Webster Financial Corporation (WBS) has released its financial results for the first quarter of 2025, showcasing a slight improvement in its net interest margin, which rose to 3.65% from 3.61% in the previous quarter and 3.62% in the same period last year.

The company's tangible book value per common share also demonstrated growth, standing at $45.46 as of March 31, 2025. This represents an increase from $44.28 at the end of 2024 and a significant leap from $40.35 recorded on March 31, 2024.

The CEO of Webster Financial Corporation highlighted the substantial financial returns achieved in the first quarter of 2025 as a result of continued core loan and deposit growth that began towards the end of last year and extended into the beginning of this year.

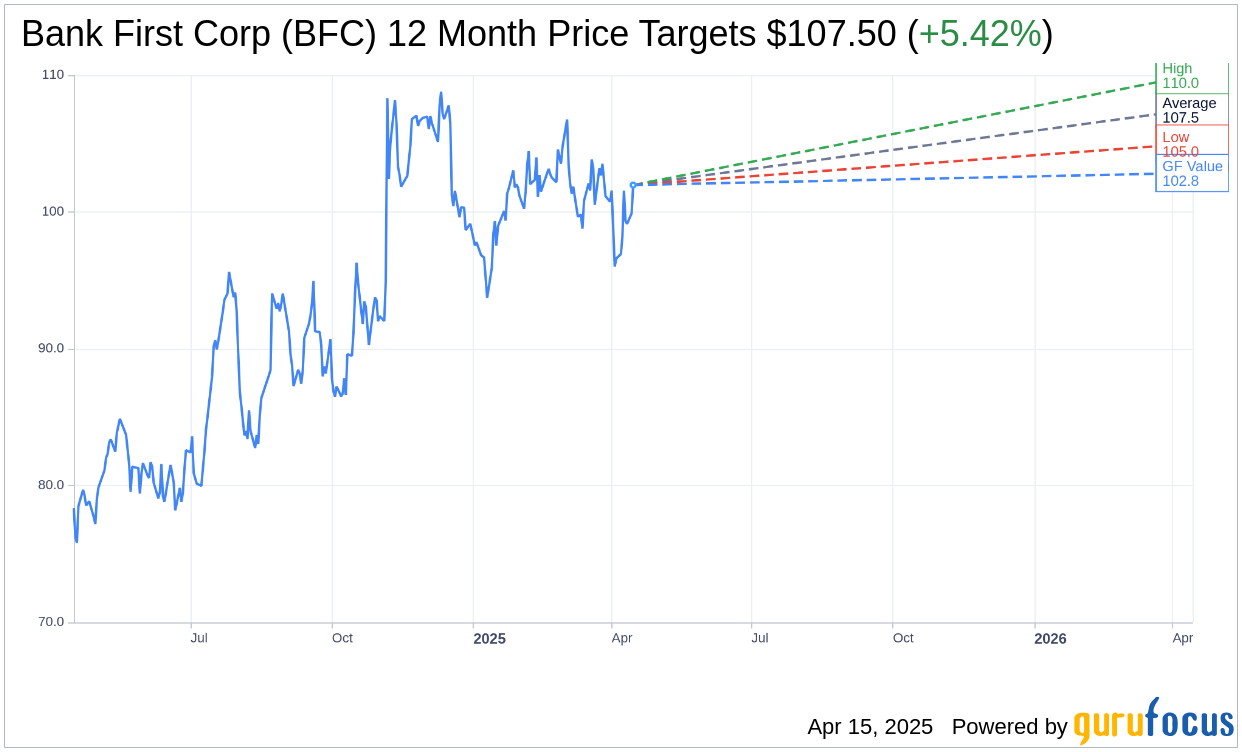

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Bank First Corp (BFC, Financial) is $107.50 with a high estimate of $110.00 and a low estimate of $105.00. The average target implies an upside of 5.42% from the current price of $101.97. More detailed estimate data can be found on the Bank First Corp (BFC) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Bank First Corp's (BFC, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Bank First Corp (BFC, Financial) in one year is $102.85, suggesting a upside of 0.86% from the current price of $101.97. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Bank First Corp (BFC) Summary page.