Jefferies has adjusted its price target for PayPal (PYPL, Financial), lowering it from $75 to $65. Despite maintaining a "Hold" rating, Jefferies highlights several concerns as it previews PayPal's first-quarter earnings.

Among the issues cited is the growing difficulty in PayPal's core operations, with expectations of a potential slowdown in branded payment volume. This could be further exacerbated by the waning effects of the leap year boost, according to Jefferies.

Competition is another area of concern, with Apple Pay’s expansion onto desktop environments still in its nascent stages. Jefferies suggests that PayPal's competitive position may not see significant improvement in the near future.

Additionally, PayPal's exposure to cross-border transactions between China and the U.S. is described as an emerging wild card. Jefferies warns that a decline in these transaction volumes could pose a risk to the company's fiscal year growth.

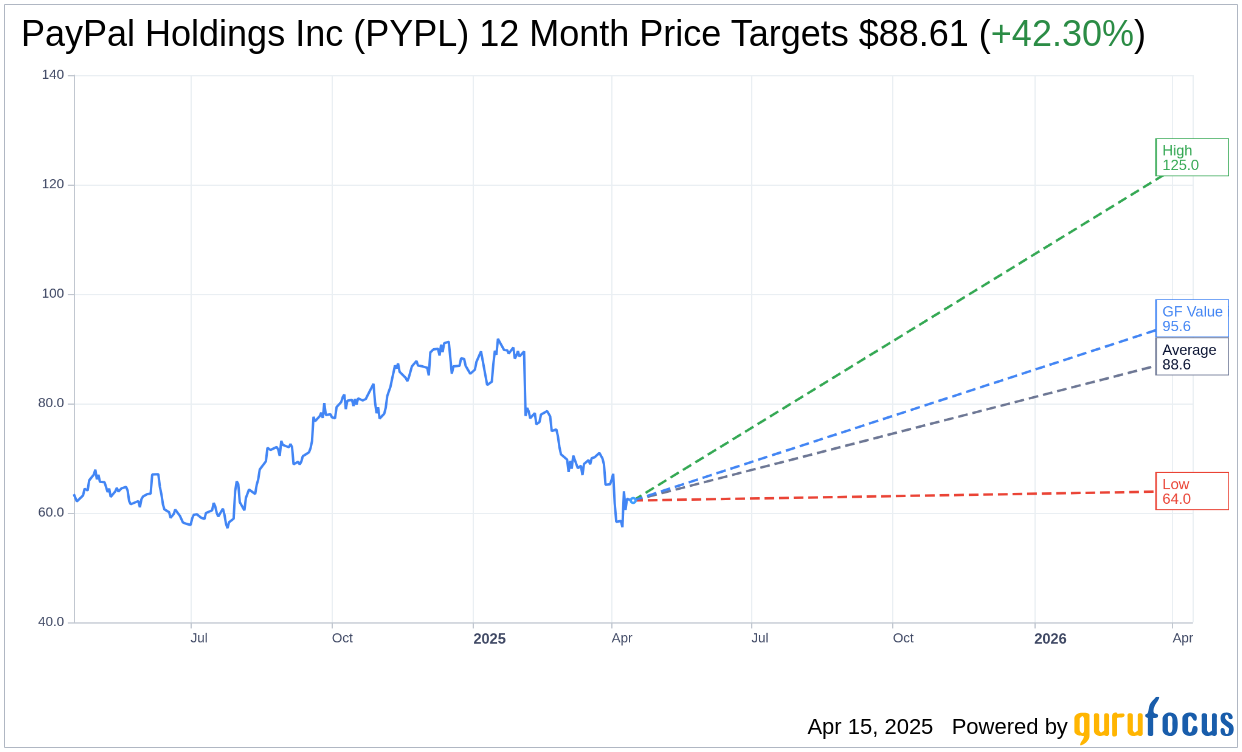

Wall Street Analysts Forecast

Based on the one-year price targets offered by 36 analysts, the average target price for PayPal Holdings Inc (PYPL, Financial) is $88.61 with a high estimate of $125.00 and a low estimate of $64.00. The average target implies an upside of 42.30% from the current price of $62.27. More detailed estimate data can be found on the PayPal Holdings Inc (PYPL) Forecast page.

Based on the consensus recommendation from 46 brokerage firms, PayPal Holdings Inc's (PYPL, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for PayPal Holdings Inc (PYPL, Financial) in one year is $95.58, suggesting a upside of 53.49% from the current price of $62.27. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the PayPal Holdings Inc (PYPL) Summary page.