- PNC Financial (PNC, Financial) beats earnings expectations but misses on revenue.

- Analysts project a potential upside of over 30% for PNC stock.

- GuruFocus estimates indicate a fair value upside of nearly 18%.

PNC Financial Services Group Inc (NYSE: PNC) delivered a solid first-quarter performance, with GAAP earnings per share reaching $3.51, outpacing analyst expectations by $0.13. Yet, while revenue climbed 5.8% year-over-year to $5.45 billion, it narrowly missed estimates by $30 million. The company's net interest margin improved to 2.78%, but net interest income fell by $47 million, highlighting both strengths and challenges in its financial operations.

Wall Street Analysts' Insights

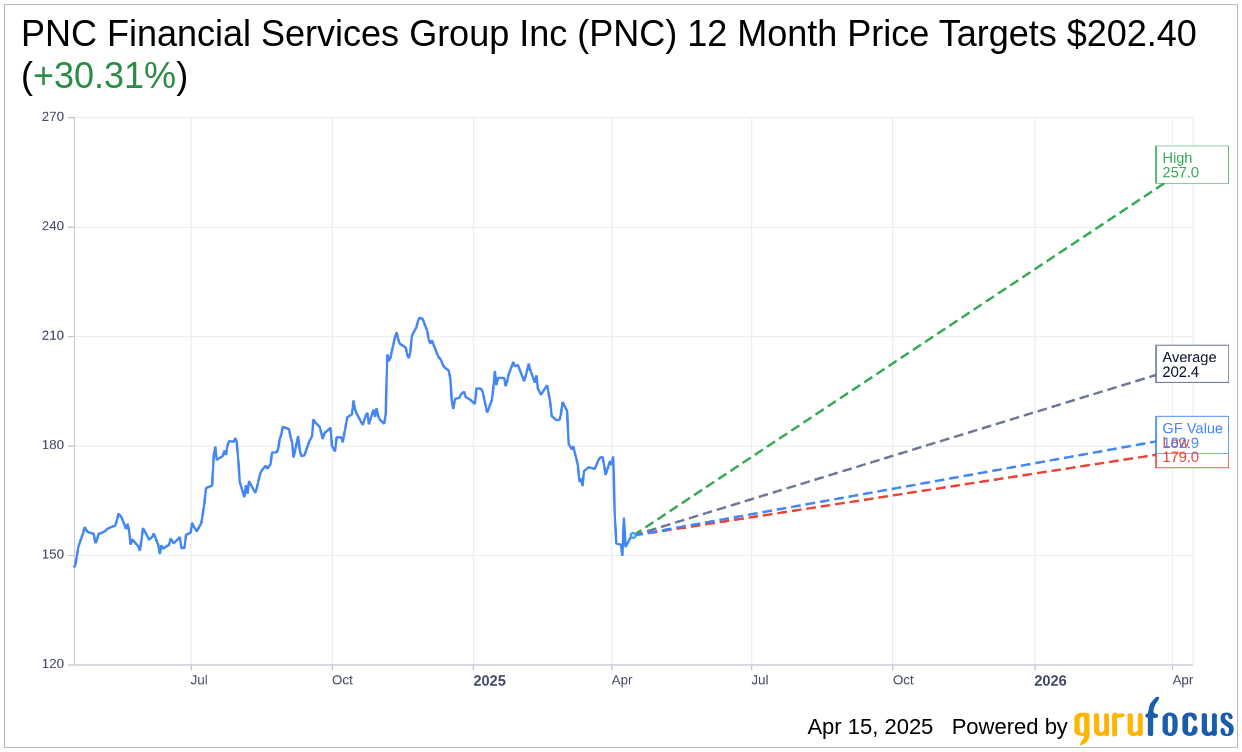

Analysts are optimistic about PNC Financial's future, with 18 offering a one-year average price target of $202.40. The high estimate pegs the stock at $257.00, while the low sits at $179.00. With PNC's current trading price at $155.32, the average target suggests a notable potential upside of 30.31%. Investors can explore more detailed estimate information on the PNC Financial Services Group Inc (PNC, Financial) Forecast page.

The sentiment among brokerage firms is similarly positive, with a consensus recommendation of 2.2. This "Outperform" rating, based on inputs from 23 brokers, employs a scale from 1 (Strong Buy) to 5 (Sell), underscoring market confidence in PNC's stock performance.

GuruFocus' Valuation Perspective

According to GuruFocus estimates, the GF Value for PNC Financial Services Group Inc (PNC, Financial) stands at $182.91, suggesting a potential 17.76% upside from the current price level of $155.32. The GF Value metric is GuruFocus' assessment of the stock's fair value, derived from historical trading multiples, business growth trends, and future performance predictions. For a deeper dive into these metrics, visit the PNC Financial Services Group Inc (PNC) Summary page.