Recent insights from Jefferies indicate a notable deceleration in demand within the cybersecurity industry for the first quarter, compared to the previous quarter. The firm attributes this trend to macroeconomic uncertainties, exacerbated by the anticipation surrounding the 90-day tariff pause. Optimism for the upcoming three months has hit a record low in the survey's history.

Network security emerged as the standout sector according to the survey, with Check Point Software Technologies (CHKP, Financial) showing significant quarter-over-quarter momentum growth. Meanwhile, Varonis Systems (VRNS) experienced the most pronounced decline in momentum, dropping to 0.8% below plan after being 2.6% above plan in the last quarter.

Key players in the network security domain, including Palo Alto Networks (PANW), Zscaler (ZS), Check Point (CHKP, Financial), and Fortinet (FTNT), demonstrated strong performances. However, CrowdStrike (CRWD) witnessed a slight dip in performance relative to their plans, partly due to ongoing impacts from a recent outage incident.

Wall Street Analysts Forecast

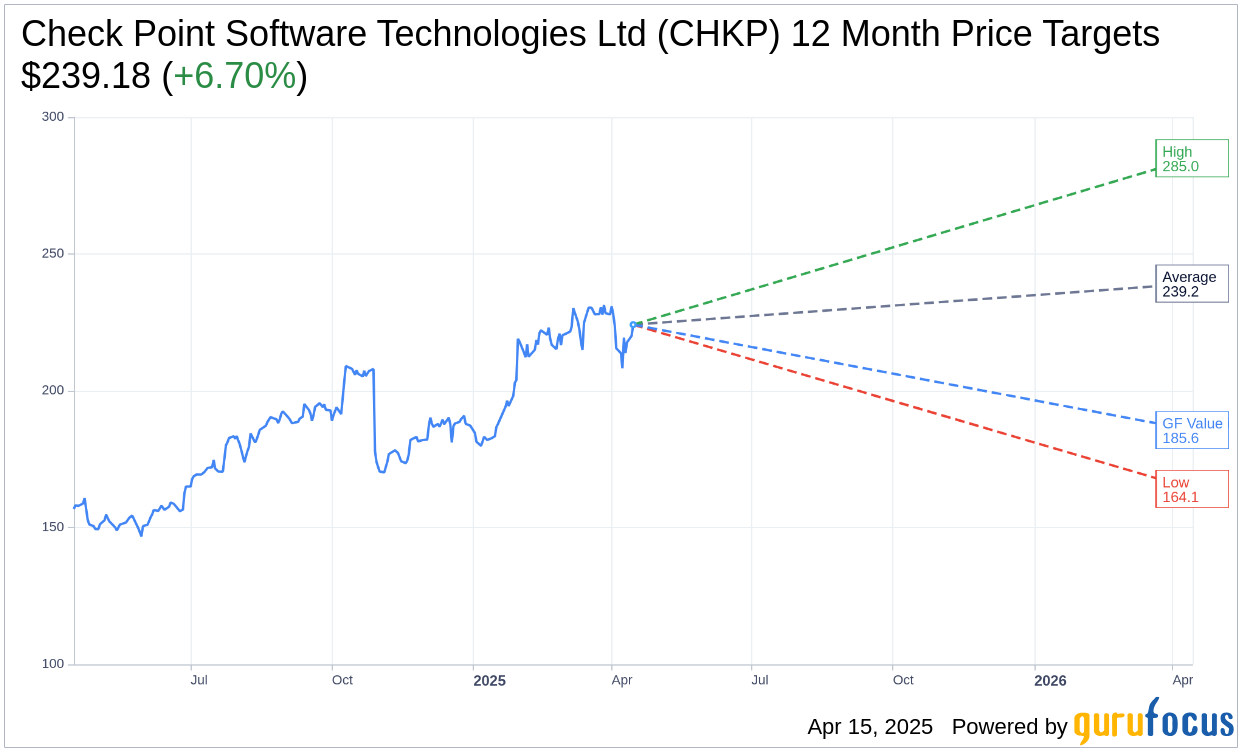

Based on the one-year price targets offered by 30 analysts, the average target price for Check Point Software Technologies Ltd (CHKP, Financial) is $239.18 with a high estimate of $285.00 and a low estimate of $164.14. The average target implies an upside of 6.70% from the current price of $224.16. More detailed estimate data can be found on the Check Point Software Technologies Ltd (CHKP) Forecast page.

Based on the consensus recommendation from 39 brokerage firms, Check Point Software Technologies Ltd's (CHKP, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Check Point Software Technologies Ltd (CHKP, Financial) in one year is $185.62, suggesting a downside of 17.19% from the current price of $224.16. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Check Point Software Technologies Ltd (CHKP) Summary page.