TOMI Environmental Solutions, Inc. (TOMZ, Financial) reported adjusted revenue of $1.3 million for the fourth quarter, a decrease from the $1.66 million recorded during the same period last year. Despite the quarterly downturn, the company announced a 5% annual revenue increase for the year ending December 31, 2024.

CEO Dr. Halden Shane highlighted the company's strategic efforts over the year, which included expanding their customer base, diversifying their product offerings, and forging new partnerships. These initiatives are aimed at enhancing the global distribution of their SteraMist brand and improving the deployment of iHP technology across various divisions.

The fourth-quarter financial results reflected substantial non-cash charges to reserve accounts, contributing to TOMI's GAAP net loss for both the quarter and the entire year. However, Dr. Shane noted that, when excluding these non-cash adjustments, the company's financial health showed improvement compared to the previous year.

Looking ahead, the company is optimistic about 2025, citing encouraging preliminary results for the first quarter. Early data indicates a 42% rise in revenue over the same period in the previous year, bolstered by increased sales in their BIT solutions. This uptrend suggests a promising start for TOMI as they continue to enhance their offerings and market reach.

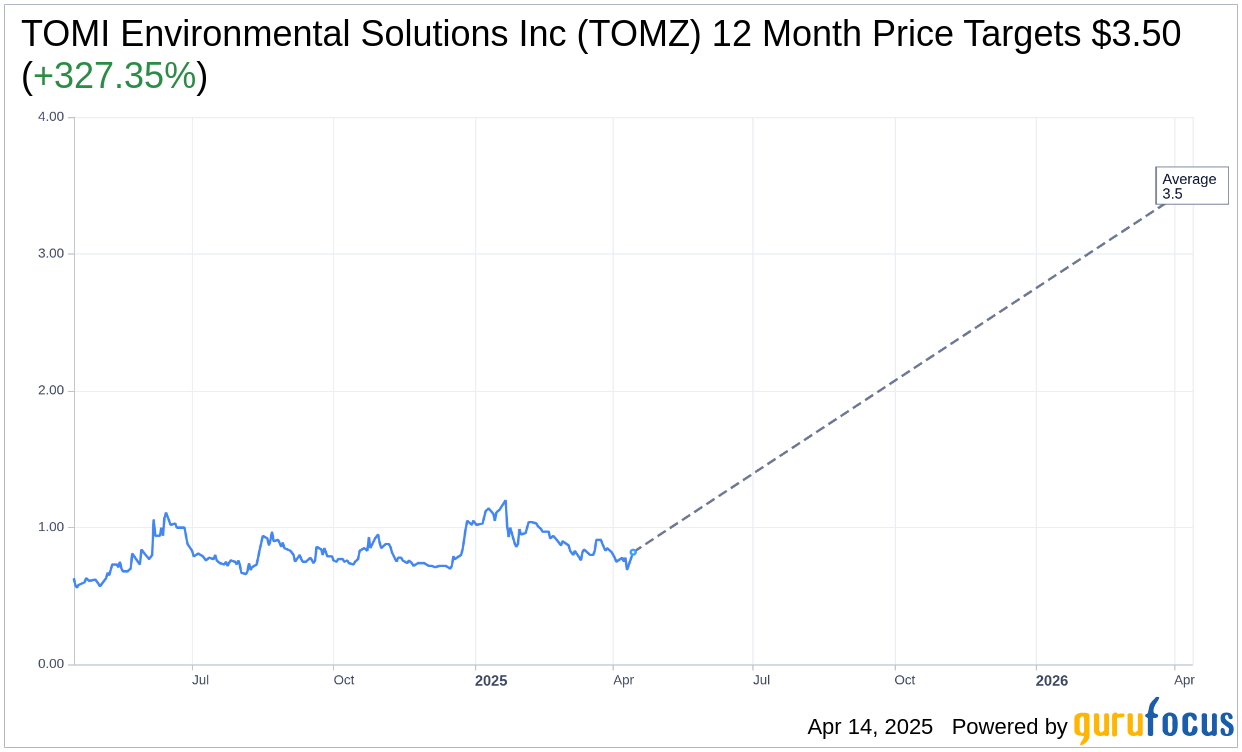

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for TOMI Environmental Solutions Inc (TOMZ, Financial) is $3.50 with a high estimate of $3.50 and a low estimate of $3.50. The average target implies an upside of 327.35% from the current price of $0.82. More detailed estimate data can be found on the TOMI Environmental Solutions Inc (TOMZ) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, TOMI Environmental Solutions Inc's (TOMZ, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for TOMI Environmental Solutions Inc (TOMZ, Financial) in one year is $1.70, suggesting a upside of 107.57% from the current price of $0.819. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the TOMI Environmental Solutions Inc (TOMZ) Summary page.