Barclays has revised its price target for CyberArk (CYBR, Financial), trimming it from $450 to $405. Despite this adjustment, Barclays maintains an Overweight rating on the company's shares. This update is part of Barclays' preview of the first quarter results for 16 companies involved in security, design, and vertical software-as-a-service sectors.

CyberArk, a key player in cybersecurity solutions, continues to attract attention as it prepares to report its quarterly performance. The Overweight rating indicates that Barclays still holds a positive outlook on the stock, suggesting that it is expected to outperform in the market.

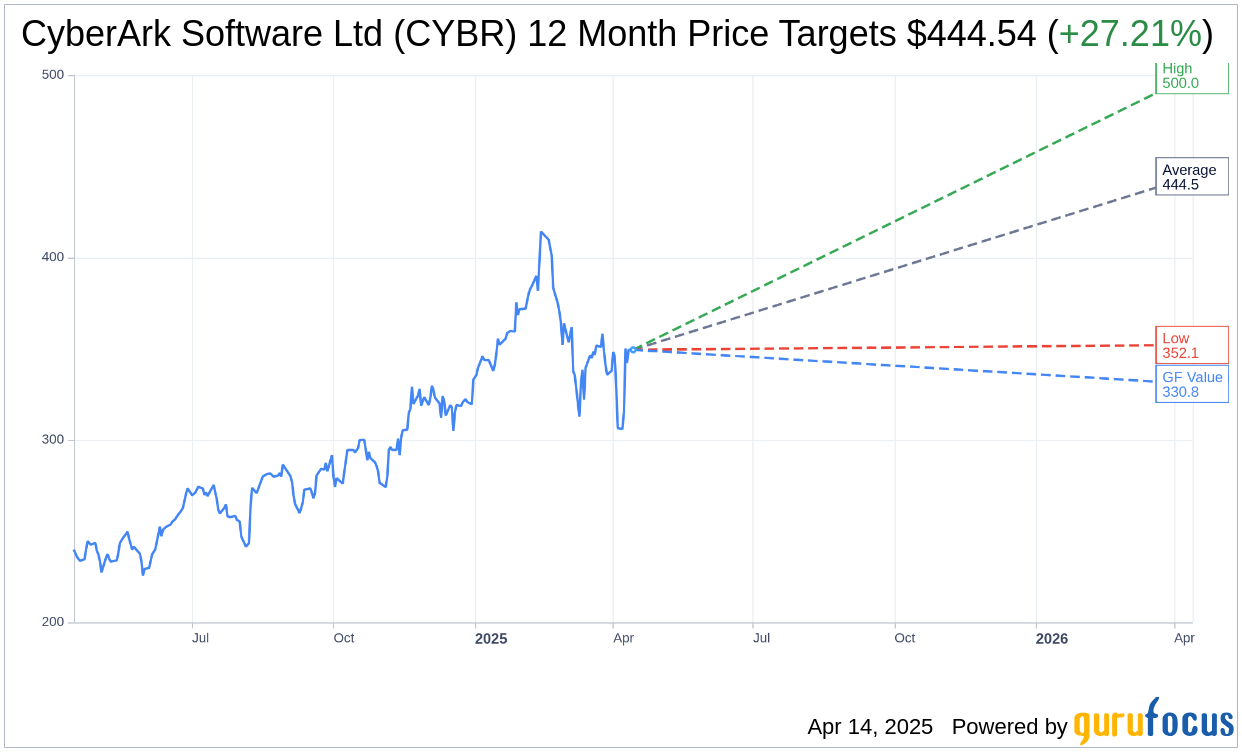

Wall Street Analysts Forecast

Based on the one-year price targets offered by 34 analysts, the average target price for CyberArk Software Ltd (CYBR, Financial) is $444.54 with a high estimate of $500.00 and a low estimate of $352.11. The average target implies an upside of 27.21% from the current price of $349.44. More detailed estimate data can be found on the CyberArk Software Ltd (CYBR) Forecast page.

Based on the consensus recommendation from 37 brokerage firms, CyberArk Software Ltd's (CYBR, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CyberArk Software Ltd (CYBR, Financial) in one year is $330.79, suggesting a downside of 5.34% from the current price of $349.44. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CyberArk Software Ltd (CYBR) Summary page.