StoneX Group Inc. (SNEX, Financial) is set to expand its global reach through a definitive merger agreement with R.J. O’Brien & Associates, the oldest futures brokerage and clearing firm in the United States. This strategic move will incorporate all of R.J. O'Brien’s worldwide operations into StoneX, pending necessary regulatory consents and standard closing conditions.

The merger, expected to finalize in the third quarter of this year, will establish the combined entity as a prominent futures commission merchant within the U.S. market. This integration is poised to strengthen its influence and capability within the global financial markets, offering enhanced services and a broader footprint in the futures trading landscape.

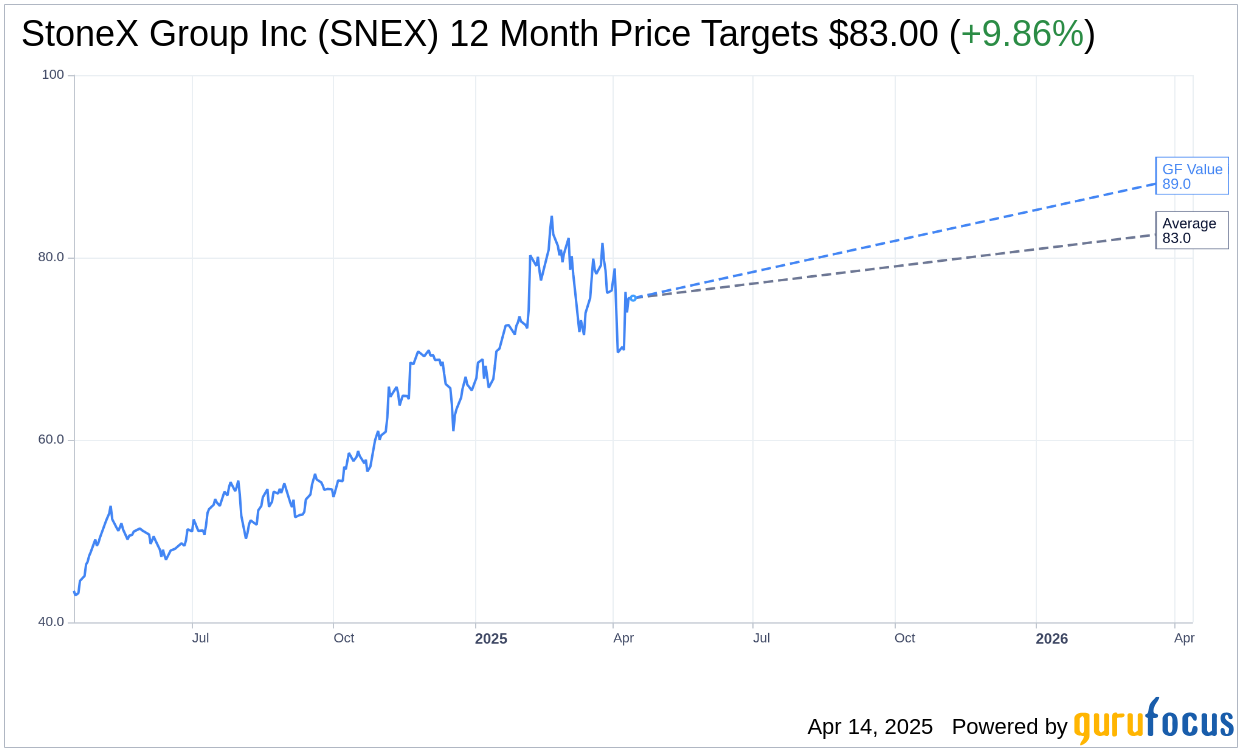

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for StoneX Group Inc (SNEX, Financial) is $83.00 with a high estimate of $83.00 and a low estimate of $83.00. The average target implies an upside of 9.86% from the current price of $75.55. More detailed estimate data can be found on the StoneX Group Inc (SNEX) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, StoneX Group Inc's (SNEX, Financial) average brokerage recommendation is currently 1.0, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for StoneX Group Inc (SNEX, Financial) in one year is $88.98, suggesting a upside of 17.78% from the current price of $75.55. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the StoneX Group Inc (SNEX) Summary page.