- Paychex, Inc. (PAYX, Financial) strategically expands by acquiring Paycor HCM, Inc., strengthening its foothold in human capital management.

- Analysts project an average price increase for Paychex shares, suggesting a modest future upside.

- GuruFocus' GF Value indicates a slight potential downside, demanding investor caution.

Paychex, Inc. (PAYX) has successfully completed its acquisition of Paycor HCM, Inc., a strategic endeavor designed to fortify its position within the human capital management arena. This acquisition is anticipated to unlock new revenue streams and broaden Paychex's suite of payroll and talent software solutions.

Analyst Insights and Price Predictions

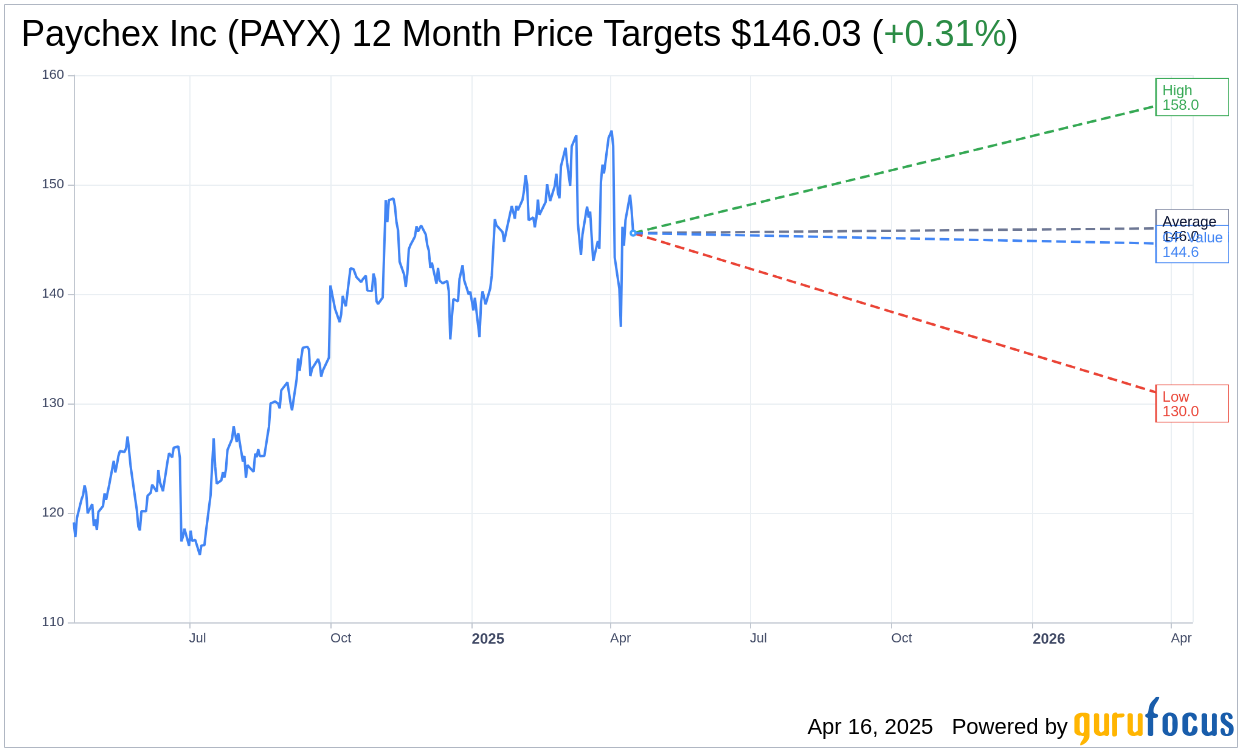

According to projections from 14 financial analysts, the average price target for Paychex Inc (PAYX, Financial) over the next year stands at $146.03. The estimates range from a low of $130.00 to a high of $158.00. This average price target represents a potential upside of 0.31% relative to the current trading price of $145.57. For a more comprehensive analysis, visit the Paychex Inc (PAYX) Forecast page.

Brokerage Industry Recommendations

The consensus recommendation, compiled from 18 brokerage firms, places Paychex Inc (PAYX, Financial) at an average recommendation of 3.1, which corresponds to a "Hold" status. The recommendation scale varies from 1 to 5, with 1 indicating a Strong Buy and 5 indicating a Sell.

Evaluating Paychex’s Future Value

GuruFocus projects the GF Value for Paychex Inc (PAYX, Financial) in the coming year as $144.56, suggesting a possible downside of 0.69% from its current price of $145.57. GF Value represents GuruFocus' estimation of the stock's fair market value, taking into account past trading multiples, historical business growth, and future performance predictions. More in-depth insights are accessible on the Paychex Inc (PAYX) Summary page.