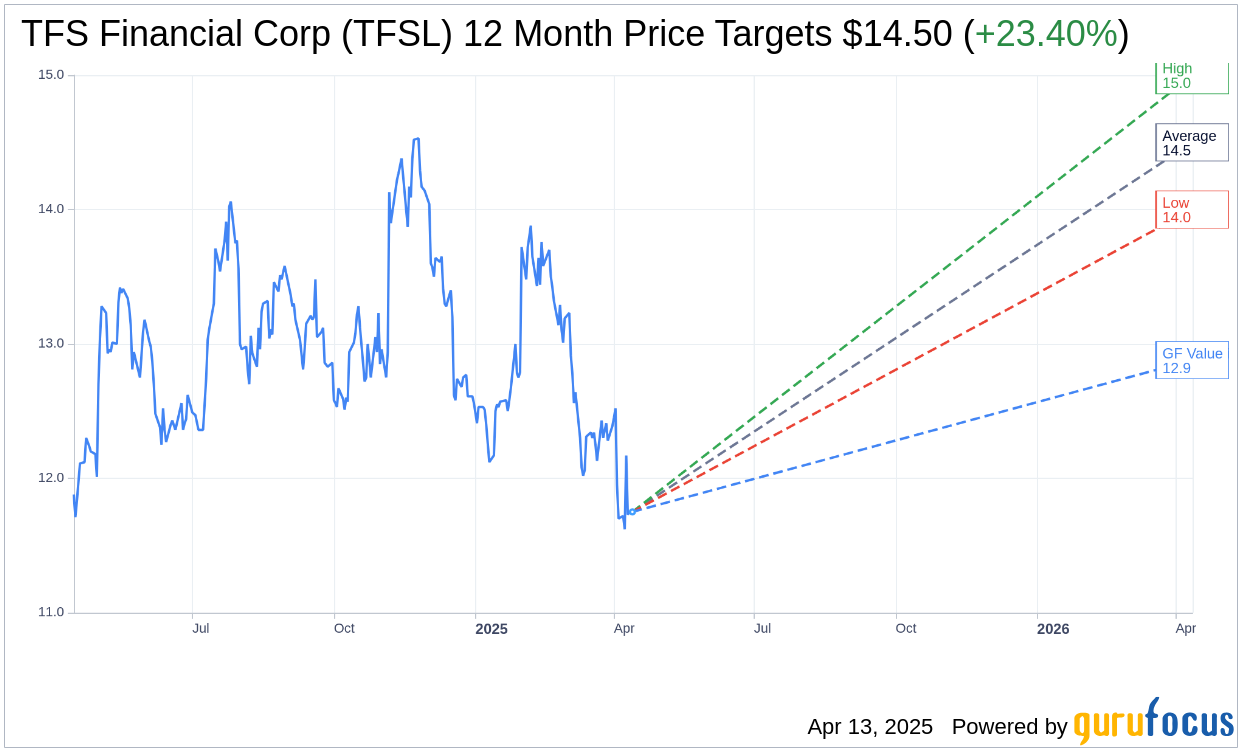

According to projections from two financial analysts, the average price target for TFS Financial Corp (TFSL, Financial) stands at $14.50. This target includes a high estimate of $15.00 and a low estimate of $14.00, indicating a potential upside of 23.40% from its current trading price of $11.75. For a more comprehensive analysis, investors can visit the TFS Financial Corp (TFSL) Forecast page.

The consensus recommendation from the surveyed brokerage firms positions TFS Financial Corp. (TFSL, Financial) at an average brokerage recommendation of 3.0, which translates to a "Hold" status. This rating system ranges from 1 to 5, where 1 indicates a Strong Buy and 5 signifies Sell.

Utilizing GuruFocus estimates, the anticipated GF Value for TFS Financial Corp (TFSL, Financial) over the next year is $12.88. This suggests a moderate upside of 9.62% from its current price of $11.75. The GF Value represents GuruFocus’ fair value estimate, calculated using the historical trading multiples of the stock, past business growth, and projected future performance. For more in-depth details, the TFS Financial Corp (TFSL) Summary page is available.