BTIG analyst Ryan Zimmerman has revised the price target for GE HealthCare (GEHC, Financial), lowering it from $103 to $95 while maintaining a Buy rating on the stock. This adjustment comes in light of the upcoming first-quarter results for the MedTech industry.

Traditionally viewed as a stable investment sector, MedTech companies now face challenges that may overshadow their quarterly earnings. Analysts highlight that the focus is shifting towards how well companies manage ongoing issues such as the persistent trade tensions with China and significant budget reductions in U.S. federal healthcare agencies.

The uncertainty surrounding these geopolitical and domestic issues could influence investor sentiment negatively, as companies might struggle to provide satisfactory clarity on their navigational strategies during the earnings season.

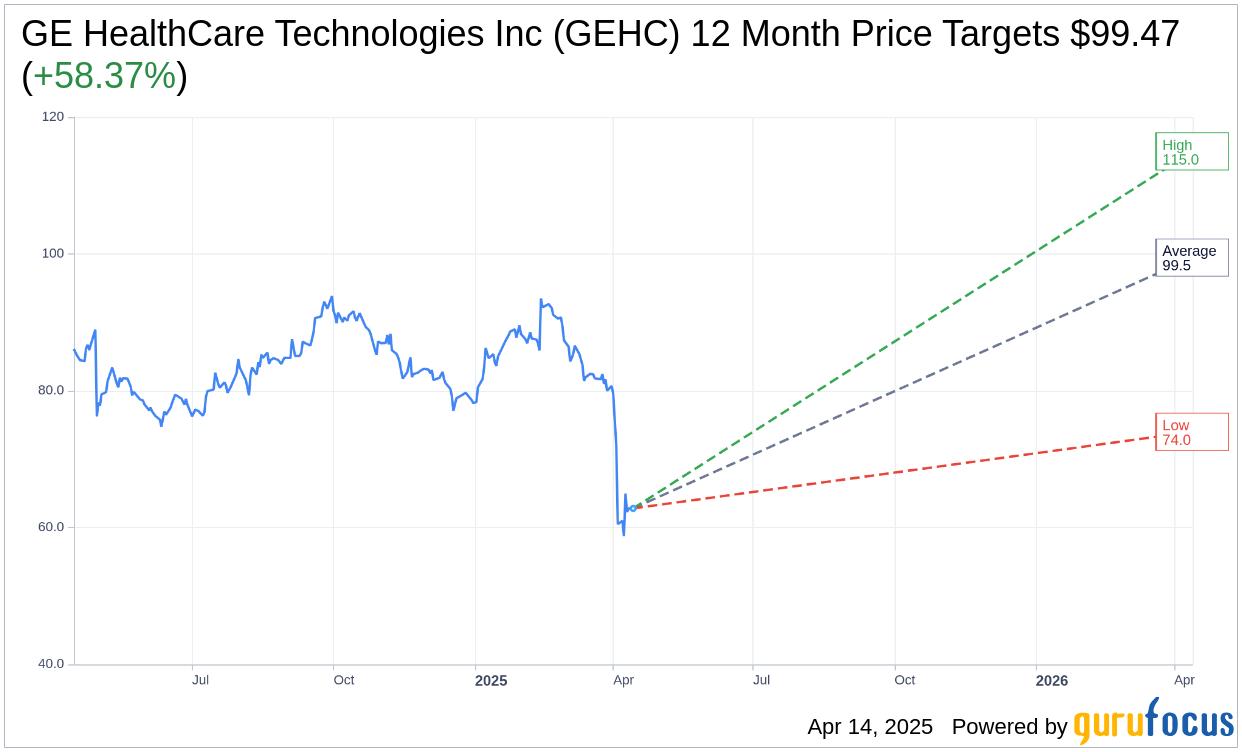

Wall Street Analysts Forecast

Based on the one-year price targets offered by 18 analysts, the average target price for GE HealthCare Technologies Inc (GEHC, Financial) is $99.47 with a high estimate of $115.00 and a low estimate of $74.00. The average target implies an upside of 58.37% from the current price of $62.81. More detailed estimate data can be found on the GE HealthCare Technologies Inc (GEHC) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, GE HealthCare Technologies Inc's (GEHC, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.