- StoneX Group (SNEX, Financial) is set to merge with R.J. O'Brien & Associates, potentially strengthening its market position.

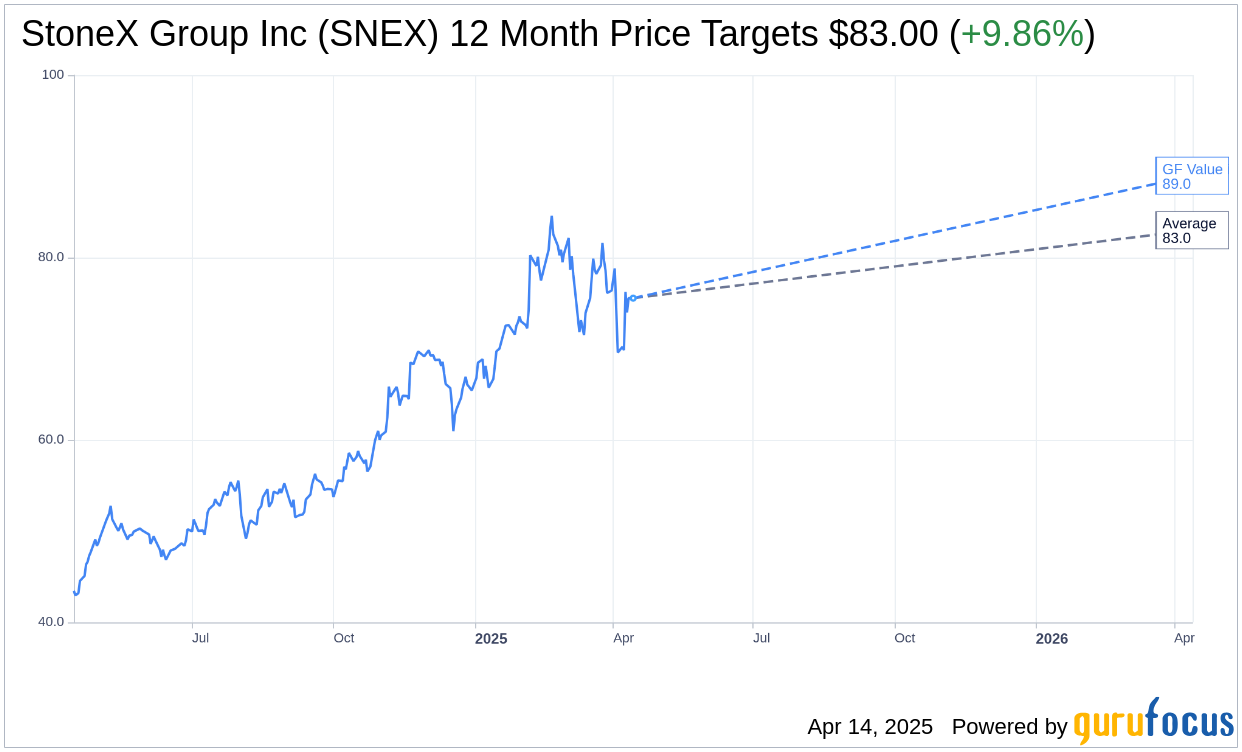

- Analysts set a one-year price target for SNEX at $83.00, suggesting a 9.86% potential upside.

- GuruFocus estimates a GF Value of $88.98, indicating a possible 17.78% upside.

StoneX Group (SNEX) has announced a strategic merger with R.J. O'Brien & Associates, poised to consolidate and enhance its global business operations. Investors can expect the deal to close by the third quarter, marking a significant step in augmenting StoneX's market capabilities.

Wall Street Analysts Forecast

In examining the projections of one analyst over the next year, StoneX Group Inc (SNEX, Financial) is forecasted to reach an average target price of $83.00. Currently priced at $75.55, this presents an opportunity for a 9.86% increase. Investors seeking more detailed projections can explore our comprehensive StoneX Group Inc (SNEX) Forecast page for further insights.

Moreover, the consensus from two brokerage firms presently rates StoneX Group Inc's (SNEX, Financial) stock at 1.0, signaling a "Buy" recommendation. This rating is based on a scale from 1 to 5, with 1 being a Strong Buy and 5 a Sell, underscoring strong analyst confidence in SNEX's performance.

From a valuation standpoint, GuruFocus calculates the GF Value for StoneX Group Inc (SNEX, Financial) to be $88.98 over the next year. This suggests a potential upside of 17.78% from its current market price of $75.55. The GF Value provides an estimate of what the stock should ideally be trading at, determined by historical trading multiples and anticipated business growth. For a deeper dive into these valuations, visit the StoneX Group Inc (SNEX) Summary page.