Key Highlights:

- VinFast (VFS, Financial) partners with PT Oto Klix Indonesia to expand service offerings for electric vehicles.

- Analysts project a significant 143.55% upside potential for VFS stock.

- Current analyst consensus recommends a "Buy" for VinFast shares.

VinFast (VFS) strategically collaborates with PT Oto Klix Indonesia, utilizing 150 service workshops to boost its after-sales services for electric vehicles in Indonesia. This alliance is a pivotal step in VinFast's strategy to broaden its electric vehicle market footprint and improve service quality across Southeast Asia.

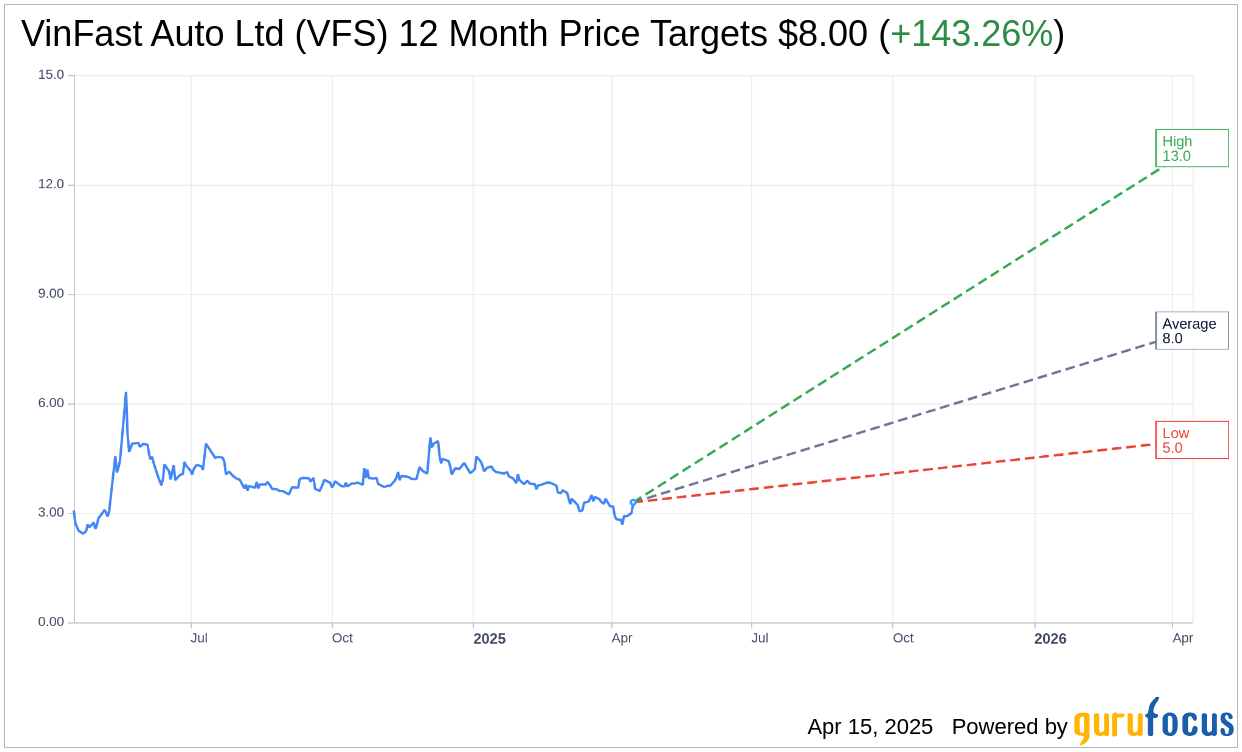

Wall Street Analysts Forecast

According to price targets from four financial analysts, the average price target for VinFast Auto Ltd (VFS, Financial) stands at $8.00. The projections range from a high of $13.00 to a low of $5.00. The average target suggests a remarkable potential upside of 143.55% from the current trading price of $3.28. Investors seeking more detailed forecast data should visit the VinFast Auto Ltd (VFS) Forecast page.

From the analysis provided by four brokerage firms, VinFast Auto Ltd (VFS, Financial) holds an average brokerage recommendation score of 1.5, categorizing it under the "Buy" recommendation. The rating system ranks from 1 to 5, where 1 represents a Strong Buy and 5 signals a Sell.