KeyBanc has raised its price target for AbCellera (ABCL, Financial) from $4 to $5, maintaining an Overweight rating on the stock. This adjustment comes ahead of the company's first-quarter earnings report, with the investment firm highlighting several key factors influencing the healthcare information technology (HCIT) sector.

According to KeyBanc, investor attention is increasingly directed towards legislative policies, healthcare system utilization, and macroeconomic factors, including potential economic slowdown and rising inflation. Despite concerns, the HCIT industry is currently valued less compared to the broader healthcare sector, presenting investment opportunities.

KeyBanc suggests that companies with a stable footing in healthcare markets, particularly those serving payers and large pharmaceutical firms, might face the least revenue and earnings risk in the upcoming year. This perspective underlines the importance of focusing on entities capable of outperforming market expectations over the next 12 months.

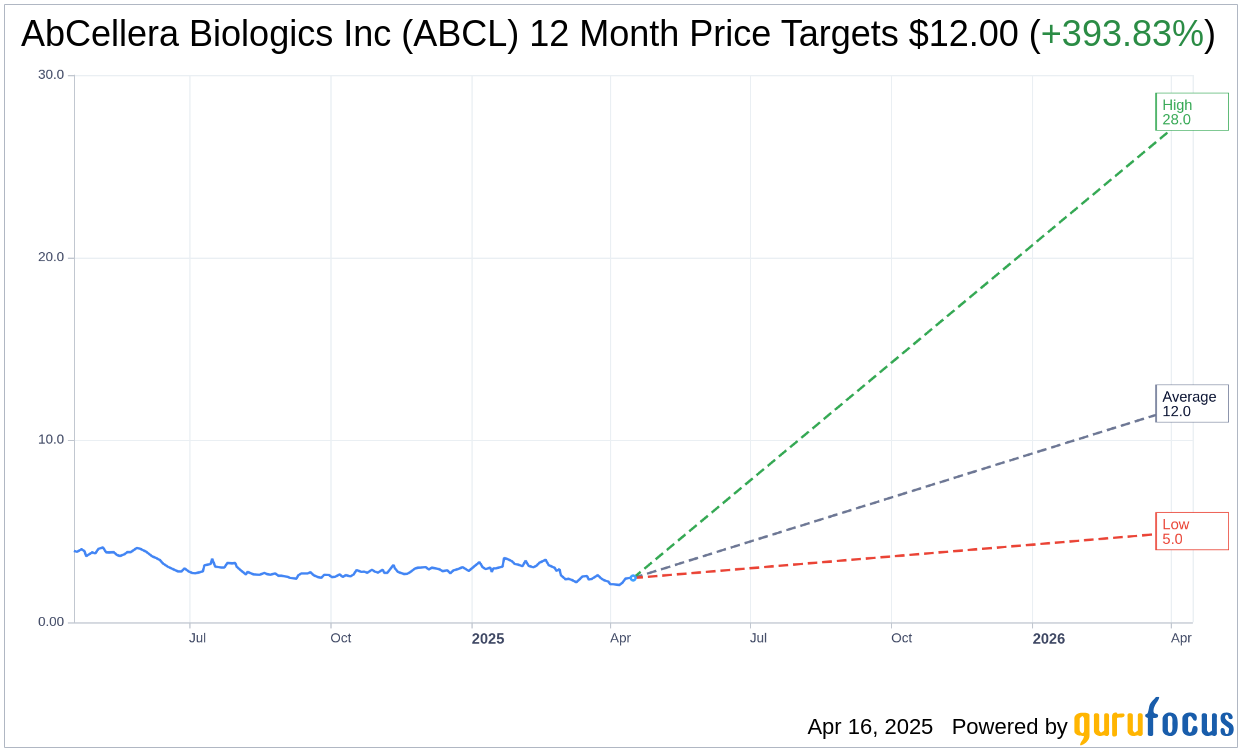

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for AbCellera Biologics Inc (ABCL, Financial) is $12.00 with a high estimate of $28.00 and a low estimate of $5.00. The average target implies an upside of 393.83% from the current price of $2.43. More detailed estimate data can be found on the AbCellera Biologics Inc (ABCL) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, AbCellera Biologics Inc's (ABCL, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for AbCellera Biologics Inc (ABCL, Financial) in one year is $1.14, suggesting a downside of 53.09% from the current price of $2.43. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the AbCellera Biologics Inc (ABCL) Summary page.