Truist analyst Peter Osterland has revised the price target for Minerals Technologies (MTX, Financial), bringing it down to $92 from a previous estimate of $101. Despite this adjustment, the analyst maintains a Buy rating for the company's stock. This change is part of a broader review of the chemicals sector.

The revision comes as the firm evaluates the potential impacts of ongoing tariff issues. While the latest projections by Truist do not factor in a significant economic downturn, they do reflect tempered expectations for demand growth through 2025-2026. This cautious outlook suggests a slower pace of growth in demand than previously anticipated.

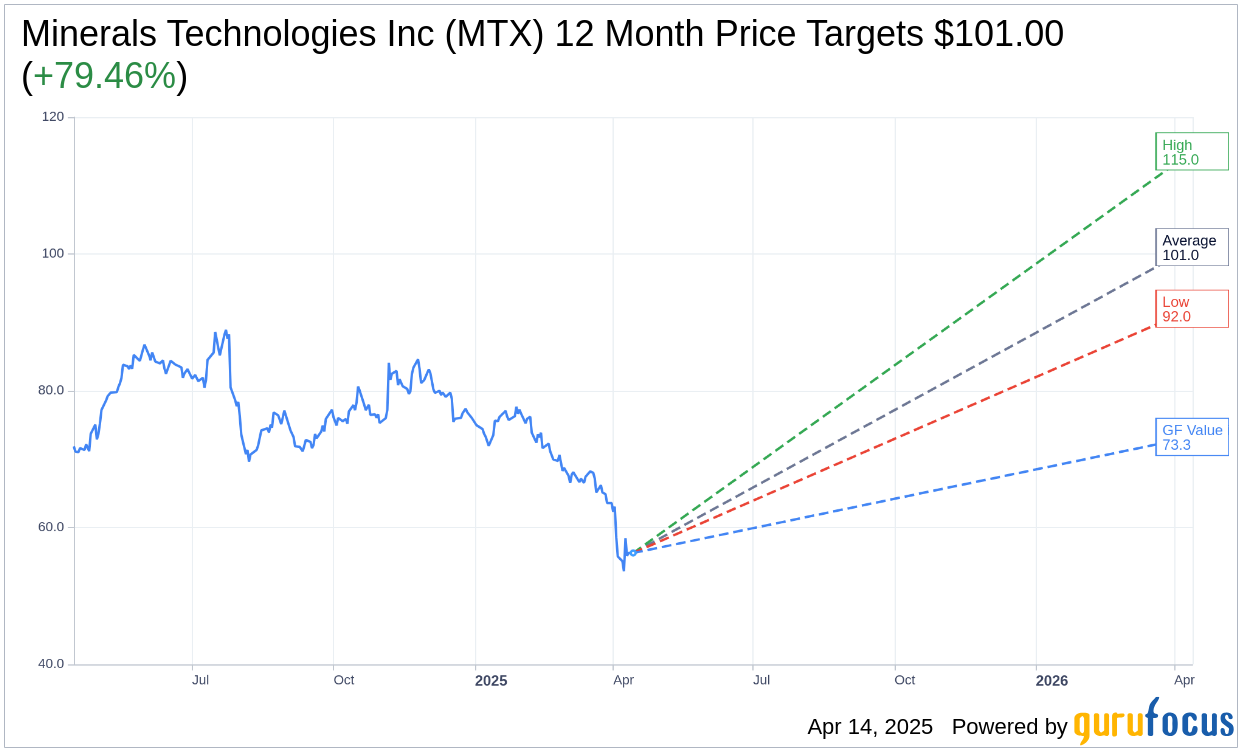

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Minerals Technologies Inc (MTX, Financial) is $101.00 with a high estimate of $115.00 and a low estimate of $92.00. The average target implies an upside of 79.46% from the current price of $56.28. More detailed estimate data can be found on the Minerals Technologies Inc (MTX) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Minerals Technologies Inc's (MTX, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Minerals Technologies Inc (MTX, Financial) in one year is $73.25, suggesting a upside of 30.15% from the current price of $56.28. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Minerals Technologies Inc (MTX) Summary page.