Introduction

Disney+ has emerged as a key growth driver for Disney, primarily driven by its solid content portfolio. The service offers nearly 700 movies and 11,700 episodes of television shows from brands such as Disney, Pixar, Marvel, Star Wars and National Geographic and Disney+ originals. Disney has an impressive line-up of big-budget movies slated to be released over the next couple of years, a number of which will appear on Disney+ simultaneously with their theatrical releases. The rapidly growing subscriber base should strengthen Disney's position in the increasingly saturated streaming space currently dominated by Netflix.

Impact of Trump's Movie Tariffs

Concerns have been raised by Barclays analyst Kannan Venkateshwar regarding the imposition of film tariffs in the US, arguing that if they become pervasive, they may hurt the sector that the tariffs are meant to promote. The United States creates a $15 billion trade surplus by exporting three times as much content as it imports. According to Morgan Stanley, in the worst-case scenario, film tariffs may lower the earning capacity of every business along the value chain. There would be fewer and more costly films if 100% tariffs were applied to part or all of the price. The writing, production, editing, and postproduction phases of the modern filmmaking process are divided among several nations. Retaliatory tariffs are another possibility; foreign governments may impose taxes or impose restrictions on US streaming services or movie releases. In order to make sure the industry is satisfied with the new tariffs, President Trump has stated that the administration will meet with them. While the next two Avengers films will be filmed in the UK, the majority of Disney's latest Marvel movie, "Thunderbolts," was shot in Georgia.

Competition

Disney+ and Hulu have more streaming subscribers than Netflix, and by 2025, their current size and content pipeline will support long-term DTC profitability. Strong franchises and other key building blocks give Disney a long-term edge in producing new films and making money off of content. Broadcast networks continue to be distinctive assets that draw in content and promote advertising.

The longest-lasting advantage belongs to Disney's experiences division, which is mainly made up of theme parks and revenue streams associated with travel. Disney characters are so timeless that it is almost impossible for new competitors to provide as appealing a destination. Additionally, Disney's franchises and characters generate licensing income for consumer goods, which is a high-margin source of steady income. The nearest rival, NBC Universal, is a long way behind and is not likely to make much progress. To sum up, Disney can offer a distinctive and superior experience that will generate steady demand, making its products stand out from the competition.

Furthermore,according to the Jefferies report, the economic slowdown and decline in US tourism poses considerable level of risk to Disney's experiences revenue and profit in 2024–2026. However,projects that the experiences segment will grow by a mid-single digit per year, propelled by new cruise ships, theme parks, and hospitality services. Experience margins may decrease from 27% in 2024 to 22% in 2026 as a result of operating leverage, but they will rise to almost 30% by the end of the projection.

Bull Case

Disney's expanding streaming service offerings — Disney+, ESPN+, Hulu, Disney+ Hotstar (India, Indonesia, Malaysia and Thailand) and Star+ (Latin America) — are expected to be major growth drivers in the long run. These services are driving Direct-to-Consumer (DTC) subscription fees that increased 13% year over year in the second quarter of fiscal 2024 that ended on Mar 31. Growth in core Disney+ subscribers and to a lesser extent, Hulu and ESPN+, were the key drivers. DTC subscription fees are expected to witness a CAGR of 9% between 2024 and 2027.

Content Strategy

Utilizing Disney's wide film and TV content library, the company attempts to generate its streaming profit by firstly declining content cost and secondly, boosting subscriber retention. The prominent franchises that are like Marvel, Star Wars, Disney Animation and, the classic catalog titles that these franchises, require only a little ongoing investment in place of the high cost required for new original series. By the means of cycling library hits in and out of rotation, Disney is able to keep its viewership high and churn low even without movie costs. The ad-supported tier which is promoted by the recycled back-contents brings additional income and does this from the content already acknowledged and loved by viewers. The free bundled offer of Disney+, Hulu and ESPN+ will further introduce more fixed content costs per subscriber and thus, make the journey to reach the positive free cash flow faster.

The breadth of Disney's content can be the remedy to closing its profitability gap through of transforming legacy assets to low-cost offerings, that goes up the revenue and decrease the production expenses. The library marathons or thematic months that are proposed to introduce are of low cost and thus generate buzz efficiently. Licensing the classics for third-party platforms or curated physical merchandise packs underwrites monetization. Curated "vault" bundles enhance premium tier adoption, while introducing microtransactions—like short-form episodic spins—drives incremental micro-revenue. An advertiser-supported channel featuring proven hits yields differentiated ad rates. Finally, the repurposing of the archival footage for the making of a behind-the-scenes docuseries will not just be a nostalgic act but will also come at a low cost, and maintain subscriber engagement, and revenue even before the original shows start to grow evenly.

Live Sports Opportunity

Disney's focus on sports streaming, particularly Live Sports, is expected to drive growth in the long haul. For instance, ESPN+ offers tournaments like UFC Lightweight Championship, Major League Baseball (MLB), National Hockey League (NHL), Major League Soccer, Grand Slam tennis, Italy's Serie A soccer and live sporting events, original shows, series and documentaries. Renewal of MLB sports rights deal through 2028 and agreement with Spanish club football's first division, La Liga, further strengthens Disney's sports content offerings. Disney also remains focused on offering content on linear television. In this respect, Disney and ESPN's recent long-term partnerships with National Football League (NFL) are noteworthy.

Subscribers Growth

Rapid international expansion has been a key catalyst driving Disney+'s growth. In the past couple of years, Disney+ has been launched in India (through the Disney+ Hotstar service), through a strategic partnership with Canal+ in France, in Japan (via NTT DOCOMO) and several European as well as Latin American countries. Disney+ is currently available in more than 80 countries and territories outside the United States and Canada. The international expansions and a solid content portfolio have helped Disney+ garner a substantial subscriber base within a short period. Disney's new hub for international content creation supports the worldwide expansion of the company's direct-to-consumer business. This is expected to drive Disney Media and Entertainment Distribution (DMED) revenues, under which Disney+ is reported.

Experience Segment

Recovery in the theme parks business is expected to drive Disney's prospects in the long haul. Latest attractions like the Frozen theme land at Hong Kong Disneyland and Walt Disney Studios Park in Paris, as well as the Zootopia theme land at Shanghai Disney Resort, are expected to boost the prospects of the theme parks business.

Bear Case

Disney is suffering from lower advertising revenues. In fiscal 2023, revenues declined 15% from the year-ago period due to fewer impressions primarily attributed to declines at Hulu and Disney+. The decrease in impressions at Disney+ was due to the lack of IPL cricket programming compared with the year-ago period. Moreover, Disney is focusing on its streaming business, which needs significant investment on content and marketing. The rising spending is expected to keep consolidated margins under pressure. Moreover, Linear Networks' profitability suffers from higher programming and production costs. Disney's recently theatrical releases have failed to ignite box office with unimpressive box office performances of The Marvels, Wish, Ant-Man and the Wasp: Quantumania and Elemental. Although Guardians of the Galaxy: Vol 3 did well, it is expected to not have been enough to drive Disney's box office performance in the near term.

Disney has a leveraged balance sheet. Total borrowings (including the current portion of borrowings) were $45.3 billion as of Dec. 28, 2024, compared with $45.81 billion as of Sept. 28, 2024. Disney's debt balance compares unfavorably with cash, cash equivalents and its current marketable investment securities balance of $6 billion.

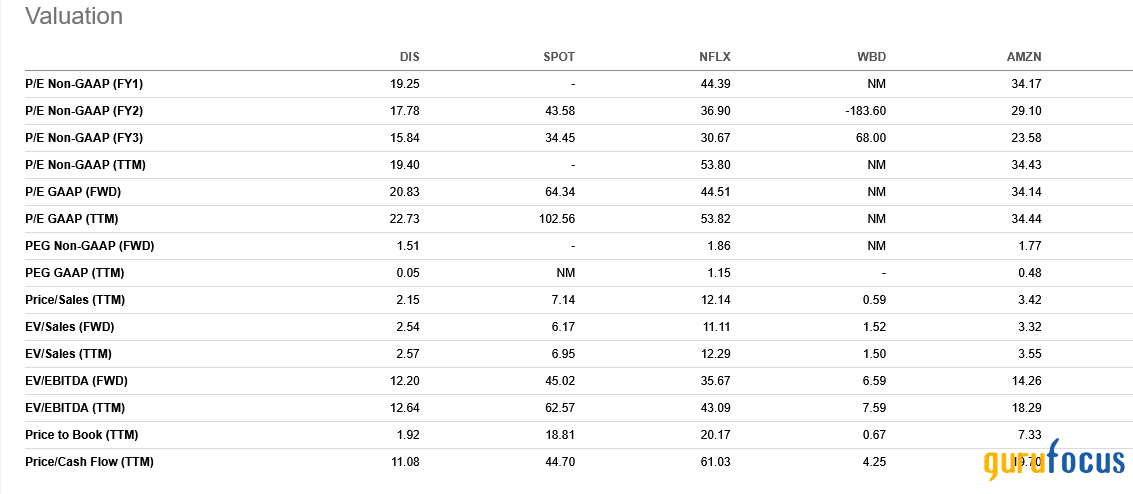

Multiples

From a Disney viewpoint, FY1 non-GAAP P/E of 19.3 is quite lower than Netflix's 44, and Amazon's 34 approximately, which means our downside protection is much more attractive. The EV/EBITDA of approximately 12 and approximately 12.6 shows Disney's stable revenue mix through non-streaming areas while Netflix trades at about 36-43 and Spotify at about 45-63. At a 2.15 times Price/Sales compared to Netflix's 12.1 and Spotify's 7.1, we gain advantages from a steady content licensing, parks, and merchandise revenue. Disney's PEG non-GAAP of 1.5 is low while the GAAP PEG is just 0.05 overwhelmingly which means that they have a strong growth potential that is currently undervalued by the market. Disney have a P/S ratio of 0.6 that is higher than Warner Bros. but we are still enjoying a scale

DCF

Gurus

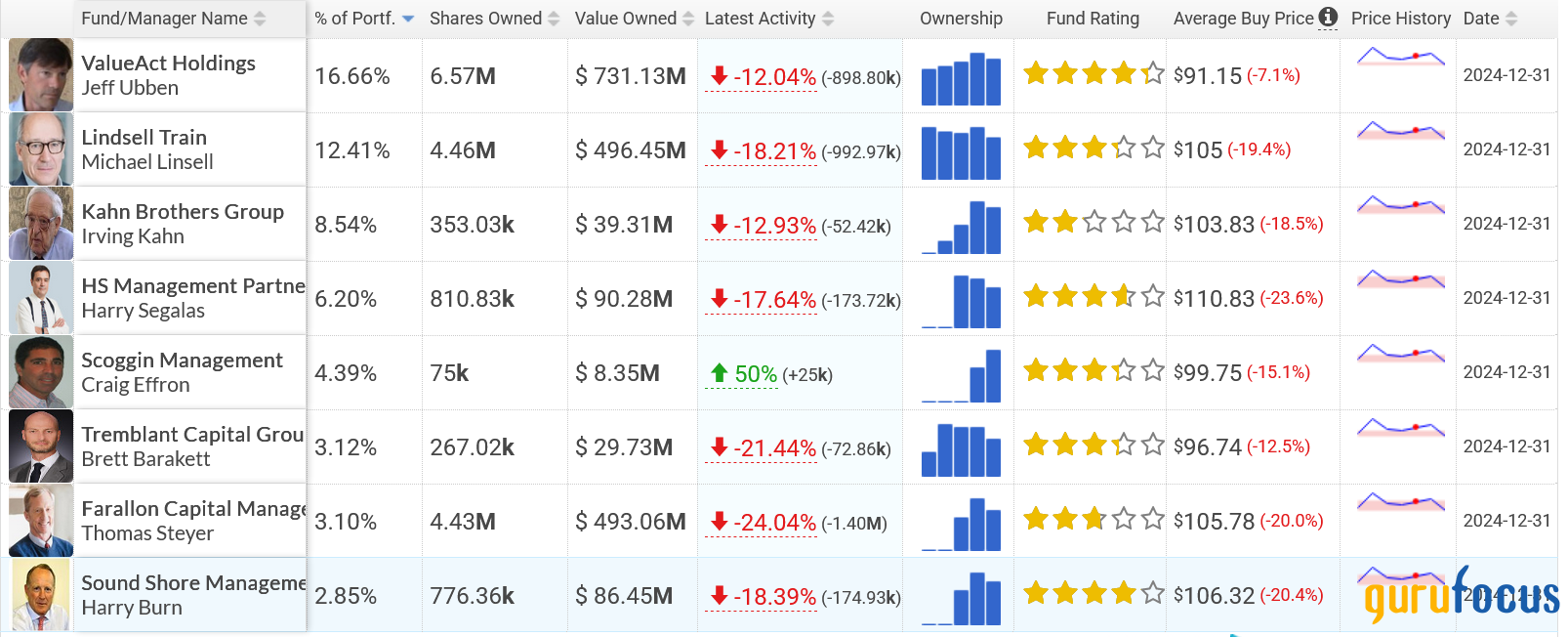

Disney's free cash flow is up almost 30% over the five years which helps to explain why Jeff Ubben's portfolio is so heavily exposed to Walt Disney. And this sets a good stage for possible share buyback programmes in the near future. However, as a rebuttal, the capex requirements would also need to be assessed in the coming quarters as streaming service is the fastest growing segment for Disney and the company is far from its biggest competitor in terms of subscriber count.

Conclusion

Disney+ is facing significant competition in the streaming market from the likes of Netflix and Amazon prime video. Netflix enjoys a first-mover advantage in the streaming market, and its solid original programming portfolio is a major differentiator. Amazon is also catching up. Apple TV+ is gaining recognition with Emmy and Oscar wins. Comcast's Peacock and Paramount Global's Paramount+ benefit from their huge libraries of movies and shows. Moreover, with the completion of the merger of WarnerMedia with Discovery, the competition is expected to get stiffer.