- Element Solutions Inc (ESI, Financial) has been upgraded to a Buy rating by Bank of America.

- The average analyst price target suggests a 62.23% upside potential.

- Strategically positioned in high-growth sectors, ESI offers compelling investment opportunities.

Element Solutions Inc (NYSE: ESI) has recently caught the attention of Bank of America, which has upgraded its rating to "Buy." The boost in confidence highlights ESI's robust earnings resilience and strategic alignment within high-growth industries. Even after a notable 34% decline in its share price, the company remains an attractive proposition due to its expansive global manufacturing presence and effective tariff mitigation strategies.

Analyst Price Targets Indicate Significant Upside

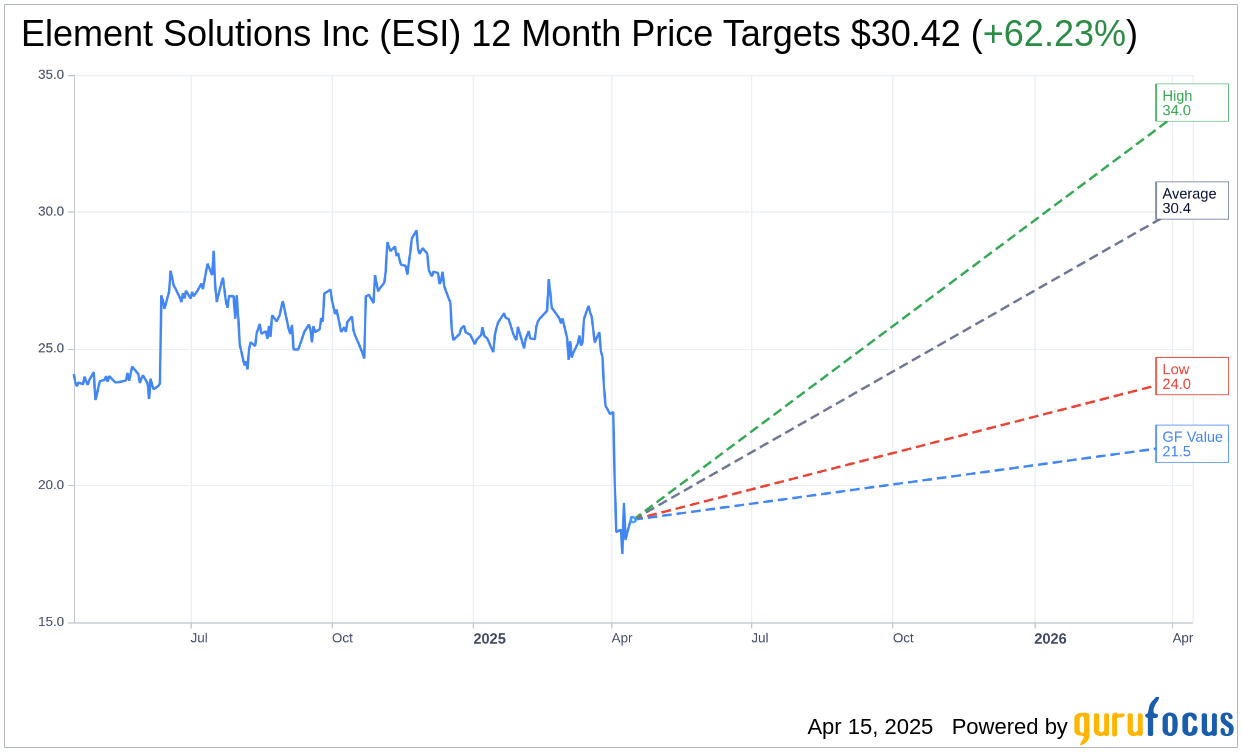

The stock's future looks promising, with 13 analysts predicting an average one-year target price of $30.42 for Element Solutions Inc. This suggests a potential upside of 62.23% from its current trading price of $18.75. Price targets vary, with $34.00 as the high estimate and $24.00 as the low. For detailed estimates, visit the Element Solutions Inc (ESI, Financial) Forecast page.

Market Recommendations Reflect Positive Sentiment

Current market sentiment is favorable towards ESI, showcasing an average brokerage recommendation of 2.1 from 13 firms, a status indicating "Outperform." The recommendation scale spans from 1, representing a Strong Buy, to 5, indicating a Sell.

GuruFocus GF Value: A Measure of Fair Trading Value

Utilizing the renowned GuruFocus metrics, the estimated GF Value for Element Solutions Inc stands at $21.53 over the next year. This reflects a projected upside of 14.83% from its current price. The GF Value assessment provides a fair trading estimate, considering historical stock multiples, past growth, and future business projections. Further insights are available on the Element Solutions Inc (ESI, Financial) Summary page.

Investors looking for opportunities in companies with robust growth potential and strategic market position may find Element Solutions Inc a worthy consideration. With substantial upside potential and strong Wall Street endorsement, ESI remains a stock to watch.