Key Takeaways:

- NioCorp Developments (NB, Financial) projects a narrowing net loss for the fiscal year.

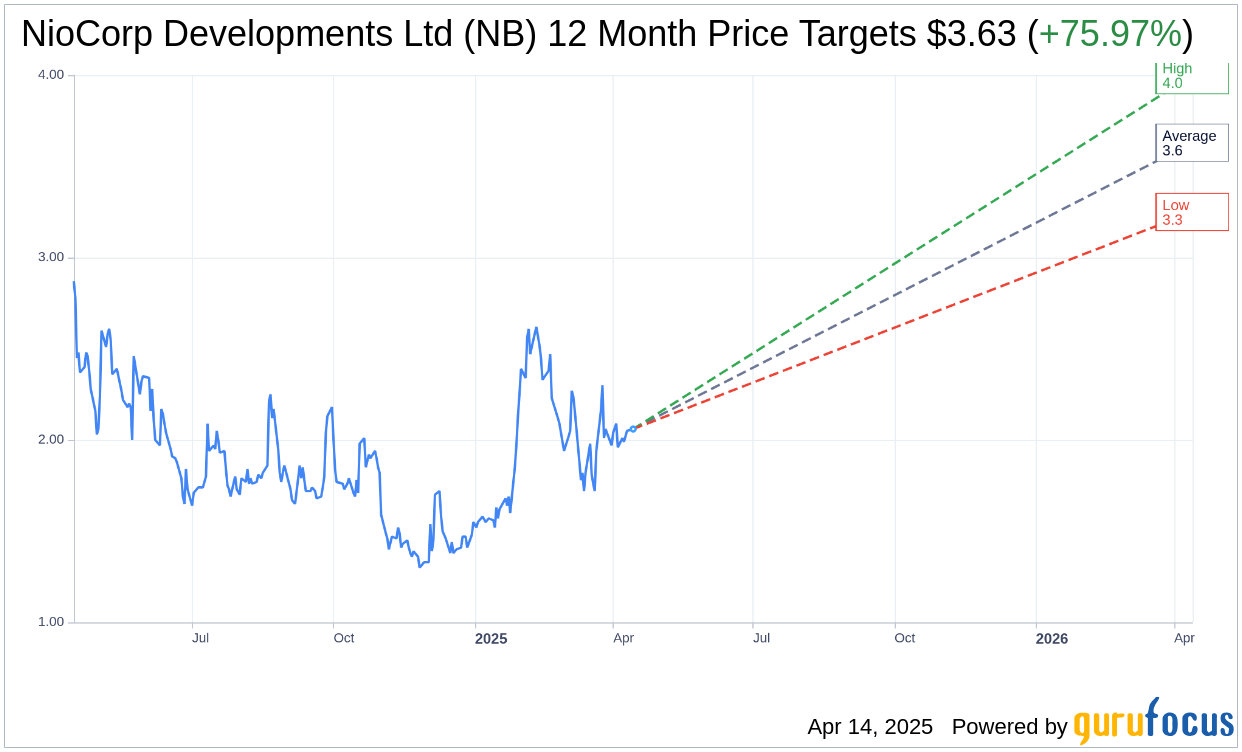

- Analysts predict a significant upside potential for NB stock.

- The consensus among brokerage firms rates NB as "Outperform."

NioCorp Developments: Financial Outlook

NioCorp Developments (NB) is set to announce a net loss of $5.4 million for the quarter ending March 2025, with an EPS of -$0.11, aligned with last year's performance. Over a nine-month period, the company anticipates a reduced loss of $8 million, showcasing a notable improvement from the previous year's $11 million deficit.

Wall Street Analysts' Targets and Recommendations

According to forecasts from two analysts, the average one-year price target for NioCorp Developments Ltd (NB, Financial) stands at $3.63, with projections ranging between a high of $4.00 and a low of $3.25. This average target suggests a potential upside of 75.97% from the current stock price of $2.06. For more in-depth data, visit the NioCorp Developments Ltd (NB) Forecast page.

The consensus from two brokerage firms assigns NioCorp Developments Ltd (NB, Financial) an average recommendation of 2.0, which translates to an "Outperform" rating. In the rating system, 1 indicates a Strong Buy, while 5 signifies a Sell.

Conclusion

With a projected narrowing of losses and substantial upside potential as per analyst forecasts, NioCorp Developments Ltd (NB, Financial) presents an intriguing opportunity for investors. The "Outperform" rating further strengthens the stock's case, suggesting positive sentiment among brokerage firms. Investors might want to consider these factors when evaluating NB's investment prospects.