- Semi-Annual Dividend: Coca-Cola FEMSA (KOF, Financial) is set to pay a dividend of $0.883 per share with a forward yield of 1.89%.

- Attractive Price Target: Analysts forecast an average price target of $103.88, suggesting a 9.27% upside potential.

- Outperform Rating: Received an "Outperform" consensus from 10 brokerage firms with an average recommendation score of 1.7.

Coca-Cola FEMSA (KOF) has delighted shareholders with the announcement of a semi-annual dividend of $0.883 per share. This generous distribution reflects a forward yield of 1.89%, benefiting investors who are recorded as shareholders as of April 22. Mark your calendars for the ex-dividend date, also set on April 22, with the payment scheduled for May 5.

Wall Street Analysts Forecast

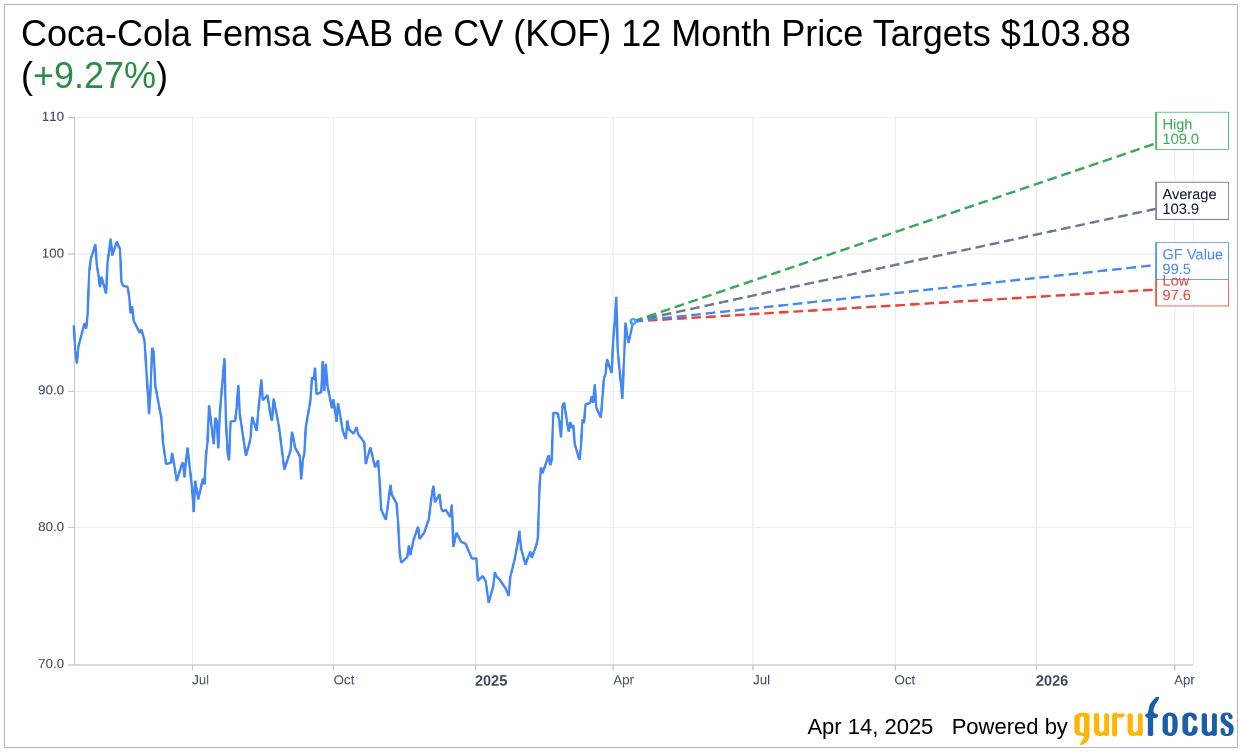

What do analysts think about Coca-Cola FEMSA's stock potential? Based on insights from nine analysts, the average price target for Coca-Cola Femsa SAB de CV (KOF, Financial) is projected at $103.88. This forecast comes with a high estimate of $109.00 and a low of $97.56. Compared to the current price of $95.07, this average target suggests an upside of 9.27%. For more comprehensive estimates, visit the Coca-Cola Femsa SAB de CV (KOF) Forecast page.

The market sentiment remains optimistic, with a consensus recommendation of "Outperform" from 10 brokerage firms, averaging a recommendation score of 1.7 on a scale from 1 (Strong Buy) to 5 (Sell).

Understanding GF Value

In collaboration with GuruFocus estimates, the projected GF Value for Coca-Cola Femsa SAB de CV (KOF, Financial) in a year stands at $99.48. This indicates a potential upside of 4.64% from the current market price of $95.07. The GF Value is a proprietary estimate of the stock's fair value, derived from historical multiples, past growth trends, and anticipated business performance. Dive deeper into these insights on the Coca-Cola Femsa SAB de CV (KOF) Summary page.

In conclusion, Coca-Cola FEMSA presents an intriguing proposition for investors, combining a steady dividend yield with promising stock potential, according to Wall Street analysts and GuruFocus metrics.