Morgan Stanley has revised its price target for Range Resources (RRC, Financial), adjusting it downward from $49 to $41. The firm maintains an Equal Weight rating on the company's stock. This adjustment is part of a broader recalibration of expectations across its North American energy coverage, as the firm updates estimates to align with the recent downturn in oil prices.

The revised forecasts indicate a reduction in cash flow projections for 2025-2026, positioning them below prevailing consensus estimates. Morgan Stanley's analysis suggests that an uncertain market environment is prompting a reassessment of valuation metrics, particularly for small to mid-cap producers and those facing challenges in execution.

Despite the changes, Morgan Stanley's perspective on the Exploration and Production (E&P) sector remains at an In-Line rating, attributed to ongoing weak fundamentals in the oil market over the near-to-medium term.

Wall Street Analysts Forecast

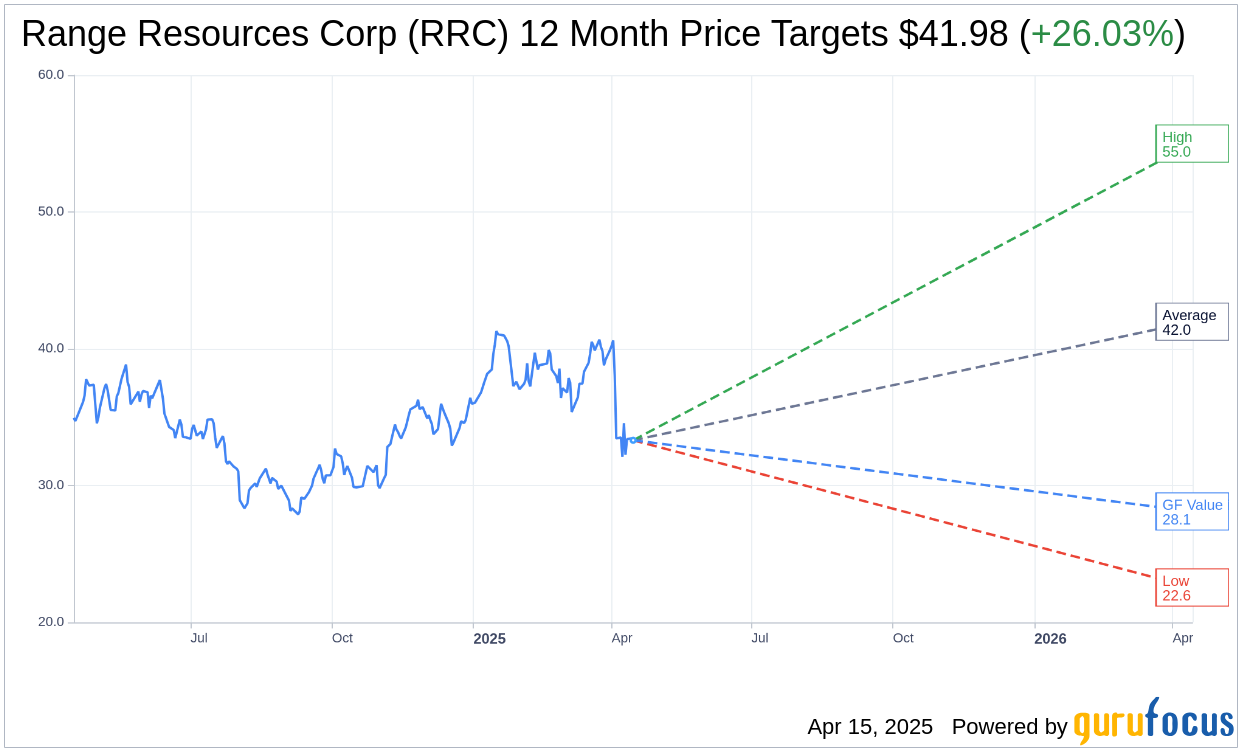

Based on the one-year price targets offered by 25 analysts, the average target price for Range Resources Corp (RRC, Financial) is $41.98 with a high estimate of $55.00 and a low estimate of $22.55. The average target implies an upside of 26.03% from the current price of $33.31. More detailed estimate data can be found on the Range Resources Corp (RRC) Forecast page.

Based on the consensus recommendation from 27 brokerage firms, Range Resources Corp's (RRC, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Range Resources Corp (RRC, Financial) in one year is $28.11, suggesting a downside of 15.61% from the current price of $33.31. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Range Resources Corp (RRC) Summary page.