- Albertsons Companies (ACI, Financial) exceeded Q4 earnings expectations with significant revenue growth.

- Analysts predict a moderate upside for ACI stock with a positive consensus outlook.

- The company's fiscal 2025 forecast indicates promising growth potential.

Albertsons Companies (ACI) reported a Q4 Non-GAAP EPS of $0.46, surpassing estimates by $0.05, with revenue reaching $18.8 billion, a 2.5% increase year-over-year. The company forecasts fiscal 2025 identical sales growth between 1.5% and 2.5%, with adjusted EBITDA projected at $3.8 billion to $3.9 billion.

Analyst Price Targets and Recommendations

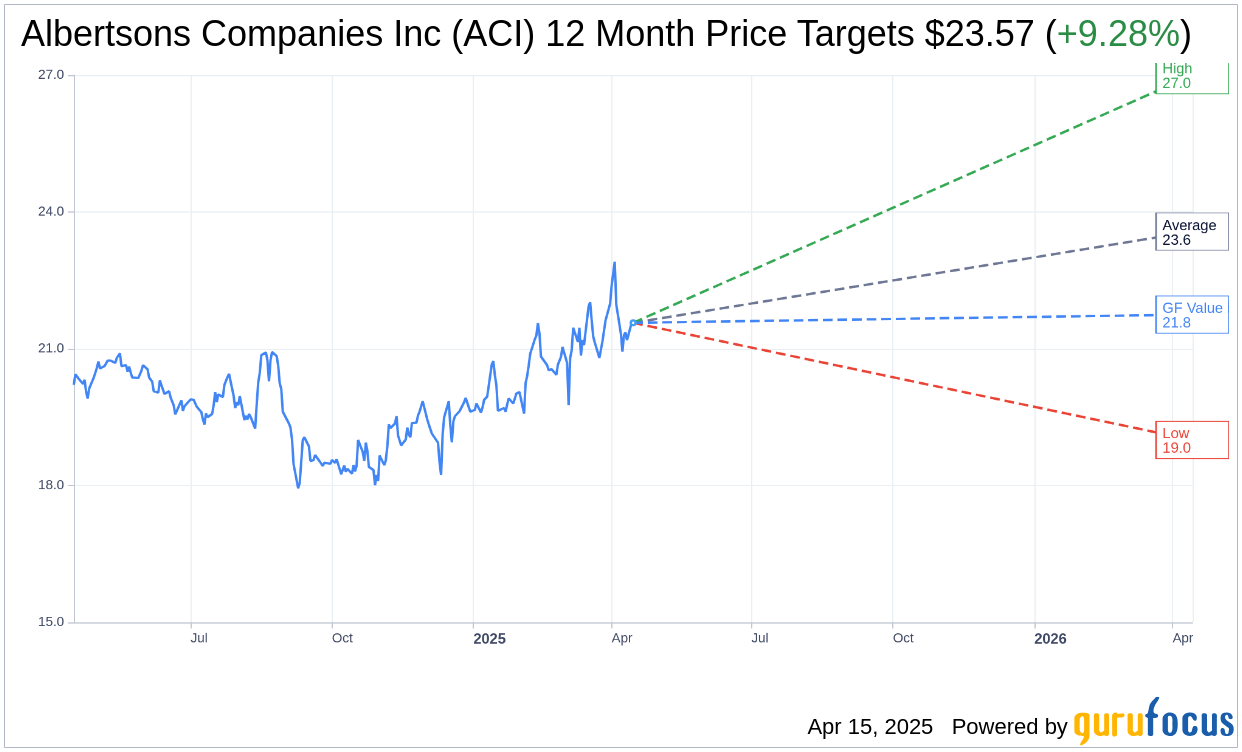

According to the one-year price targets provided by 14 analysts, the average target price for Albertsons Companies Inc (ACI, Financial) stands at $23.57. This includes a high estimate of $27.00 and a low estimate of $19.00. The average target indicates a potential upside of 9.28% from the current price of $21.57. For more detailed estimate data, visit the Albertsons Companies Inc (ACI) Forecast page.

Furthermore, the consensus recommendation from 21 brokerage firms for Albertsons Companies Inc (ACI, Financial) is an average rating of 2.4, suggesting an "Outperform" status. The rating scale ranges from 1 to 5, where 1 represents a Strong Buy, and 5 signifies a Sell.

GF Value Insights

According to GuruFocus estimates, the projected GF Value for Albertsons Companies Inc (ACI, Financial) in one year is $21.75, indicating a slight upside of 0.83% from the current price of $21.57. The GF Value is GuruFocus' calculation of the fair value at which the stock should be trading. It is determined by considering the historical trading multiples, as well as past business growth and future performance estimates. Find more detailed information on the Albertsons Companies Inc (ACI) Summary page.