Following the completion of an extensive waste stripping initiative by mid-2025, the mining sequence is anticipated to shift towards extracting higher grade ore beginning in the third quarter of 2025. This strategic move is expected to significantly enhance production capabilities.

Since March 2025, daily output has seen a substantial boost, climbing from around 30 ounces per day in the second quarter of 2025 to over 50 ounces per day in both March and April. Production levels are projected to continue rising throughout the third and fourth quarters of 2025 as operations increasingly focus on these higher grade ore blocks.

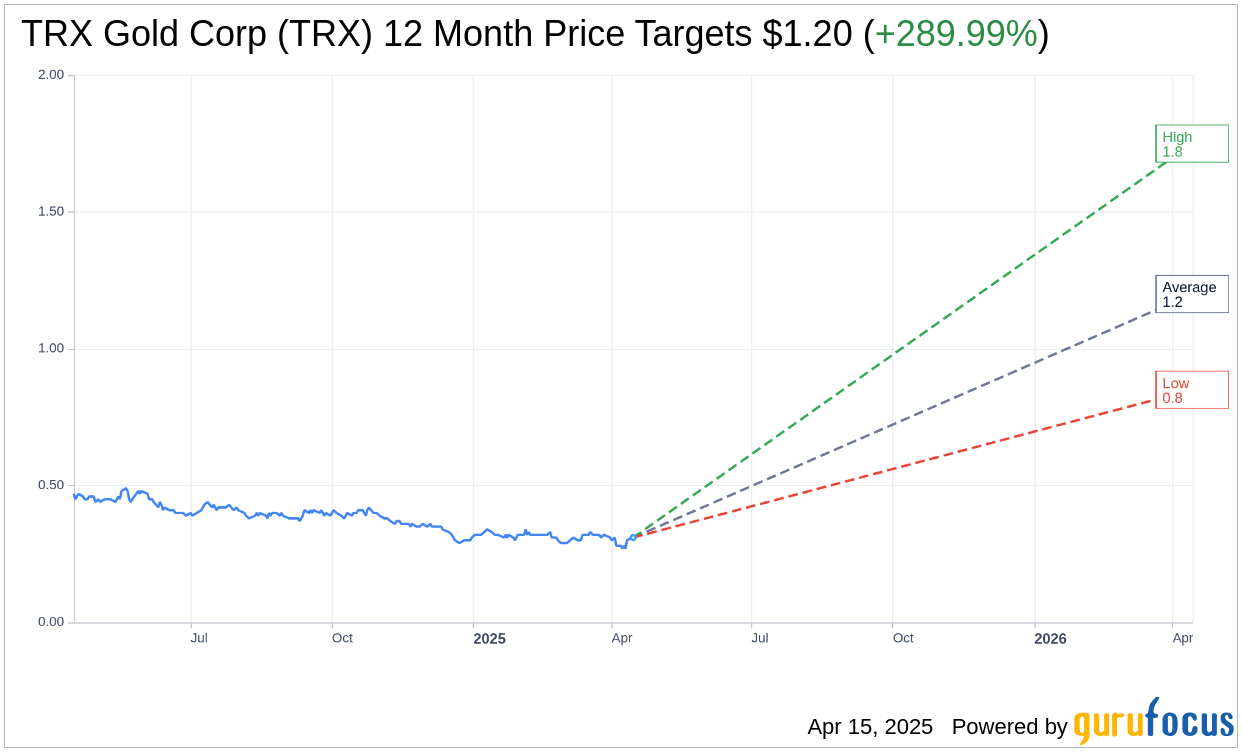

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for TRX Gold Corp (TRX, Financial) is $1.20 with a high estimate of $1.75 and a low estimate of $0.85. The average target implies an upside of 289.99% from the current price of $0.31. More detailed estimate data can be found on the TRX Gold Corp (TRX) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, TRX Gold Corp's (TRX, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for TRX Gold Corp (TRX, Financial) in one year is $0.97, suggesting a upside of 215.24% from the current price of $0.3077. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the TRX Gold Corp (TRX) Summary page.