Citi has revised its price target for Flowserve (FLS, Financial), a prominent player in the industrial equipment sector, lowering it from $72 to $56. Despite this adjustment, the firm upholds its Buy rating on the stock. This update comes as part of Citi's preview of the first quarter for U.S. electrical equipment and industrial conglomerates.

Citi's analysis suggests that the protectionist economic strategies under the Trump Administration could potentially revitalize long-term growth trends within this sector. The firm perceives emerging value opportunities across the industry, emphasizing a positive outlook on the sector's overall performance. According to the analyst, order levels and earnings for the first quarter are anticipated to remain largely satisfactory. The Buy rating suggests that Citi still sees potential growth and opportunity in Flowserve’s shares, despite the lowered price target.

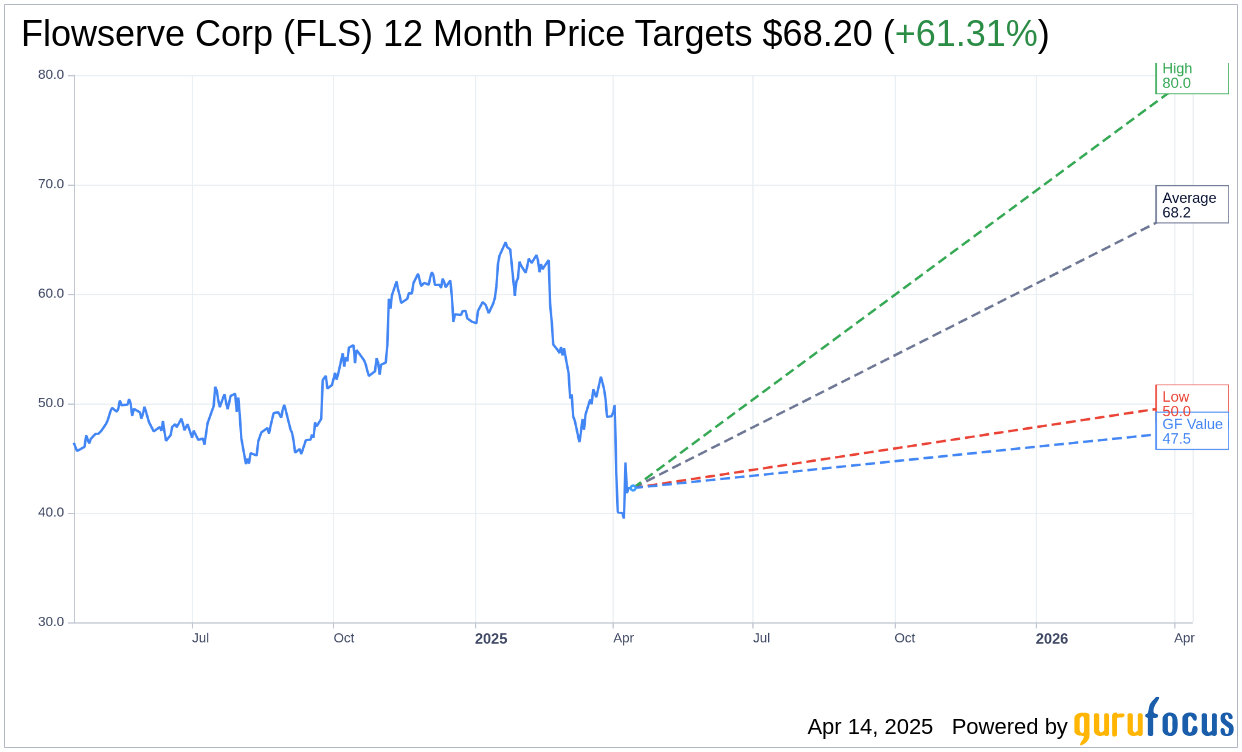

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Flowserve Corp (FLS, Financial) is $68.20 with a high estimate of $80.00 and a low estimate of $50.00. The average target implies an upside of 61.31% from the current price of $42.28. More detailed estimate data can be found on the Flowserve Corp (FLS) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Flowserve Corp's (FLS, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Flowserve Corp (FLS, Financial) in one year is $47.51, suggesting a upside of 12.37% from the current price of $42.28. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Flowserve Corp (FLS) Summary page.