Quick Highlights:

- Progressive Corp (PGR, Financial) shares increased by 2% after exceeding Q1 expectations.

- Direct auto policies surged by 25% compared to the previous year.

- GAAP EPS rose by 11% to $4.37, with net premiums written climbing 17% to $22.2 billion.

Impressive Q1 Performance for Progressive Corp

Progressive Corp (PGR) has delivered exceptional Q1 results, witnessing its share price ascend by 2%. This growth was propelled by the company surpassing expectations, as policies in force soared to 36.3 million. Notably, direct auto policies experienced a remarkable 25% year-over-year increase, showcasing the firm's strong market presence. Moreover, the company's GAAP EPS saw an impressive 11% escalation to $4.37, while net premiums written advanced by 17%, reaching $22.2 billion. These figures underscore Progressive's robust business performance and strategic execution.

Wall Street Analysts Forecast

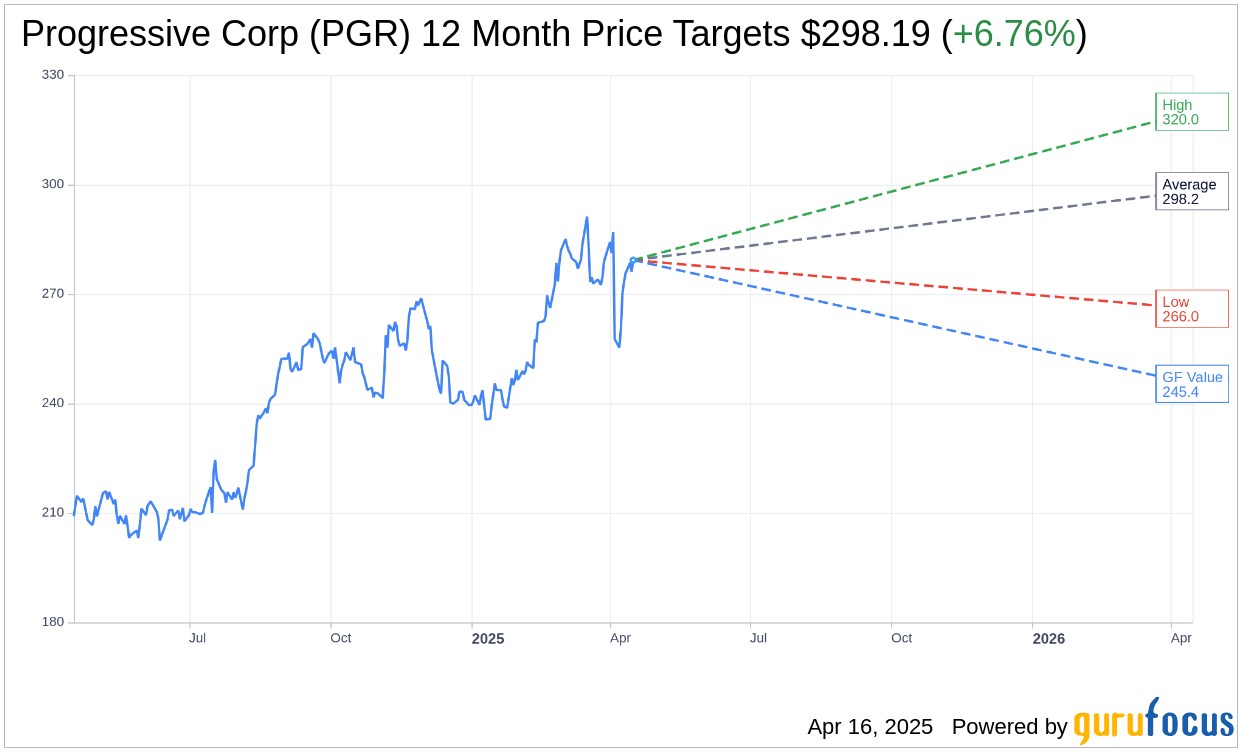

Wall Street analysts have set a positive tone for Progressive Corp, with 16 experts providing one-year price targets. The average target price stands at $298.19, offering a potential upside of 6.76% from the current price of $279.31. Analysts' forecasts range from a high estimate of $320.00 to a low of $266.00. For more detailed insights, visit the Progressive Corp (PGR, Financial) Forecast page.

In terms of brokerage recommendations, Progressive Corp (PGR, Financial) maintains an "Outperform" rating, supported by an average brokerage recommendation of 2.3 from 22 firms. This rating scale spans from 1, indicating a Strong Buy, to 5, which denotes a Sell.

GuruFocus Metrics: Evaluating GF Value

Despite the optimistic price targets, GuruFocus metrics suggest a more cautious approach. The estimated GF Value for Progressive Corp (PGR, Financial) is projected at $245.40 over the next year. This suggests a potential downside of 12.14% from its current trading price of $279.31. The GF Value considers historical trading multiples, past business growth, and forecasts of future performance to provide a fair valuation. For an in-depth exploration of these insights, refer to the Progressive Corp (PGR) Summary page.