Microchip Technology (MCHP, Financial) has introduced the BR235 and BR235D series, a new line of 25A QPL hermetically sealed electromechanical power relays. These relays comply with the stringent MIL-PRF-83536 specification and are ISO-9001 certified, ensuring high standards for quality and reliability. The series is designed to cater to the demanding requirements of mission-critical applications in commercial aviation, defense, and space sectors.

These new power relays are built to provide long-term reliability and are supported globally to meet the unique needs of customers in the aerospace and defense industries. The relays are characterized by a 25A 3PDT rating and come in several variants to offer design flexibility.

The series offers options in both suppressed and non-suppressed models, with coil voltages ranging from 6-48 VDC and 115 VAC. Additionally, they feature versatile mounting styles, available with or without mounting tabs, and various terminal pin types including straight or J-Hook. Customers can also choose between tin or gold plating for these devices.

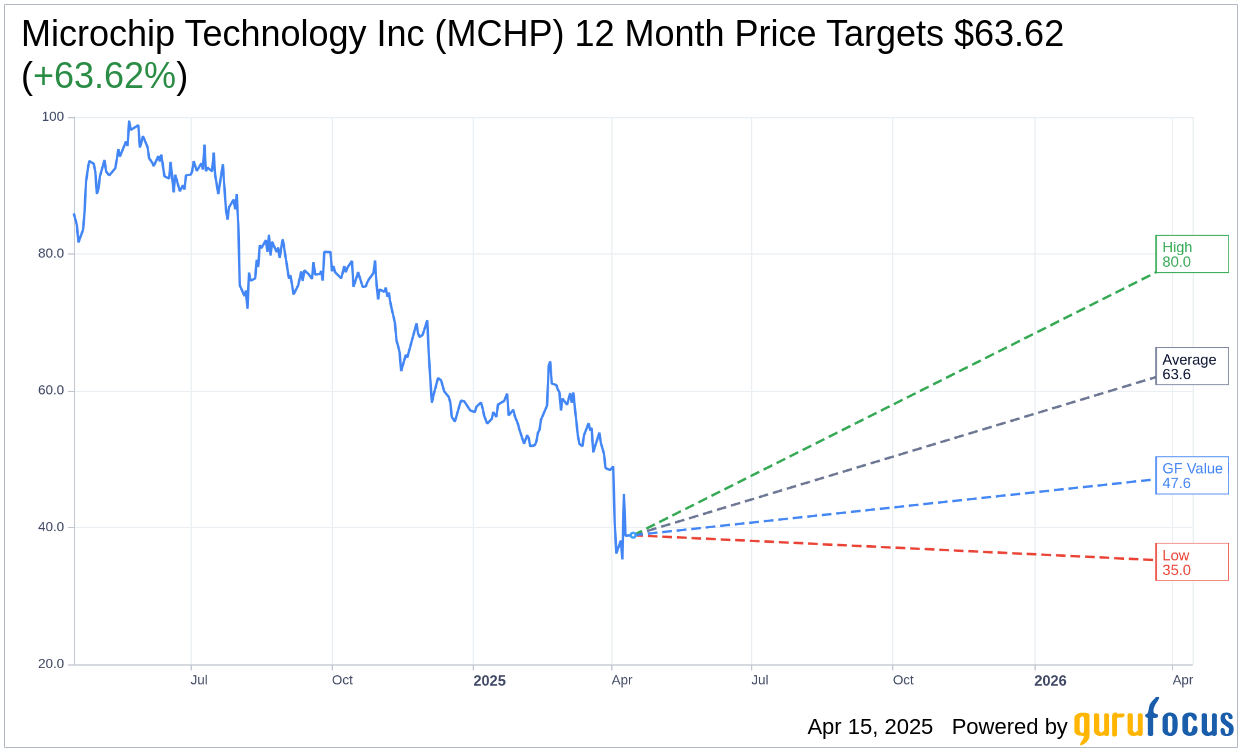

Wall Street Analysts Forecast

Based on the one-year price targets offered by 21 analysts, the average target price for Microchip Technology Inc (MCHP, Financial) is $63.62 with a high estimate of $80.00 and a low estimate of $35.00. The average target implies an upside of 63.62% from the current price of $38.88. More detailed estimate data can be found on the Microchip Technology Inc (MCHP) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, Microchip Technology Inc's (MCHP, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Microchip Technology Inc (MCHP, Financial) in one year is $47.63, suggesting a upside of 22.51% from the current price of $38.88. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Microchip Technology Inc (MCHP) Summary page.