Bank of America (BofA) has revised its price target for Dover Corporation (DOV, Financial), reducing it to $210 from the previous target of $250. Despite maintaining a Buy rating on the stock, the adjustment reflects BofA's cautious stance given the current market conditions.

In its preview for the Industrials/Multi-Industry sector, BofA anticipates that companies' first-quarter earnings will either meet or exceed expectations. However, due to heightened uncertainties and established tariffs, the firm has opted to lower its estimates ahead of time.

This decision follows the announcement of a temporary 90-day pause on reciprocal tariffs as of April 9. Nonetheless, BofA's analyst indicates that persistent concerns over tariff policies continue to influence their financial projections for the sector, including Dover.

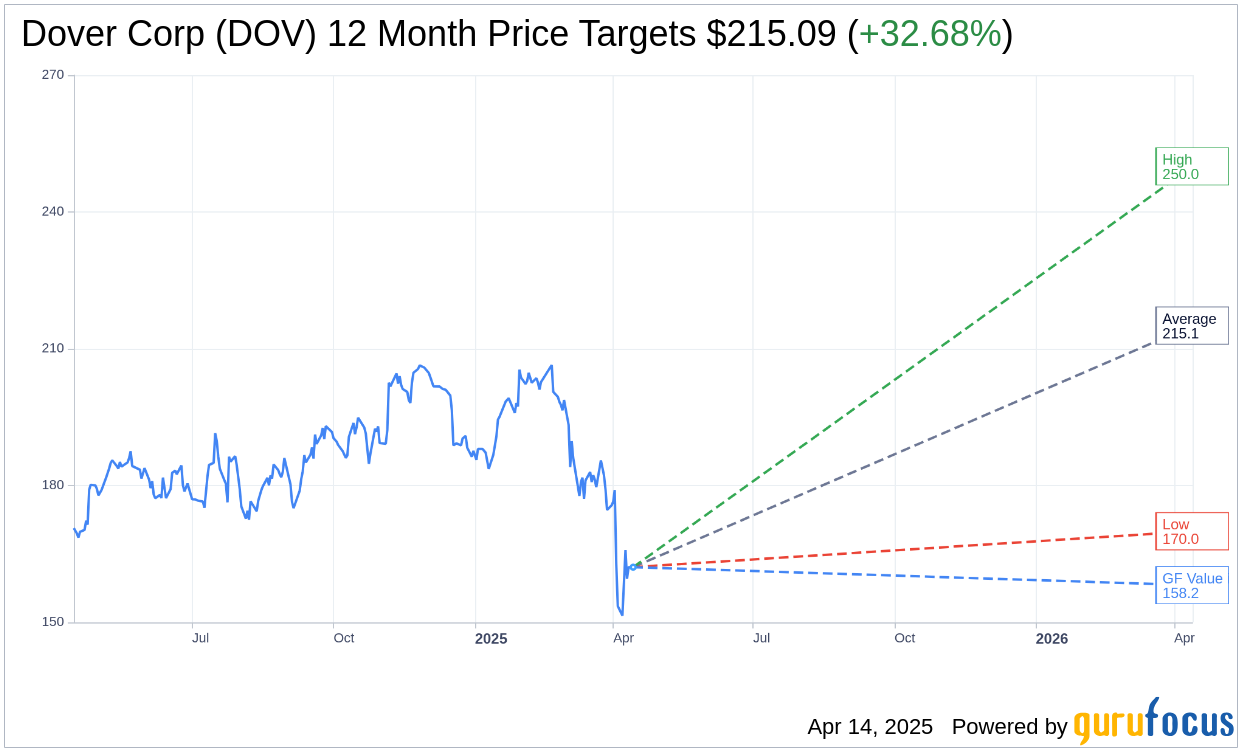

Wall Street Analysts Forecast

Based on the one-year price targets offered by 16 analysts, the average target price for Dover Corp (DOV, Financial) is $215.09 with a high estimate of $250.00 and a low estimate of $169.98. The average target implies an upside of 32.68% from the current price of $162.11. More detailed estimate data can be found on the Dover Corp (DOV) Forecast page.

Based on the consensus recommendation from 19 brokerage firms, Dover Corp's (DOV, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Dover Corp (DOV, Financial) in one year is $158.16, suggesting a downside of 2.44% from the current price of $162.11. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Dover Corp (DOV) Summary page.