Key Highlights:

- StoneX Group's acquisition of R.J. O'Brien & Associates aims to solidify its status as a leading futures commission merchant in the U.S.

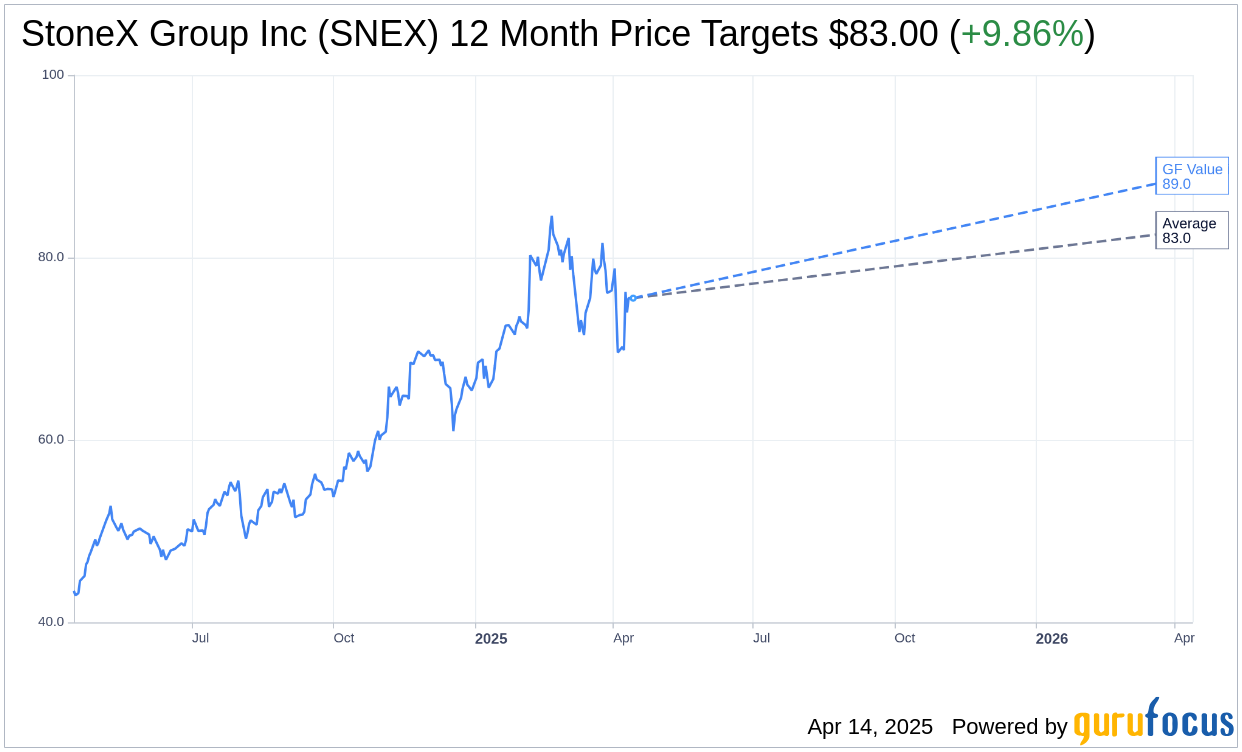

- Wall Street's price target suggests a potential 9.86% upside for investors in the coming year.

- GuruFocus estimates a GF Value increase, projecting a 17.78% upside from the current stock price.

StoneX Group (SNEX, Financial) has finalized an agreement to unite with R.J. O'Brien & Associates. This strategic merger, anticipated to be completed in the third quarter, is set to elevate the collective entity as a dominant force in the U.S. futures commission merchant space, thereby strengthening its foothold in global financial markets.

Wall Street Analysts Forecast

According to price targets proposed by a sole analyst, StoneX Group Inc (SNEX, Financial) presents an average target price of $83.00. The estimates unanimously reflect a high and low projection of $83.00, projecting a potential upside of 9.86% from its current trading price of $75.55. For a comprehensive breakdown, please check the StoneX Group Inc (SNEX) Forecast page.

The consensus recommendation from two brokerage firms currently places StoneX Group Inc (SNEX, Financial) at an average brokerage recommendation score of 1.0, signifying a "Buy" status. The rating spectrum ranges from 1 (Strong Buy) to 5 (Sell).

GuruFocus estimates reveal a projected GF Value for StoneX Group Inc (SNEX, Financial) to reach $88.98 within a year. This underscores a promising upside of 17.78% from its present price point of $75.55. The GF Value represents GuruFocus' calculated fair market value, derived from historical trading multiples, alongside past business developments and projections for future business performance. Additional data and insights are accessible on the StoneX Group Inc (SNEX) Summary page.