Summary:

- Advanced Micro Devices (AMD, Financial) could incur up to $800 million in charges due to new U.S. export regulations affecting AI chip sales to China.

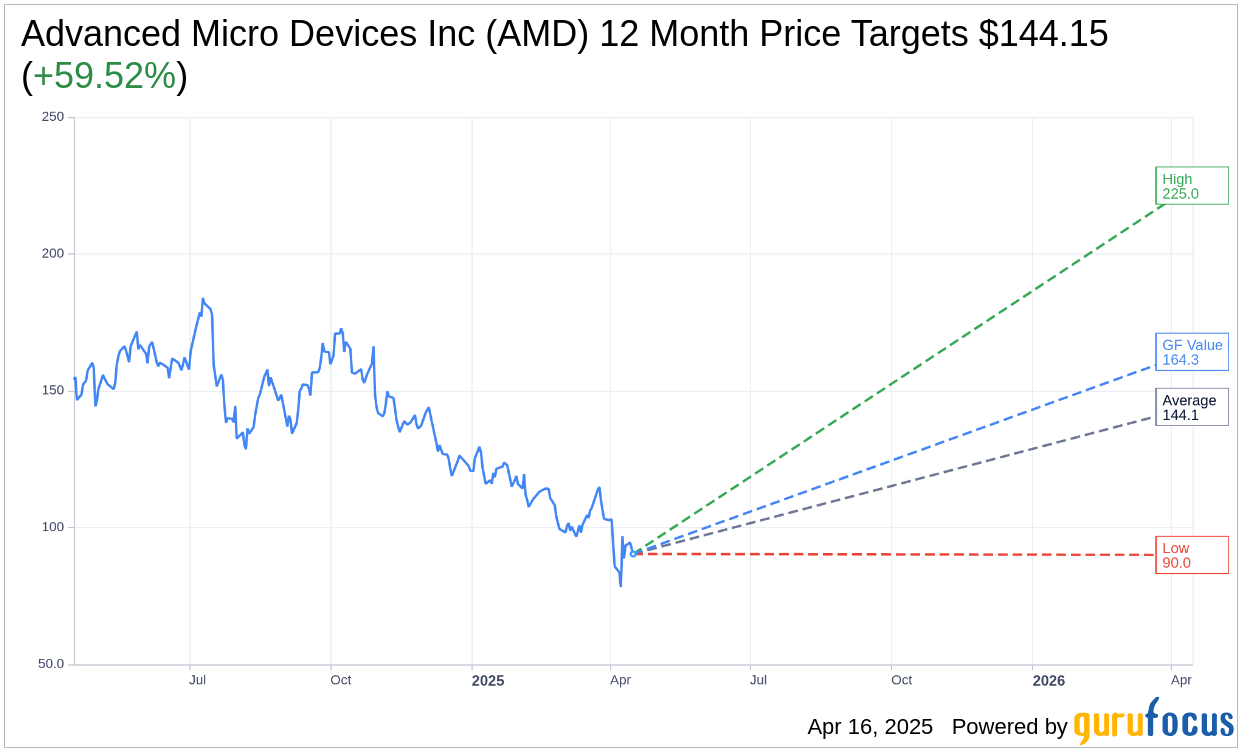

- Wall Street remains bullish with an average price target of $144.15, suggesting a 59.52% upside potential.

- GuruFocus estimates a GF Value suggesting an 81.78% upside from the current stock price.

Advanced Micro Devices (AMD) is bracing for significant challenges as new U.S. licensing requirements are expected to impact the export of its MI308 AI chips to China. This regulatory hurdle could cost the company up to $800 million, adding pressure to its stock, which has already seen a 6% decline. AMD disclosed these challenges in its initial assessment to the SEC, noting the uncertain path to securing necessary licenses.

Wall Street Analysts Optimistic Despite Challenges

Despite current obstacles, analysts are optimistic about AMD's future. The average one-year price target among 40 analysts is $144.15, with projections ranging from a high of $225.00 to a low of $90.00. This average target indicates a potential 59.52% upside from the present price of $90.36. For a deeper dive into these estimates, visit the Advanced Micro Devices Inc (AMD, Financial) Forecast page.

The company's stock has received an average brokerage recommendation of 2.3 from 50 brokerage firms, reflecting an "Outperform" status. This rating is based on a scale of 1 to 5, where 1 represents a Strong Buy, and 5 signifies a Sell.

GuruFocus Valuation Metrics

According to GuruFocus estimates, the GF Value for AMD over the next year is projected at $164.26. This suggests a potential upside of 81.78% from the current stock price of $90.36. The GF Value is derived from historical trading multiples, previous business growth, and future business performance projections. Interested investors can explore more detailed data on the Advanced Micro Devices Inc (AMD, Financial) Summary page.