Summary Highlights:

- Sterling Infrastructure Inc. (STRL, Financial) is joining the S&P SmallCap 600 index on April 17, replacing Patterson Companies Inc.

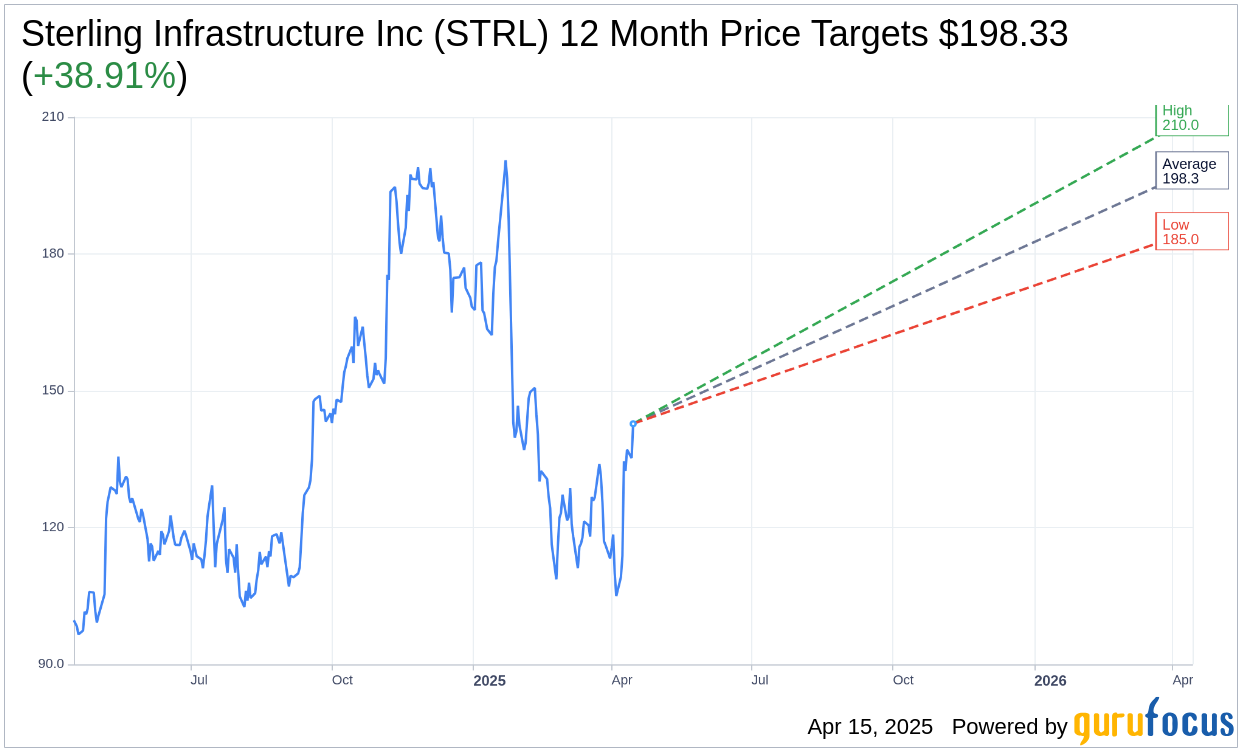

- Analysts forecast an average price target of $198.33 for STRL, representing a potential upside of 38.91% from the current price.

- GuruFocus estimates indicate a different GF Value with a downside of 50.98% from the current price.

Sterling Infrastructure Inc. (STRL) is making significant strides by entering the prestigious S&P SmallCap 600 index. This inclusion, effective April 17, follows the acquisition of Patterson Companies Inc. by Patient Square Capital, highlighting a pivotal moment for Sterling Infrastructure. Let's delve into the details on what Wall Street analysts and GuruFocus metrics suggest about STRL's market potential.

Analyst Predictions Point Toward Growth

Investment analysts foresee a promising future for Sterling Infrastructure Inc. (STRL, Financial), with a one-year average price target set at $198.33. This target ranges between a high of $210.00 and a low of $185.00, suggesting a substantial potential upside of 38.91% from its current price of $142.78. For a more comprehensive understanding, investors can explore the detailed estimates on the Sterling Infrastructure Inc (STRL) Forecast page.

The consensus from three prominent brokerage firms currently rates STRL with an average recommendation of 1.3, translating to a "Buy" status. This recommendation scale, where 1 denotes a Strong Buy and 5 indicates a Sell, underscores the optimism surrounding the company's stock.

GF Value Analysis: A Contrasting Perspective

While analyst forecasts are optimistic, GuruFocus metrics present a more conservative outlook. The GF Value for Sterling Infrastructure Inc. (STRL, Financial) is projected at $69.99 over the next year, indicating a potential downside of 50.98% from the current trading price of $142.775. The GF Value is a critical metric reflecting the stock's fair value by analyzing historical trading multiples, previous business growth, and future business performance estimations. For more insights, visit the Sterling Infrastructure Inc (STRL) Summary page.

In conclusion, Sterling Infrastructure's upcoming inclusion in the S&P SmallCap 600 index marks a strategic shift for the company. While analysts and GuruFocus provide differing perspectives, both offer valuable insights for discerning investors. Balancing these viewpoints can offer a comprehensive picture of STRL's potential trajectory in the market.