Kingsoft Cloud Holdings (KC, Financial) has announced the pricing details for its recent underwritten public offering involving 18,500,000 American Depositary Shares (ADSs). Each ADS, priced at $11.27, represents 15 ordinary shares of the company. In terms of ordinary shares, this translates to 277,500,000 shares at HK$5.83 per share, based on an exchange rate of HK$7.7574 per USD.

Investors have the option to receive either the ADSs or the equivalent ordinary shares, which will be traded on the Hong Kong Exchange (HKEX). The underwriters plan to deliver the ADSs to purchasers on or about April 17, following a "T+1" settlement through the Depository Trust Company in the U.S. For those opting for ordinary shares, delivery is expected around April 25, adhering to a "T+5" settlement via Hong Kong's Central Clearing and Settlement System.

Furthermore, Kingsoft Cloud has granted underwriters a 30-day option to acquire up to an additional 2,775,000 ADSs at the offering price, excluding underwriting discounts and commissions. This option, if exercised, will be settled exclusively in ADSs.

Leading the underwriting for this public offering are notable financial institutions including Morgan Stanley Asia, Goldman Sachs, China International Capital Corporation Hong Kong Securities, Deutsche Bank's Hong Kong Branch, The Hongkong and Shanghai Banking Corporation, and Merrill Lynch. The completion of this offering is pending typical closing conditions.

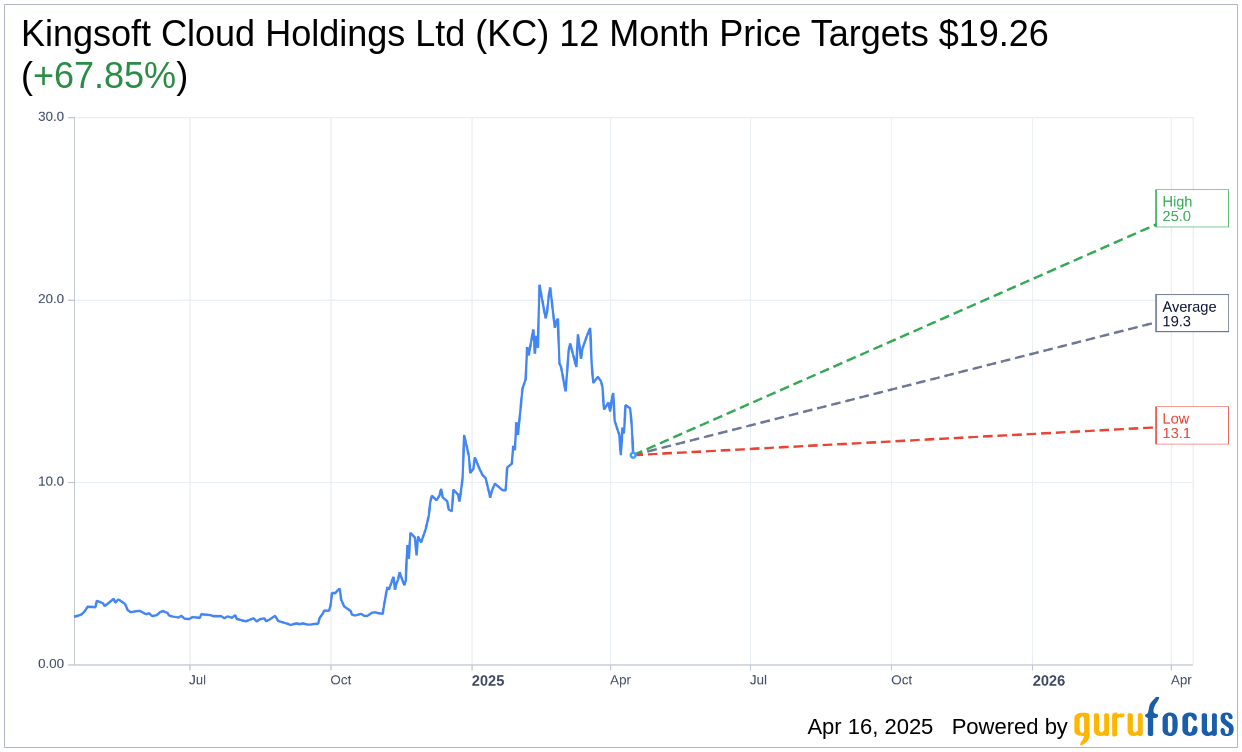

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Kingsoft Cloud Holdings Ltd (KC, Financial) is $19.26 with a high estimate of $25.00 and a low estimate of $13.10. The average target implies an upside of 67.85% from the current price of $11.48. More detailed estimate data can be found on the Kingsoft Cloud Holdings Ltd (KC) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Kingsoft Cloud Holdings Ltd's (KC, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Kingsoft Cloud Holdings Ltd (KC, Financial) in one year is $4.40, suggesting a downside of 61.66% from the current price of $11.475. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Kingsoft Cloud Holdings Ltd (KC) Summary page.