BTIG has revised its price target for Forestar Group (FOR, Financial), lowering it from $40 to $36 while maintaining a Buy rating on the stock. This adjustment comes as part of a broader assessment of the homebuilding sector as it approaches the start of its earnings season.

The firm anticipates a challenging outlook for the industry, forecasting a 7% decrease in new home sales across the United States. Additionally, the company expects an average earnings decline of 27%, attributed to waning consumer confidence. This sentiment is influenced by increased uncertainty concerning income and job security, alongside the rising cost of living and persistently high interest rates.

BTIG's updated projections underscore the potential hurdles homebuilders may face in the near term as economic pressures weigh on consumer sentiment and purchasing power.

Wall Street Analysts Forecast

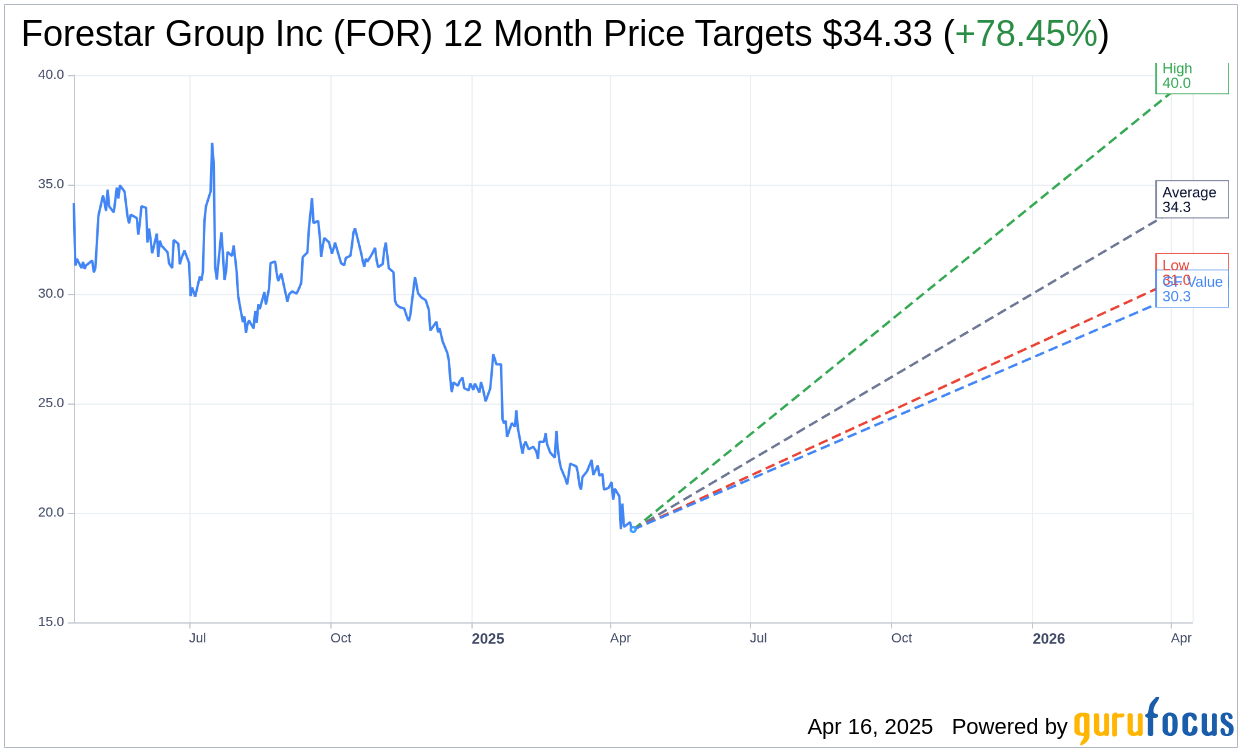

Based on the one-year price targets offered by 3 analysts, the average target price for Forestar Group Inc (FOR, Financial) is $34.33 with a high estimate of $40.00 and a low estimate of $31.00. The average target implies an upside of 78.45% from the current price of $19.24. More detailed estimate data can be found on the Forestar Group Inc (FOR) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Forestar Group Inc's (FOR, Financial) average brokerage recommendation is currently 1.5, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Forestar Group Inc (FOR, Financial) in one year is $30.25, suggesting a upside of 57.22% from the current price of $19.24. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Forestar Group Inc (FOR) Summary page.