American Airlines (AAL, Financial) has announced a groundbreaking initiative to offer complimentary inflight Wi-Fi on over two million flights annually, starting January 2026. The service, in partnership with AT&T (T), will be exclusively available to members of the AAdvantage loyalty program.

This move will establish American Airlines as the leading domestic carrier in providing free inflight connectivity, with the service being implemented across all aircraft equipped with advanced high-speed satellite connectivity from Viasat (VSAT) and Intelsat. This setup will encompass approximately 90% of the airline's fleet.

In preparation for this rollout, American Airlines has been conducting a series of complimentary Wi-Fi trials on selected routes. The tests have reportedly exceeded performance expectations, ensuring that the full-scale launch will meet passenger needs. Furthermore, the airline plans to equip over 500 regional aircraft with high-speed Wi-Fi by the end of 2025, ensuring readiness for the complimentary service the following year.

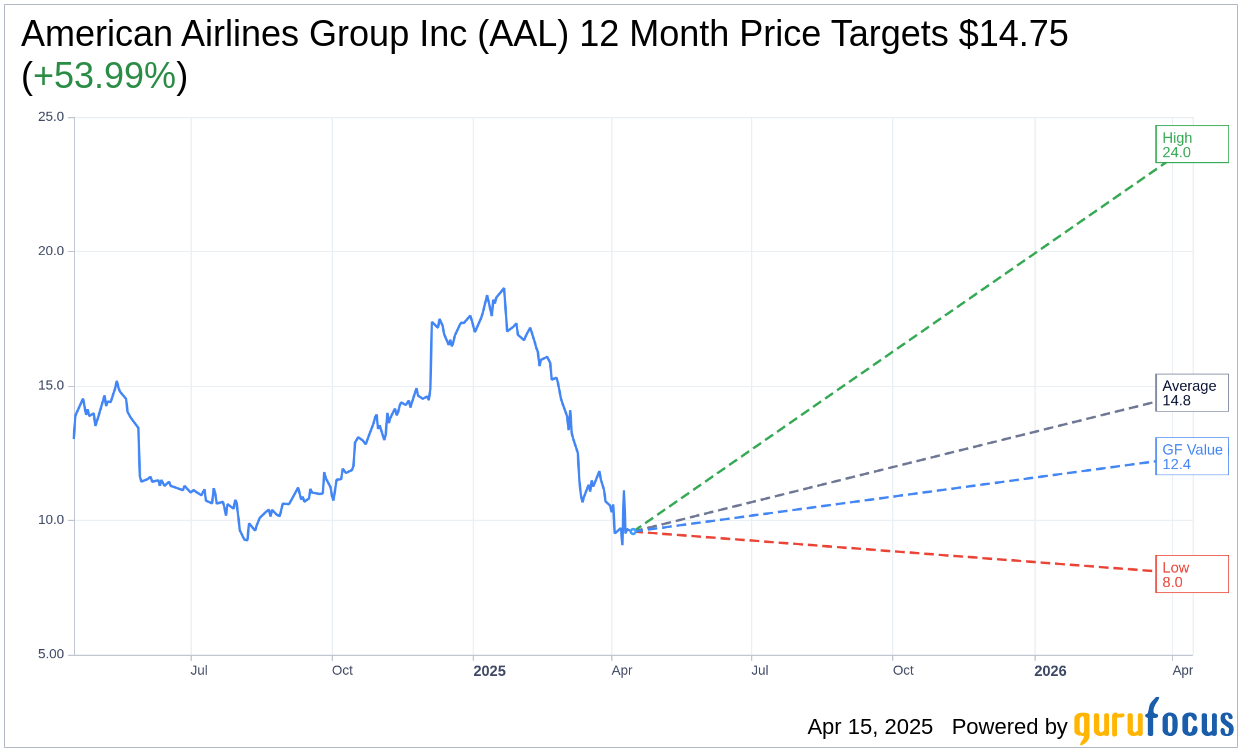

Wall Street Analysts Forecast

Based on the one-year price targets offered by 19 analysts, the average target price for American Airlines Group Inc (AAL, Financial) is $14.75 with a high estimate of $24.00 and a low estimate of $8.00. The average target implies an upside of 53.99% from the current price of $9.58. More detailed estimate data can be found on the American Airlines Group Inc (AAL) Forecast page.

Based on the consensus recommendation from 23 brokerage firms, American Airlines Group Inc's (AAL, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for American Airlines Group Inc (AAL, Financial) in one year is $12.38, suggesting a upside of 29.23% from the current price of $9.58. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the American Airlines Group Inc (AAL) Summary page.