Nvidia (NVDA) is taking significant strides to enhance its manufacturing capabilities within the United States. The tech giant has embarked on a collaborative venture with its manufacturing partners to establish new factories for producing NvidiaAIsupercomputers domestically for the first time.

The company, alongside its partners, has secured over one million square feet of space dedicated to the production and testing of its advanced technologies. This expansion includes the manufacturing of Nvidia Blackwell chips at TSMC’s (TSM) facilities in Phoenix, Arizona, and the construction of AI supercomputers in Texas, specifically with Foxconn (HNHPF) in Houston and Wistron in Dallas. These operations are expected to significantly increase output in the next 12 to 15 months.

Nvidia's strategic partnerships extend to key players like Amkor (AMKR, Financial) and Siliconware Precision (SPIL) for handling packaging and testing operations in Arizona. This complex supply chain underscores the necessity for cutting-edge manufacturing processes and technologies.

Looking ahead, Nvidia aims to produce up to half a trillion dollars in AI infrastructure over the next four years within the U.S. This ambitious target will be achieved through collaborations with TSMC, Foxconn, Wistron, Amkor, and SPIL. To enhance operational efficiency, Nvidia plans to leverage its advanced AI, robotics, and digital twin technologies. This includes employing Nvidia Omniverse for creating digital simulations of factories and NVIDIA Isaac GR00T for developing robots to streamline manufacturing processes.

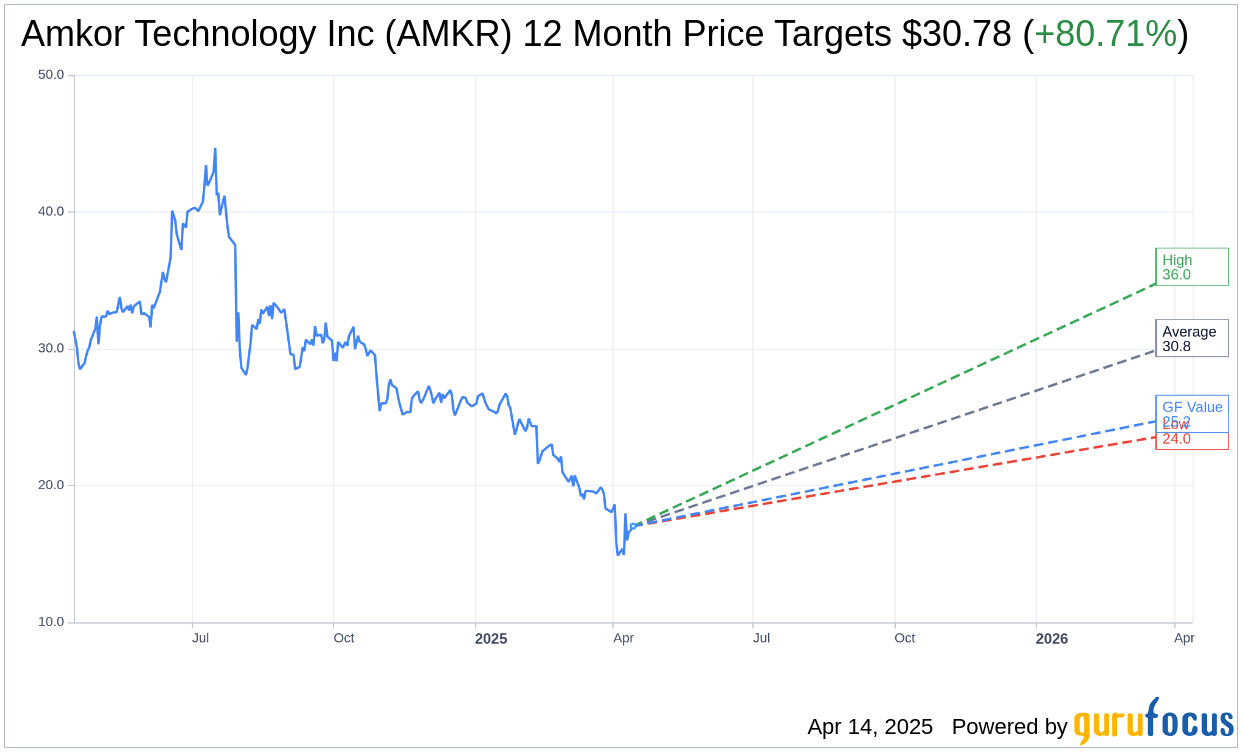

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Amkor Technology Inc (AMKR, Financial) is $30.78 with a high estimate of $36.00 and a low estimate of $24.00. The average target implies an upside of 80.71% from the current price of $17.03. More detailed estimate data can be found on the Amkor Technology Inc (AMKR) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Amkor Technology Inc's (AMKR, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Amkor Technology Inc (AMKR, Financial) in one year is $25.24, suggesting a upside of 48.21% from the current price of $17.03. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Amkor Technology Inc (AMKR) Summary page.