An options trader capitalized on a strategic move with Alibaba (BABA, Financial) calls, securing a significant profit in just one day. On purchasing 2,000 June 2025 call options at a strike price of $120 for $4.70 each, this investor made a crucial decision at 10:29 AM ET, when Alibaba shares were priced at $102.56.

By the end of the trading session, Alibaba's stock closed higher at $107.73, which positively impacted the value of the call options, marking them up to $6.58. This price increase translated into a substantial mark-to-market profit of 40%, or $375,000, against the initial investment of $940,000.

This quick turn of events underscored the potential rewards of strategic options trading, with the trader benefitting significantly from the rise in Alibaba's share price over a single trading day.

Wall Street Analysts Forecast

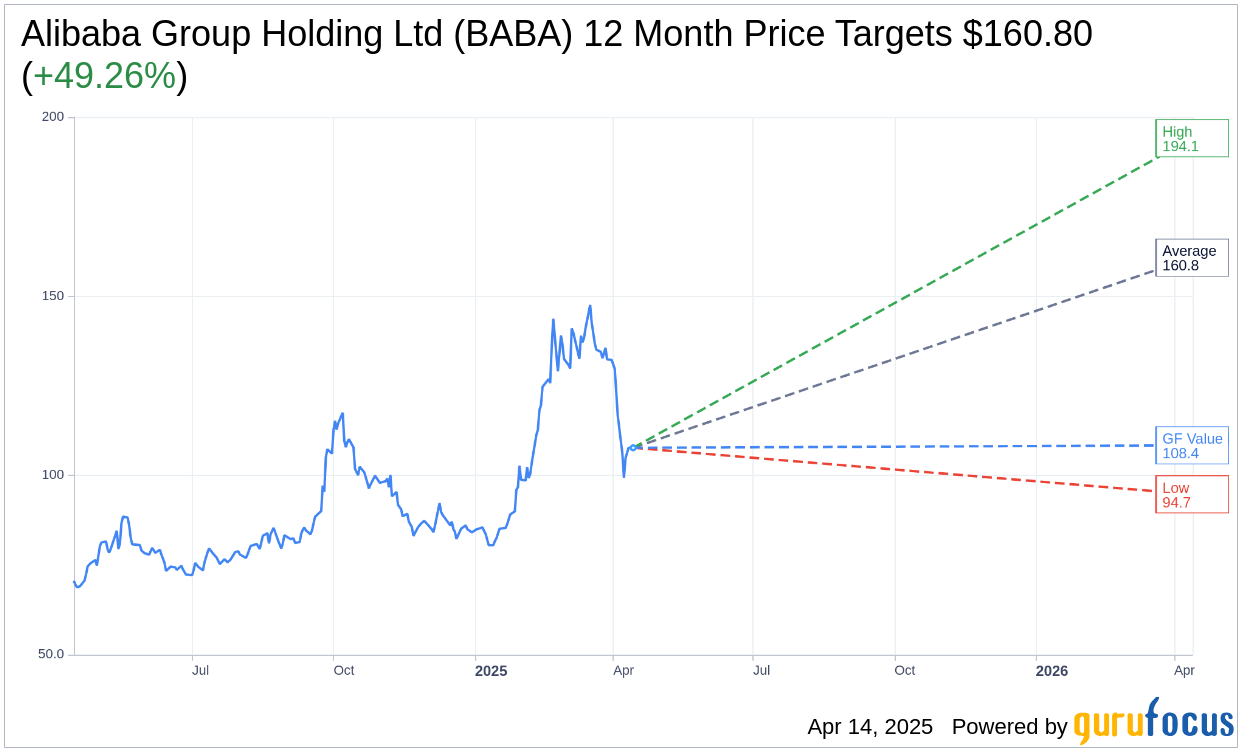

Based on the one-year price targets offered by 38 analysts, the average target price for Alibaba Group Holding Ltd (BABA, Financial) is $160.80 with a high estimate of $194.13 and a low estimate of $94.75. The average target implies an upside of 49.26% from the current price of $107.73. More detailed estimate data can be found on the Alibaba Group Holding Ltd (BABA) Forecast page.

Based on the consensus recommendation from 43 brokerage firms, Alibaba Group Holding Ltd's (BABA, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Alibaba Group Holding Ltd (BABA, Financial) in one year is $108.41, suggesting a upside of 0.63% from the current price of $107.73. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Alibaba Group Holding Ltd (BABA) Summary page.