Quick Summary:

- Taiwan Semiconductor Manufacturing Company (TSM, Financial) exceeds earnings expectations but misses on revenue.

- Wall Street analysts foresee a significant upside potential, with a consensus rating of "Outperform".

- GuruFocus values TSM at $202.63, indicating a promising growth potential of 33.6%.

Taiwan Semiconductor Manufacturing Company (TSM) recently announced a noteworthy GAAP EPADR of $2.12, outpacing market expectations by $0.06. Despite this positive earnings surprise, the company's quarterly revenue of $25.53 billion fell short by $190 million, highlighting challenges in specific markets, especially within the Americas. Nonetheless, TSM continues to play a pivotal role in advancing AI infrastructure, marking its importance in the tech sector.

Wall Street Analysts' Insights

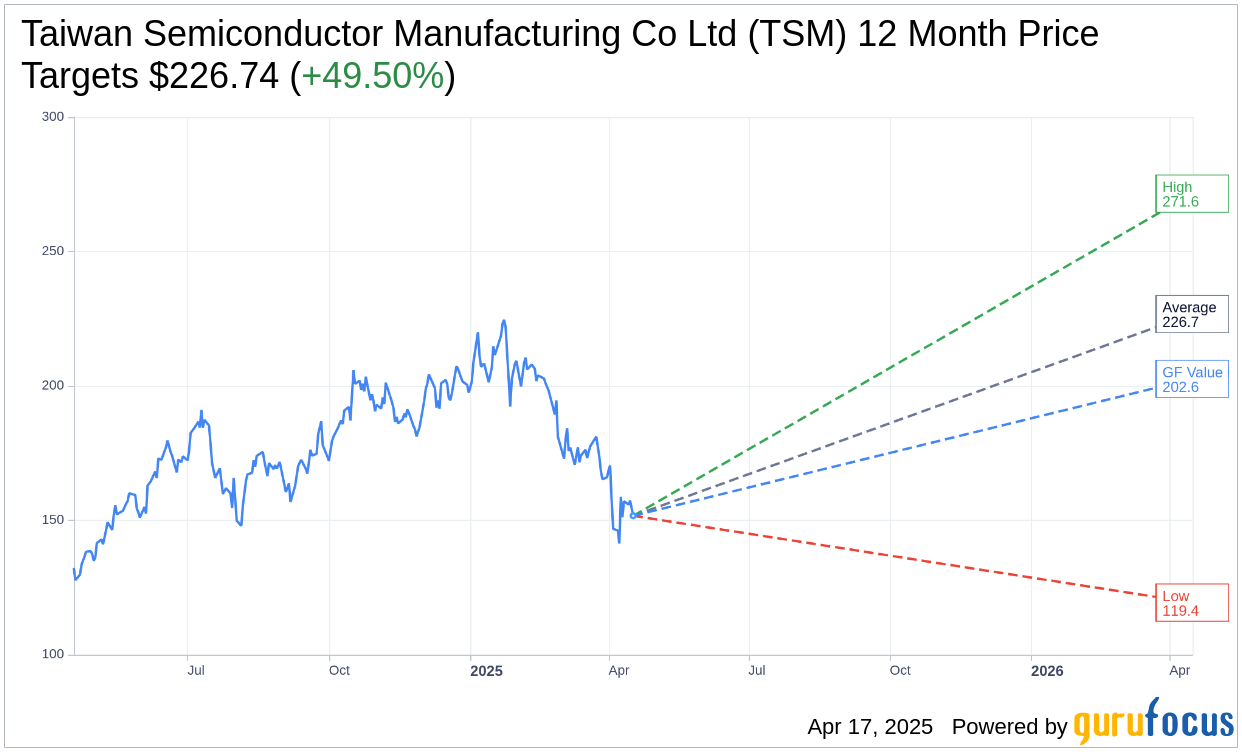

Wall Street remains optimistic about Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial), with 16 analysts projecting a one-year average target price of $226.74. This projection suggests a substantial upside of 49.50% from the current trading price of $151.67. The highest estimate stands at $271.55, while the most conservative figure is $119.37. For a deeper dive into these projections, visit the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Forecast page.

Moreover, the consensus from 18 brokerage firms posits an average recommendation of 1.6 for Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial), categorizing it as an "Outperform". This rating emanates from a scale ranging from 1 (Strong Buy) to 5 (Sell), positioning TSM as a compelling investment opportunity.

Evaluating GF Value

According to GuruFocus, the estimated GF Value for TSM in the coming year is calculated to be $202.63. This evaluation indicates a potential appreciation of 33.6% from the current price. GF Value represents an insightful assessment of a stock's fair trading value, derived from historical trading multiples coupled with past business growth and projected future performance. For further insights, investors can explore the Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) Summary page.