Bank of America has revised its price target for Axcelis Technologies (ACLS, Financial), reducing it from $70 to $56 while maintaining a Neutral rating on the stock. This adjustment reflects the bank's cautious outlook amid potential tariff impacts on U.S. chip vendors.

Despite expectations for stronger-than-anticipated first-quarter results due to optimistic earlier forecasts and favorable demand conditions, BofA highlights potential challenges ahead. The bank outlines multiple tariff scenarios affecting the semiconductor sector's sales and earnings.

In a scenario where tariffs are relatively modest, sales could decline by an average of 4% to 6%, whereas a more severe tariff environment could lead to sales drops of around 9% in 2025 and 12% in 2026. Earnings per share (EPS) might experience a reduction of 12% to 13% under moderate tariffs. These projections have prompted the bank to adjust targets across the semiconductor industry, reflecting rising uncertainty.

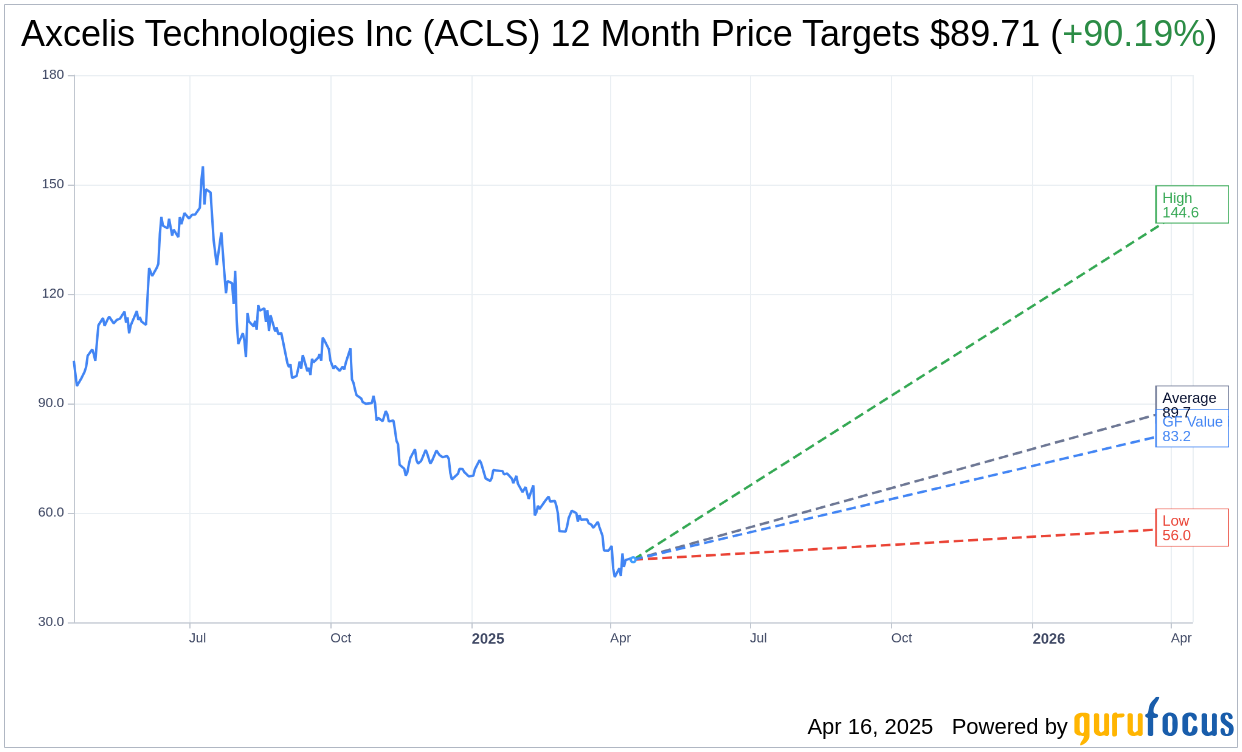

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Axcelis Technologies Inc (ACLS, Financial) is $89.71 with a high estimate of $144.57 and a low estimate of $56.00. The average target implies an upside of 90.19% from the current price of $47.17. More detailed estimate data can be found on the Axcelis Technologies Inc (ACLS) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Axcelis Technologies Inc's (ACLS, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Axcelis Technologies Inc (ACLS, Financial) in one year is $83.18, suggesting a upside of 76.34% from the current price of $47.17. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Axcelis Technologies Inc (ACLS) Summary page.