Quick Summary:

- Wells Fargo (WFC, Financial) maintains stable financial health with robust first-quarter results.

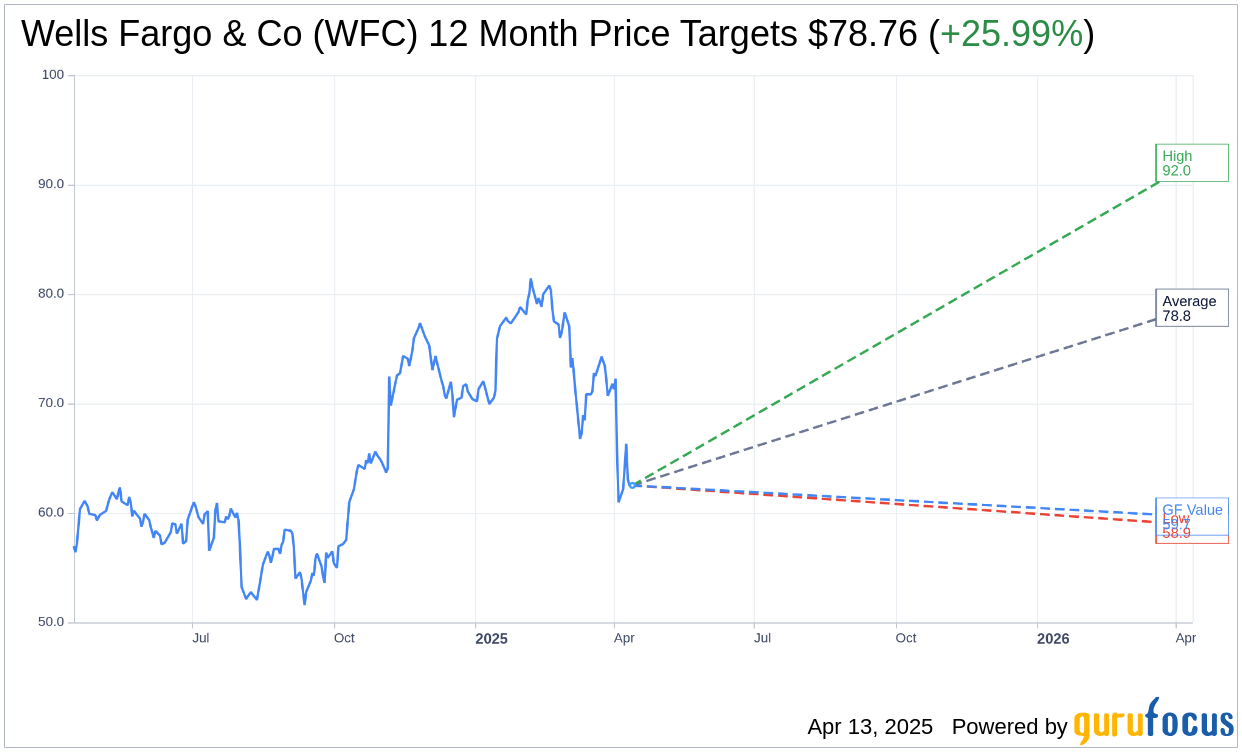

- Wall Street analysts see a potential 25.99% upside, with an average price target of $78.76.

- Wells Fargo’s GF Value suggests a slight downside, offering nuanced investment insight.

Wells Fargo (WFC) emerged from the first quarter with stable results, underscoring its disciplined expense management and solid consumer performance. Leveraging a strong balance sheet, the bank is actively expanding its commercial banking ventures and witnessing increased interest in alternative investments. However, it remains vigilant of the anticipated economic volatility as 2025 approaches.

Wall Street Analysts' Take on Wells Fargo

According to the projections from 21 analysts, the average one-year target price for Wells Fargo & Co (WFC, Financial) is pegged at $78.76. Ranging from a high of $92.00 to a low of $58.92, this average target suggests a notable potential upside of 25.99% from its current trading price of $62.51. Investors seeking further insights can visit the Wells Fargo & Co (WFC) Forecast page for more detailed estimates.

Brokerage Recommendations

Consensus from 23 brokerage firms places Wells Fargo & Co's (WFC, Financial) average brokerage recommendation at 2.1, categorizing it within the "Outperform" range. This rating operates on a scale from 1 to 5, where 1 suggests a Strong Buy and 5 indicates a Sell. This rating reflects growing confidence in the bank's strategic direction.

GF Value Indication

From the perspective of GuruFocus metrics, the estimated GF Value for Wells Fargo & Co (WFC, Financial) stands at $59.67 for the next year, implying a possible downside risk of 4.54% from its current price of $62.51. The GF Value represents an assessment of the stock’s fair trading value, drawing from historical trading multiples, past business growth, and future performance projections. For more comprehensive data, investors can explore the Wells Fargo & Co (WFC) Summary page.

Making informed investment decisions requires weighing these insights, particularly as the economic landscape evolves. Wells Fargo’s solid performance and strategic expansions are promising, but potential investors should remain mindful of the nuanced outlook presented by both market analysts and GF Value metrics.