Summary:

- Omnicom Group (OMC, Financial) reported a significant 3.4% increase in Q1 2025 organic revenue.

- The company's adjusted EPS climbed to $1.70, showcasing robust financial health.

- Analysts predict a remarkable 34.98% upside potential based on price targets.

Omnicom Group's Financial Performance

Omnicom Group (OMC) demonstrated strong performance in the first quarter of 2025, highlighted by a 3.4% increase in organic revenue driven largely by media and advertising success. In further good news for investors, the company reported an adjusted earnings per share (EPS) of $1.70, underscoring its financial robustness.

Strategic Acquisition Moves

The proposed acquisition of Interpublic is advancing smoothly, with five regulatory approvals already secured. This strategic move aims to unlock substantial synergies, with Omnicom targeting cost synergies of $750 million post-acquisition, potentially enhancing future profitability.

Analyst Price Targets and Recommendations

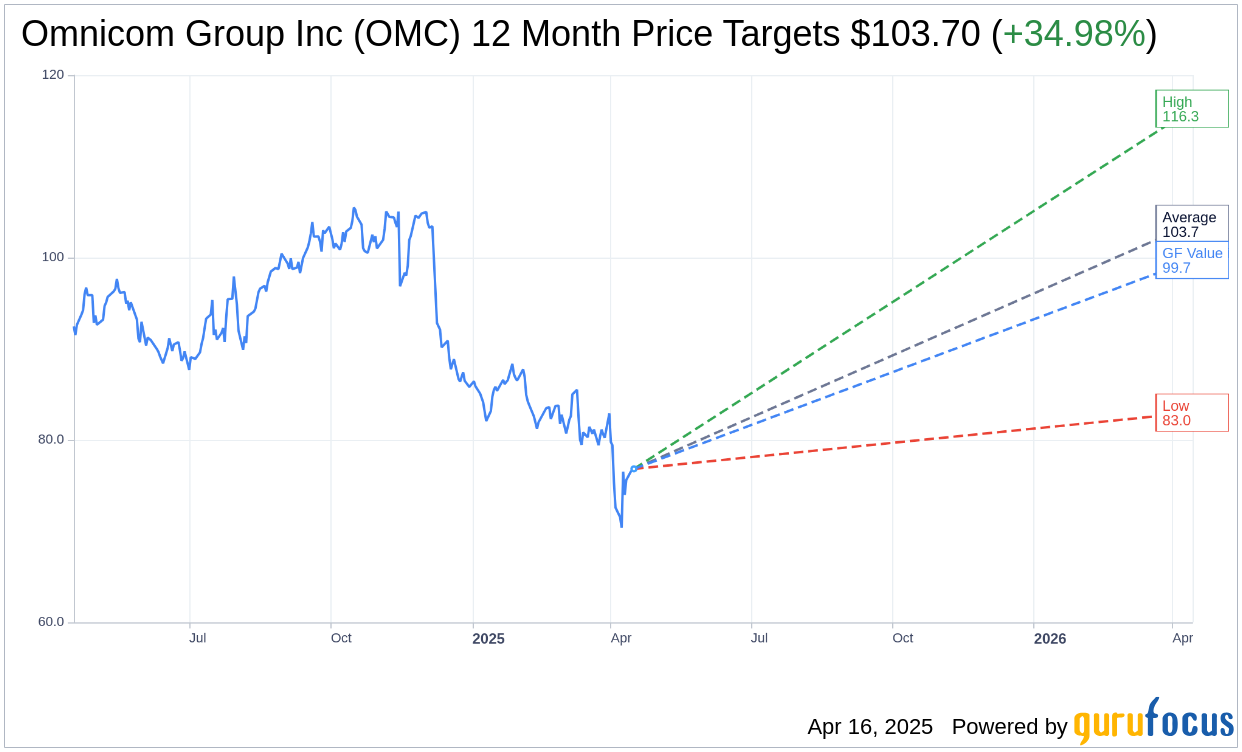

The consensus among nine analysts sets the average price target for Omnicom Group Inc (OMC, Financial) at $103.70, with estimates ranging from a low of $83.00 to a high of $116.33. This average target suggests a compelling upside potential of 34.98% from the current stock price of $76.83. For comprehensive estimates, visit the Omnicom Group Inc (OMC) Forecast page.

Furthermore, with an average brokerage recommendation of 2.3 from 12 firms, Omnicom Group Inc (OMC, Financial) is classified as "Outperform." The rating scale ranges from 1, indicating a Strong Buy, to 5, signaling a Sell.

GuruFocus Valuation Insights

According to GuruFocus estimates, the GF Value for Omnicom Group Inc (OMC, Financial) over the next year is projected at $99.74. This suggests a prospective upside of 29.82% from the current trading price of $76.83. The GF Value is a calculated estimation of the fair market value of a stock, taking into account historical trading multiples, past business growth, and projected future performance. More detailed information can be accessed on the Omnicom Group Inc (OMC) Summary page.