Key Takeaways:

- Fastenal strategizes to mitigate potential 145% tariffs by altering prices and sourcing alternatives.

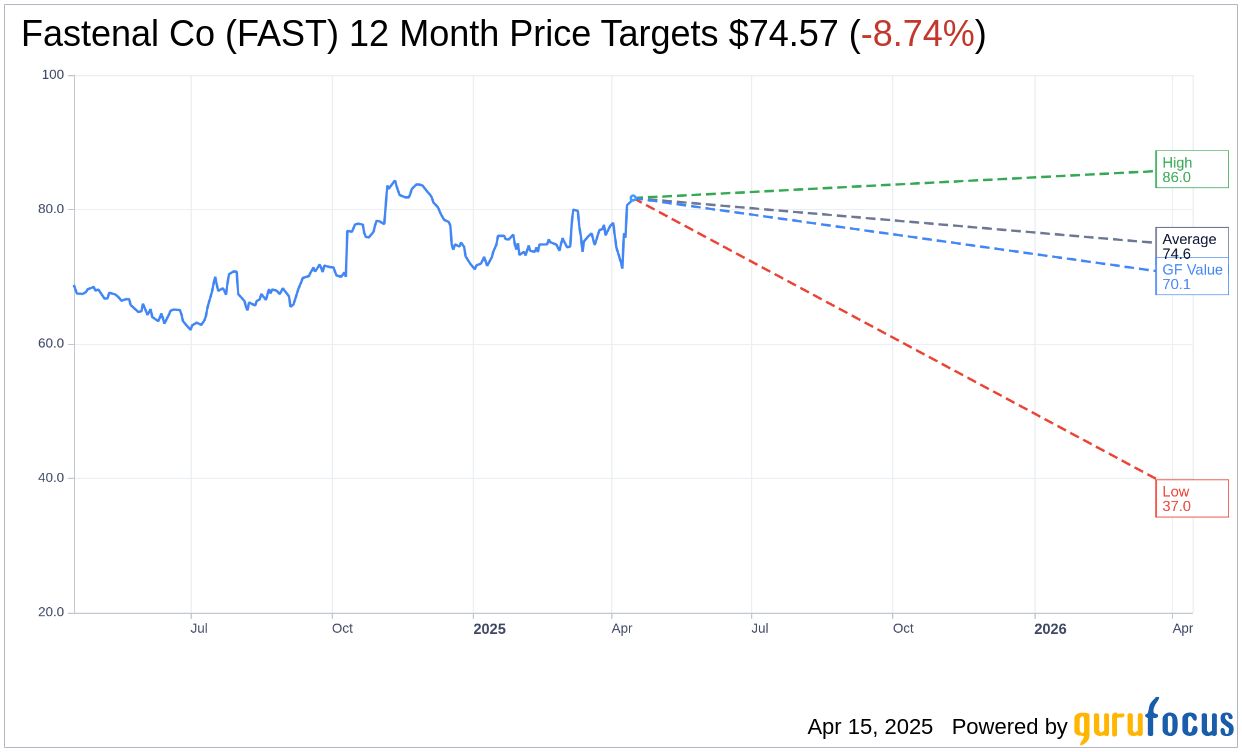

- Analysts' average one-year price target for Fastenal suggests an 8.74% downside from current levels.

- Fastenal holds a "Hold" recommendation with a GF Value estimation indicating a potential 14.22% downside.

Fastenal Co. (NASDAQ: FAST) is proactively navigating the challenges posed by a possible 145% tariff on Chinese imports. The company plans to adjust prices within its contracts and explore alternative sourcing strategies to cushion the impact. Additionally, Fastenal is leveraging its well-managed inventory and direct sourcing capabilities to ensure transparency with customers. Chief Financial Officer Holden Lewis anticipates that effective management of Selling, General, and Administrative (SG&A) costs will support ongoing sales growth.

Wall Street Analysts' Insights

According to estimates from 11 analysts, the average one-year price target for Fastenal Co. is $74.57. This target includes a high estimate of $86.00 and a low estimate of $37.00. Based on the current price of $81.71, this suggests a potential downside of 8.74%. For more detailed forecast data, visit the Fastenal Co (FAST, Financial) Forecast page.

The consensus recommendation from 16 brokerage firms places Fastenal Co. at a 2.8 rating, which translates to a "Hold" status. The rating scale used ranges from 1 (Strong Buy) to 5 (Sell).

Per GuruFocus estimates, Fastenal Co.'s one-year GF Value is projected at $70.09, indicating a potential downside of 14.22% from the current price. GF Value is GuruFocus' estimate of the stock's fair trading value, derived from historical trading multiples, past business growth, and future business performance estimates. For comprehensive data, visit the Fastenal Co (FAST, Financial) Summary page.