Amplify Energy Corp. (AMPY, Financial) has revised its merger agreement with Juniper Capital's Rocky Mountain companies, incorporating an additional $10 million cash contribution from Juniper. This move aims to further diminish the net debt of the merged entity, reinforcing the financial foundation of the combined company.

The additional cash infusion stems from thorough shareholder consultation and underscores Juniper's commitment to the merger's strategic potential. Upon finalization of the merger, Amplify intends to issue approximately 26.7 million shares of its common stock to Juniper. Additionally, Amplify will assume around $133 million in net debt as part of the arrangement.

This update is encapsulated in Amendment No. 1 to the Agreement and Plan of Merger, which was formalized on April 14, 2025. Amplify is set to submit supplementary proxy documentation to the U.S. Securities and Exchange Commission shortly, detailing the amended terms.

Martyn Willsher, Amplify's President and CEO, emphasized that the revised terms align with both parties' belief in the merger's capacity to enhance long-term shareholder value. He affirmed that this transaction represents the optimal strategy for shareholders to realize the full potential of their investments.

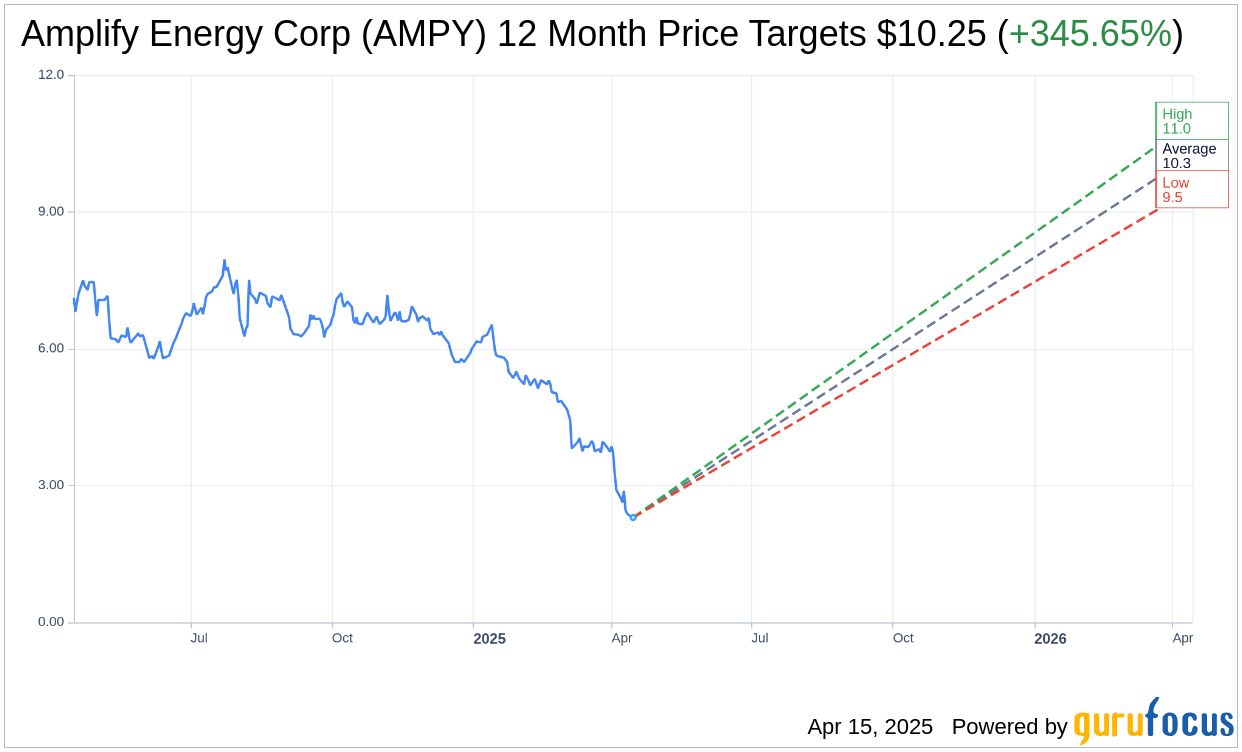

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Amplify Energy Corp (AMPY, Financial) is $10.25 with a high estimate of $11.00 and a low estimate of $9.50. The average target implies an upside of 345.65% from the current price of $2.30. More detailed estimate data can be found on the Amplify Energy Corp (AMPY) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Amplify Energy Corp's (AMPY, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Amplify Energy Corp (AMPY, Financial) in one year is $6.91, suggesting a upside of 200.43% from the current price of $2.3. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Amplify Energy Corp (AMPY) Summary page.