Quick Summary:

- Johnson & Johnson (JNJ, Financial) outperforms earnings expectations with a robust financial report.

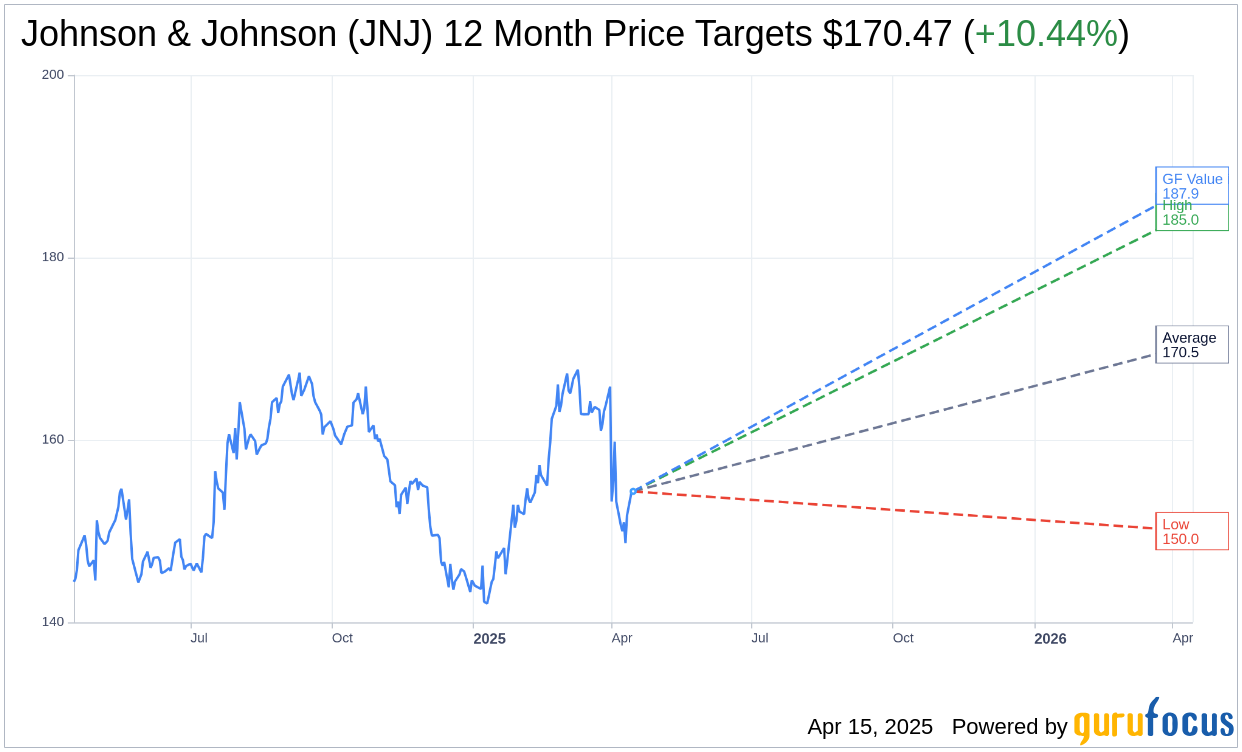

- Analysts predict a potential price increase, with an average target offering a 10.44% upside.

- GuruFocus GF Value metric implies a significant 21.72% upside potential for JNJ.

Johnson & Johnson (JNJ) recently demonstrated its financial prowess, reporting remarkable earnings that exceeded market expectations. With a non-GAAP EPS of $2.77 and total revenue of $21.9 billion, the company not only surpassed forecasts by $330 million but also showcased its resilience amid economic fluctuations. Analysts continue to view JNJ as a financially stable and fairly valued entity.

Wall Street Analysts' Projections

According to speculative analysis by 24 financial experts, the average one-year price target for Johnson & Johnson stands at $170.47. Projections range from a bullish high of $185.00 to a more conservative low of $150.00. This implies a potential upside of 10.44% from its current trading price of $154.36. For those interested in detailed data, more insights can be found on the Johnson & Johnson (JNJ, Financial) Forecast page.

Evaluations from 26 brokerage firms convey an average recommendation rating of 2.3 for Johnson & Johnson, suggesting an "Outperform" status. On this scale, a rating of 1 indicates a Strong Buy, while a 5 suggests a Sell.

GuruFocus Metrics Insight

Utilizing GuruFocus estimates, the projected GF Value for Johnson & Johnson (JNJ, Financial) is anticipated to be $187.89 in the next year. This reflects a promising 21.72% upside from the current market price of $154.36. The GF Value is a proprietary calculation by GuruFocus that assesses a stock's fair valuation, derived from historical trading multiples, past growth records, and projected performance. For further comprehensive analysis, visit the Johnson & Johnson (JNJ) Summary page.