Citigroup has adjusted its price target for Emerson Electric Co. (EMR, Financial), bringing it down from $132 to $119, though the financial institution continues to recommend buying the stock. This revision comes amid a broader examination of the U.S. electrical equipment and industrial sectors as they gear up for the first quarter.

Citi analysts suggest that the current U.S. administration's protective trade policies could rejuvenate long-term growth prospects in these industries. Despite the downward adjustment in the price target, Citi remains optimistic about the sector, indicating that foundational value within these multi-industry firms is on the rise.

As the first quarter progresses, the firm anticipates that order volumes and earnings reports from companies in this domain should largely meet expectations, presenting a stable outlook for investors.

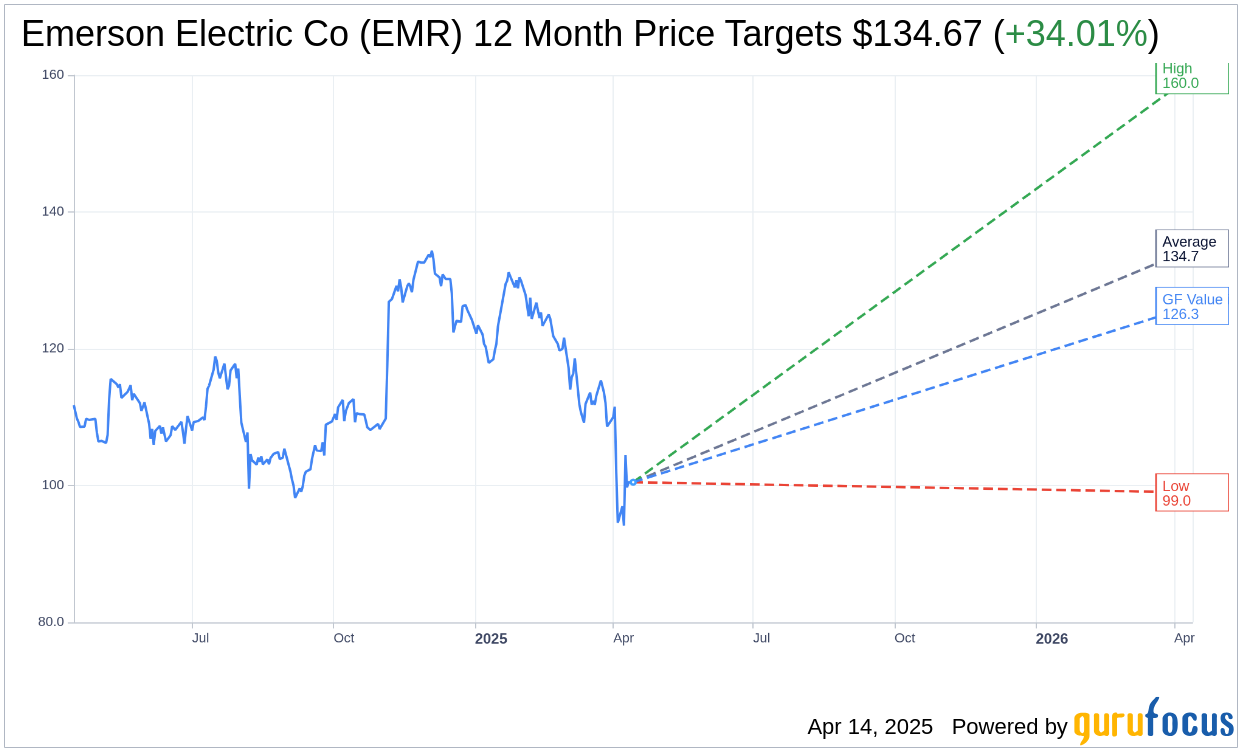

Wall Street Analysts Forecast

Based on the one-year price targets offered by 26 analysts, the average target price for Emerson Electric Co (EMR, Financial) is $134.67 with a high estimate of $160.00 and a low estimate of $99.00. The average target implies an upside of 34.01% from the current price of $100.49. More detailed estimate data can be found on the Emerson Electric Co (EMR) Forecast page.

Based on the consensus recommendation from 29 brokerage firms, Emerson Electric Co's (EMR, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Emerson Electric Co (EMR, Financial) in one year is $126.28, suggesting a upside of 25.66% from the current price of $100.49. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Emerson Electric Co (EMR) Summary page.