Bernstein has revised its price target for Agilent Technologies (A, Financial), reducing it from $145 to $125. The firm maintains a Market Perform rating for Agilent's shares. This adjustment reflects growing concerns over various factors impacting the industry, including tariffs and uncertainties surrounding funding from the National Institutes of Health (NIH) and other government entities.

Moreover, the firm is cautious about potential setbacks from the Department of Health and Human Services (HHS) affecting the pharmaceutical sector. These elements are significantly influencing the expected recovery in research and development tools, which initially seemed more promising at the start of the year.

The observed impact on the health sector is more than theoretical, as indicated by the data, leading Bernstein to adopt a cautious stance as the first quarter approaches.

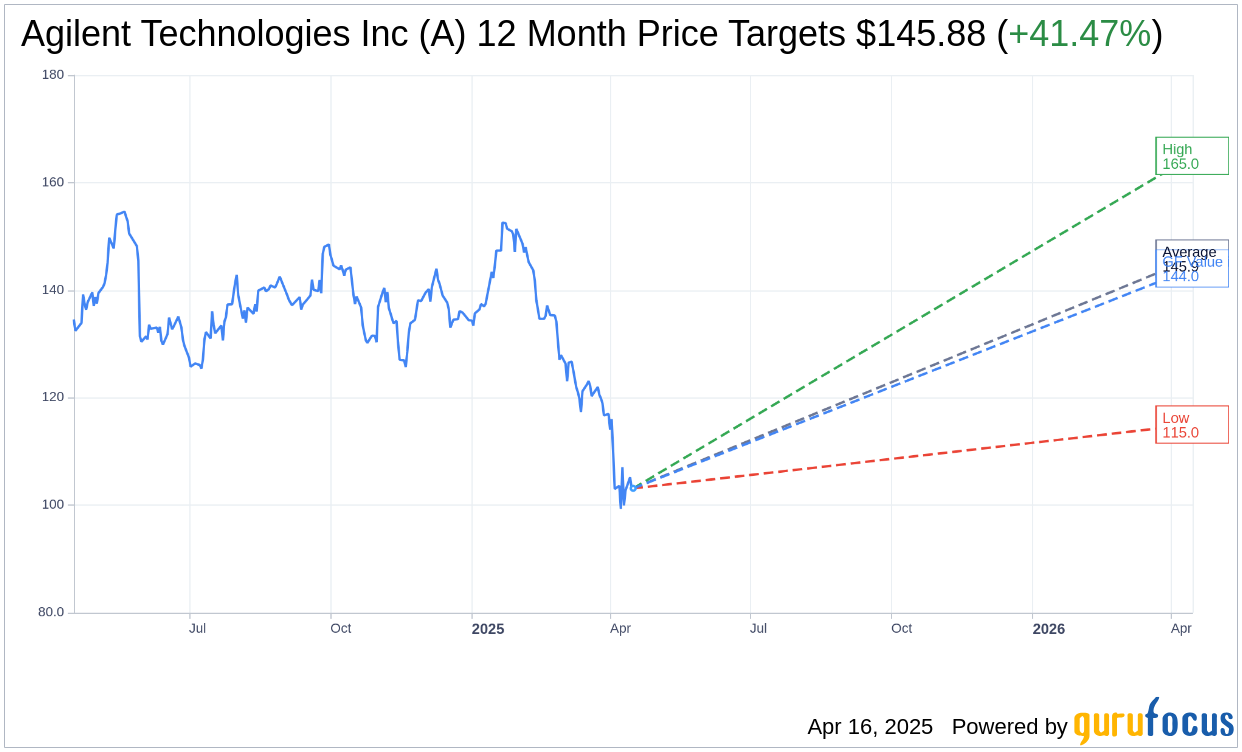

Wall Street Analysts Forecast

Based on the one-year price targets offered by 17 analysts, the average target price for Agilent Technologies Inc (A, Financial) is $145.88 with a high estimate of $165.00 and a low estimate of $115.00. The average target implies an upside of 41.47% from the current price of $103.12. More detailed estimate data can be found on the Agilent Technologies Inc (A) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Agilent Technologies Inc's (A, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Agilent Technologies Inc (A, Financial) in one year is $144.03, suggesting a upside of 39.67% from the current price of $103.12. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Agilent Technologies Inc (A) Summary page.