Key Takeaways:

- ASML Holding is anticipating a significant 50% increase in Q1 sales year-over-year.

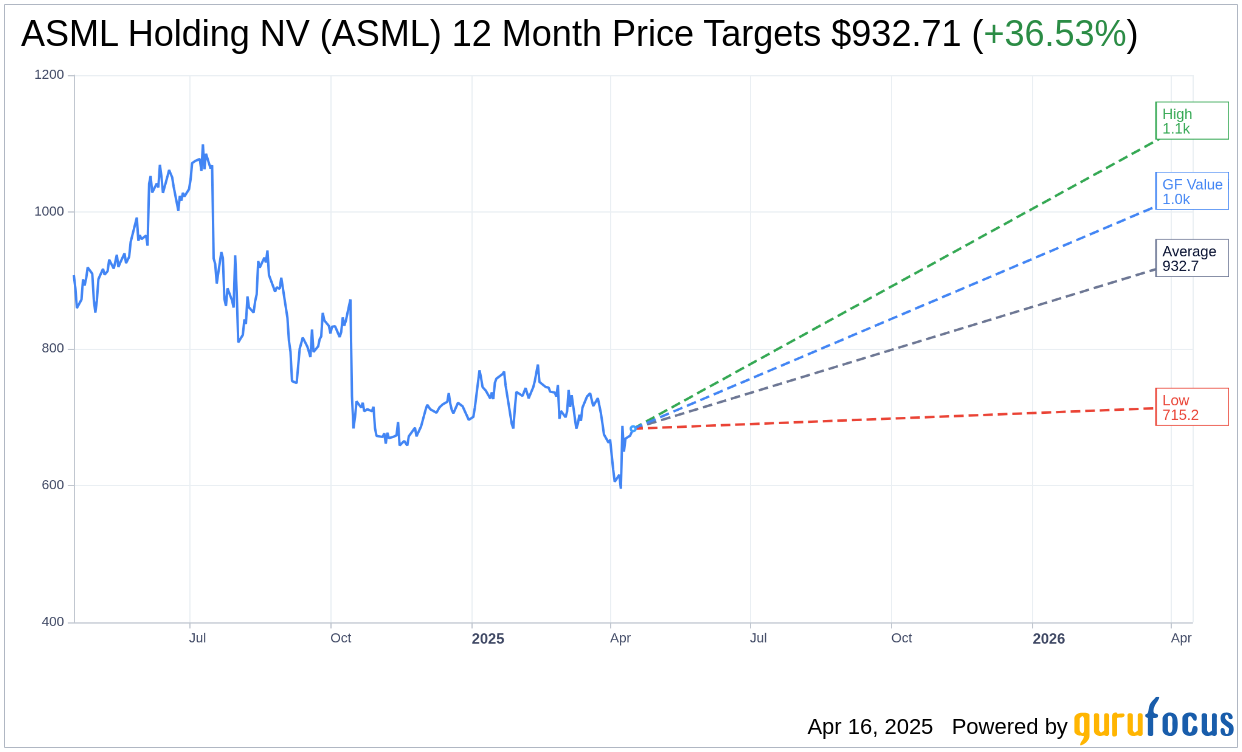

- Analysts' average price target suggests a potential 36.53% upside from the current share price.

- The consensus rating positions the stock as "Outperform," with a GF Value estimate indicating a possible 50.9% upside.

ASML Holding's Anticipated Earnings Surge

ASML Holding (ASML, Financial) is on the brink of announcing its first-quarter earnings, with excitement building over a projected sales surge of nearly 50% compared to the same period last year. Investors are keenly watching how potential chip tariffs might influence the company's impressive run.

Analyst Price Targets and Recommendations

According to projections from 12 industry analysts, ASML Holding NV (ASML, Financial) has an average price target of $932.71, which represents an upside of 36.53% from its current trading price of $683.16. The range of estimates varies, with a high of $1,133.59 and a low of $715.19. To delve deeper into these forecasts, visit the ASML Holding NV (ASML) Forecast page.

In addition to these price targets, the consensus among 15 brokerage firms places ASML Holding NV’s (ASML, Financial) recommendation at 1.8, which corresponds to an "Outperform" status. This rating scale extends from 1 (Strong Buy) to 5 (Sell), providing a clear view of the stock’s current market sentiment.

Understanding ASML's GF Value Estimate

GuruFocus estimates indicate that the one-year GF Value for ASML Holding NV (ASML, Financial) is positioned at $1030.92. With the present stock price at $683.16, this estimate suggests a significant potential upside of 50.9%. The GF Value is GuruFocus's calculated fair stock value based on historical trading multiples, past business growth, and future business performance projections. For further detailed data, explore the ASML Holding NV (ASML) Summary page.