- TSMC's share price reacts to potential U.S. semiconductor tariff news.

- Analysts set a significant upside potential for TSM stock.

- Brokerage firms maintain an "Outperform" rating for TSMC.

Shares in Taiwan Semiconductor Manufacturing Company (TSMC) experienced volatility after the U.S. indicated the potential introduction of new semiconductor tariffs. Initially, TSMC shares rose, fueled by temporary tariff exemptions on Chinese smartphones and electronics. Investors now eagerly await the company’s first-quarter earnings release, scheduled for Thursday.

Wall Street Analysts Forecast

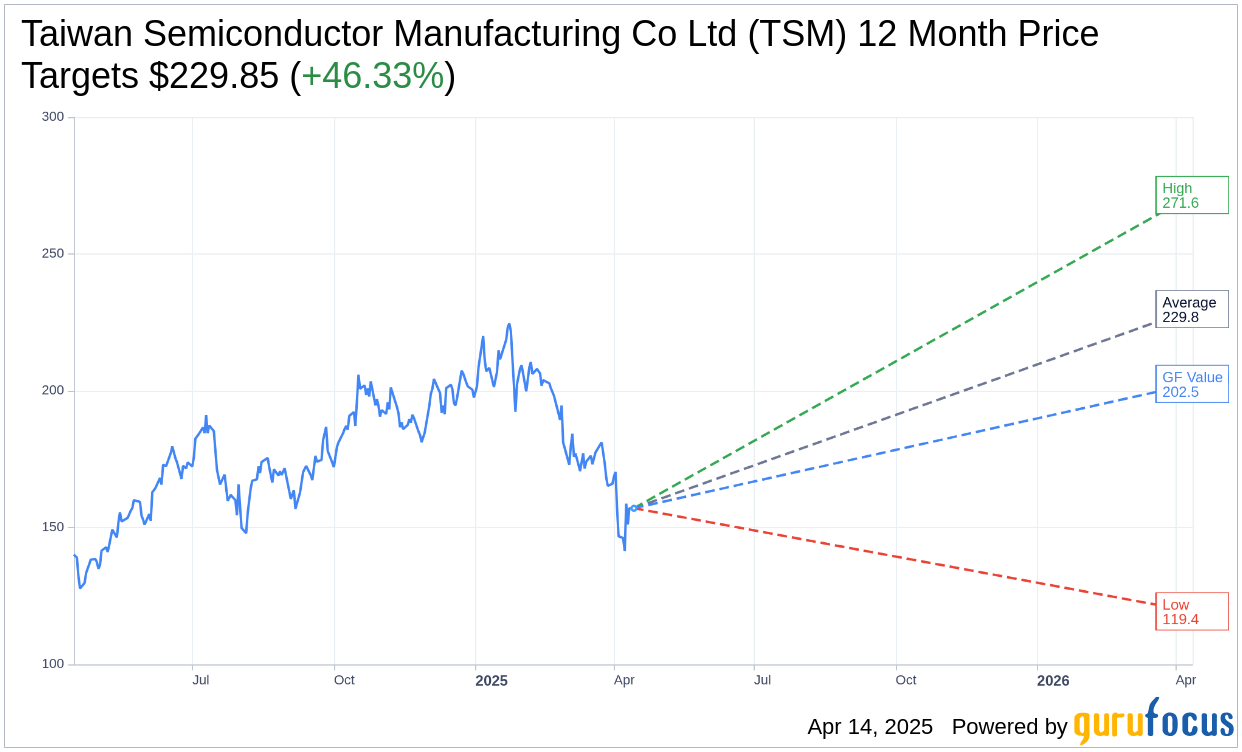

According to forecasts by 16 analysts, Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) is expected to reach an average price target of $229.85 within the next year. Predictions vary, with the highest estimate at $271.55 and the lowest at $119.37. This average target suggests a potential upside of 46.33% compared to its current trading price of $157.08. For more in-depth data, visit the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Forecast page.

Market Consensus and GF Value

From 18 brokerage firms, TSMC enjoys an average recommendation of 1.6, which aligns with an "Outperform" status. This rating is based on a scale of 1 to 5, where 1 indicates a Strong Buy and 5 represents a Sell.

GuruFocus's proprietary measurements estimate the GF Value of TSMC at $202.54 in one year. This estimate presents a upside of 28.94% from the current market price of $157.08. The GF Value is calculated considering historical trading multiples, past business growth, and future business performance forecasts. For further details, visit the Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) Summary page.