Key Takeaways:

- DuPont de Nemours upgraded to "Overweight" by KeyBanc Securities, reflecting confidence in its growth potential.

- The stock has an average price target of $96.52, offering a significant upside from its current price.

- Consensus brokerage recommendation suggests an "Outperform" status, indicating positive market sentiment.

DuPont de Nemours (DD, Financial) has captured the attention of analysts at KeyBanc Securities, who recently upgraded the stock to "Overweight." This upgrade is underpinned by DuPont's strong balance sheet and promising growth in key sectors, particularly electronics and water. Despite a notable 21% decline since the end of March, KeyBanc has set an ambitious price target of $81, taking into account the recent shifts in tariffs that affect DuPont's operations in China.

Wall Street Analysts Forecast

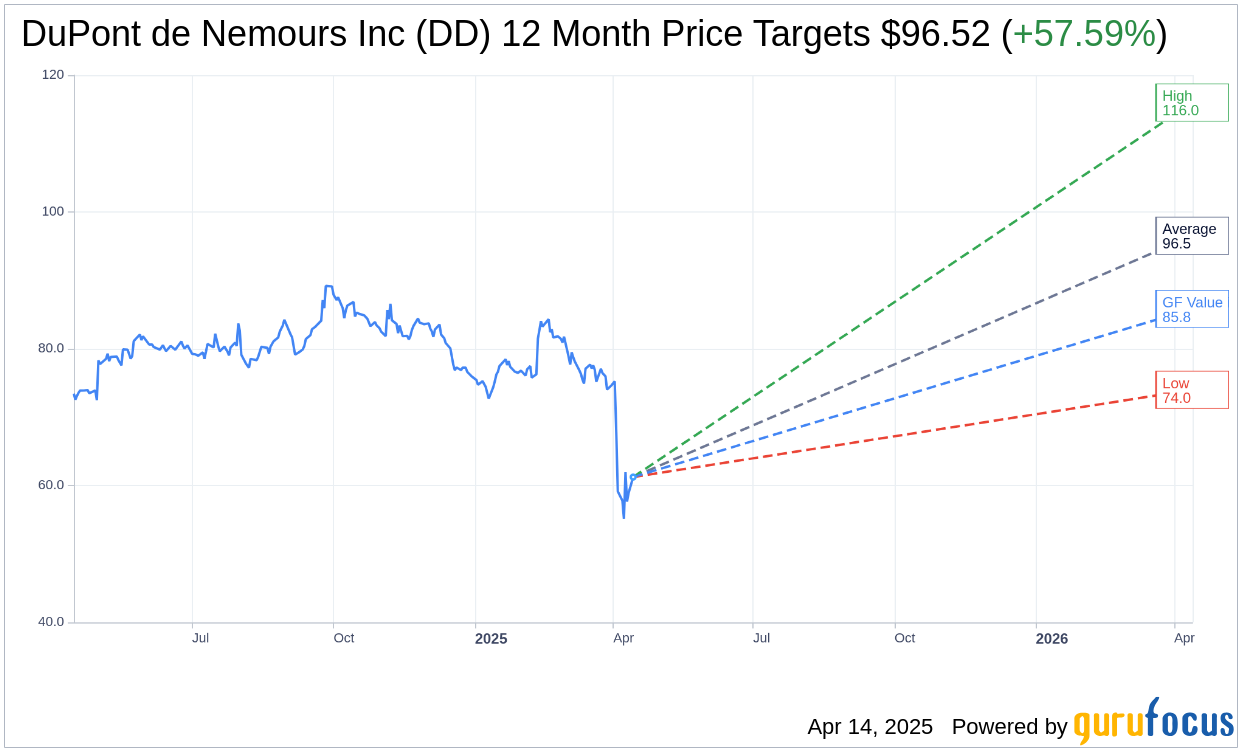

Analyst sentiment remains bullish for DuPont de Nemours Inc (DD, Financial). According to the latest data from 14 analysts, the average one-year price target stands at $96.52, with estimates ranging from a high of $116.00 to a low of $74.00. This average target suggests a potential upside of 57.59% from the current share price of $61.25. For further insights, investors can visit the DuPont de Nemours Inc (DD) Forecast page.

In terms of brokerage opinions, DuPont is making waves with an average recommendation of 2.1 among 19 firms, which translates to an "Outperform" rating. This scale measures from 1 to 5, where 1 is a "Strong Buy" and 5 is "Sell," highlighting a solid endorsement from the investment community.

GuruFocus provides its own valuation insights through the GF Value metric, estimating that DuPont's stock should ideally be valued at $85.84 in a year. This figure implies a notable upside of 40.15% from its current market price. The GF Value is a comprehensive estimation that reflects historical trading multiples, business growth trends, and projected future performance. More in-depth information is accessible on the DuPont de Nemours Inc (DD, Financial) Summary page.