Morgan Stanley has revised its price target for Check Point Software Technologies (CHKP, Financial), reducing it from $235 to $220. Despite the adjustment, the firm maintains an Equal Weight rating on the company's shares.

This modification is part of a broader assessment by Morgan Stanley, which involves reevaluating the potential risks and rewards associated with numerous software companies. The primary focus of this reevaluation is the uncertainty surrounding tariff risks and how these concerns have been reflected in current share prices.

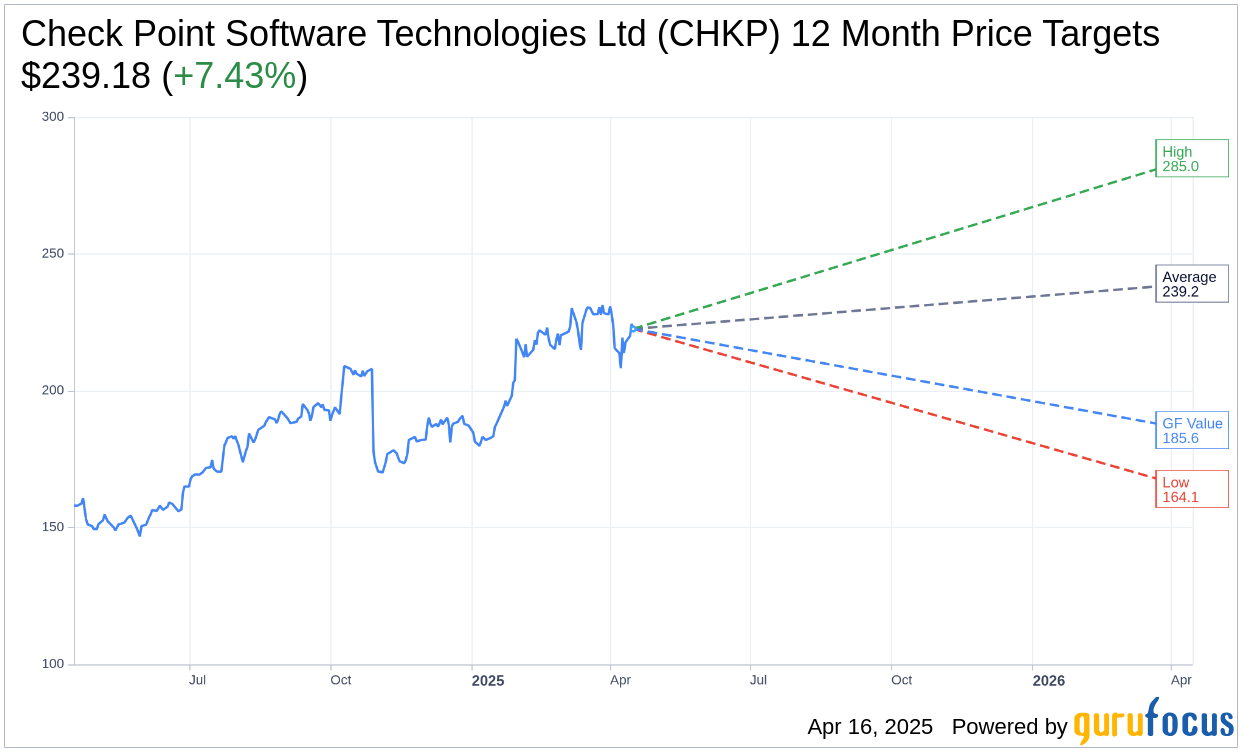

Wall Street Analysts Forecast

Based on the one-year price targets offered by 30 analysts, the average target price for Check Point Software Technologies Ltd (CHKP, Financial) is $239.18 with a high estimate of $285.00 and a low estimate of $164.14. The average target implies an upside of 7.43% from the current price of $222.63. More detailed estimate data can be found on the Check Point Software Technologies Ltd (CHKP) Forecast page.

Based on the consensus recommendation from 39 brokerage firms, Check Point Software Technologies Ltd's (CHKP, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Check Point Software Technologies Ltd (CHKP, Financial) in one year is $185.62, suggesting a downside of 16.62% from the current price of $222.63. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Check Point Software Technologies Ltd (CHKP) Summary page.