Key Takeaways:

- Quantum Computing Inc. secures a pivotal order for its Quantum Photonic Vibrometer, underscoring its technological prowess.

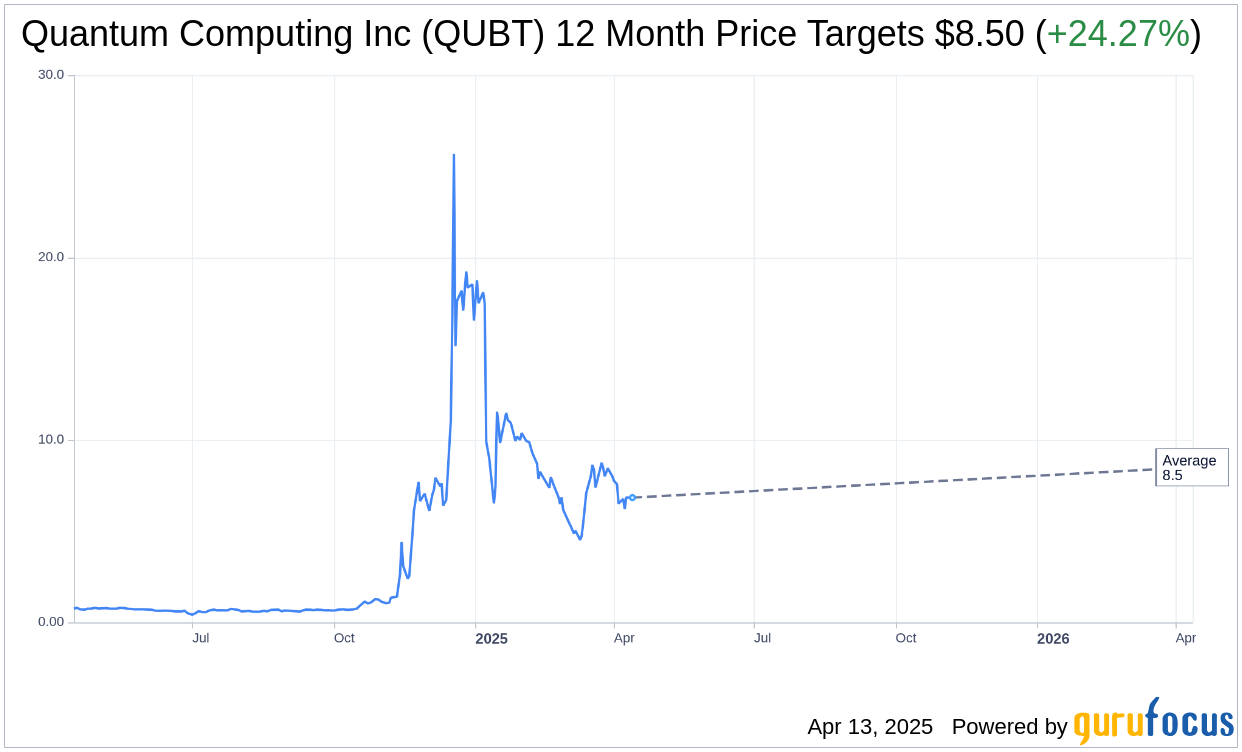

- Wall Street analysts project a potential 24.27% upside for QUBT stock.

- Contrasting valuations highlight differing perspectives on the stock's future performance.

Quantum Computing Inc. (QUBT, Financial) recently announced securing a noteworthy order from Delft University of Technology in the Netherlands for its Quantum Photonic Vibrometer. This purchase underscores the product's superior capabilities in non-destructive testing, which are crucial to the university's structural health monitoring research. The order represents a significant milestone and reflects the growing adoption of Quantum Computing's technology in cutting-edge research environments.

Wall Street Analysts Forecast

According to the latest analysis from one active analyst, the average price target for Quantum Computing Inc. (QUBT, Financial) stands at $8.50. This projection indicates a potential upside of 24.27% from the current share price of $6.84. The forecast range is consistent, with both the high and low estimates anchoring at $8.50. Investors can access deeper insights on these projections on the Quantum Computing Inc (QUBT) Forecast page.

The consensus recommendation from brokerage firms rates Quantum Computing Inc. (QUBT, Financial) at an average of 2.0, which translates to an "Outperform" rating. This rating is part of a broader scale that ranges from 1 for a Strong Buy to 5 for a Sell, indicating positive sentiment among analysts regarding QUBT's future performance.

However, when evaluated through the lens of GuruFocus estimates, the estimated GF Value for Quantum Computing Inc. (QUBT, Financial) is projected at $1.28 over the next year. This suggests a significant downside of 81.29% from the current trading price of $6.84. The GF Value considers historical trading multiples and past business growth, alongside future business performance estimates. For a more comprehensive analysis, visit the Quantum Computing Inc (QUBT) Summary page.