- United Airlines (UAL, Financial) reports strong Q1 2025 results with record revenue, despite economic challenges.

- Analyst predictions suggest significant upside potential for UAL with a robust average target price.

- GuruFocus estimates indicate a potential downside based on GF Value assessments.

United Airlines (UAL) has demonstrated resilience in its latest financial performance, reporting an impressive Q1 2025 revenue of $13.2 billion, marking a 5.4% increase from the previous year. This achievement comes amid a challenging economic environment, where effective cost management and strategic capacity adjustments have allowed the airline to maintain a solid pretax margin. The company anticipates its full-year EPS to be between $11.50 and $13.50.

Wall Street Analysts Forecast

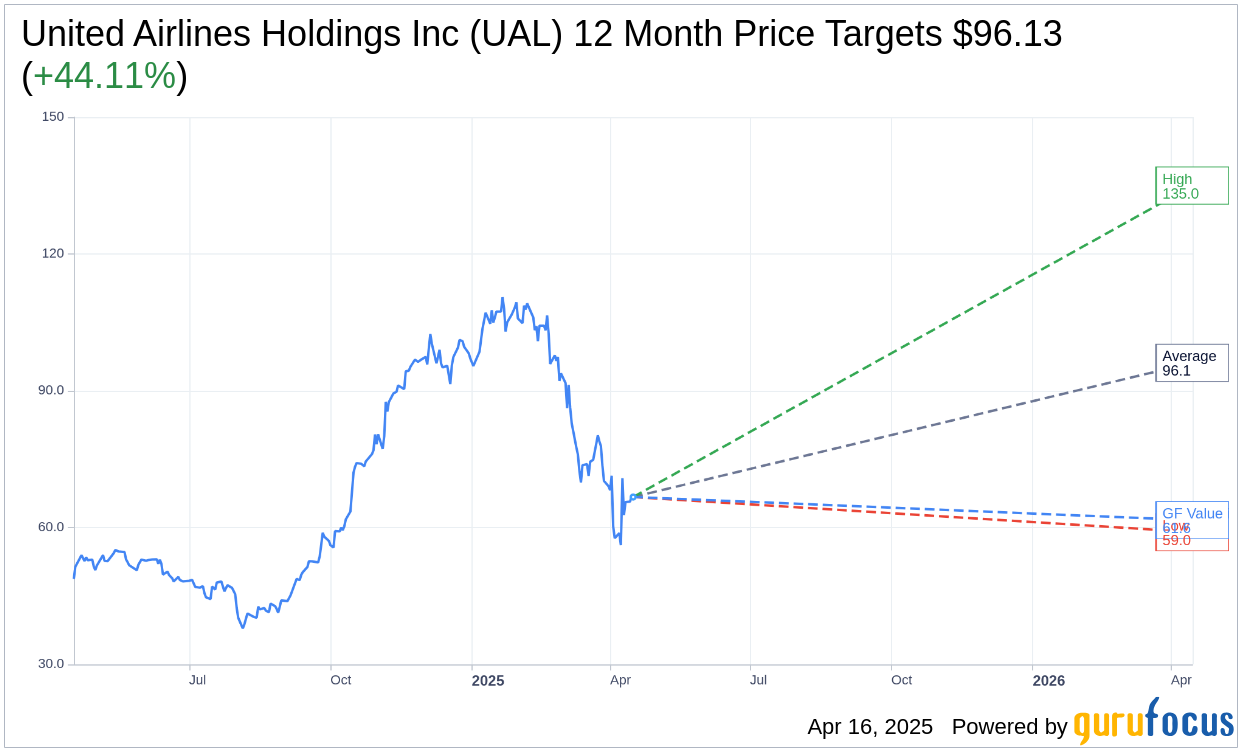

According to the one-year price targets proposed by 18 analysts, United Airlines Holdings Inc (UAL, Financial) has an average target price of $96.13. This projection ranges from a high of $135.00 to a low of $59.00, reflecting an anticipated upside of 44.11% from its current trading price of $66.71. Investors can delve into more detailed estimates by visiting the United Airlines Holdings Inc (UAL) Forecast page.

The broader consensus from 23 brokerage firms positions United Airlines Holdings Inc (UAL, Financial) with an average brokerage recommendation of 1.8, which corresponds to an "Outperform" rating. This scale is based on a range from 1 to 5, where 1 equates to a Strong Buy and 5 represents a Sell.

Conversely, based on GuruFocus metrics, the calculated GF Value for United Airlines Holdings Inc (UAL, Financial) in the coming year is $61.63. This suggests a potential downside of 7.62% from the company's current share price of $66.71. The GF Value is derived from historical trading multiples, past business growth, and future business performance forecasts. To explore more comprehensive data, visit the United Airlines Holdings Inc (UAL) Summary page.