Key Insights:

- Taiwan Semiconductor (TSM, Financial) shares surged by 5% following a substantial 60% profit spike in Q1.

- Projected Q2 revenue is set between $28.4B and $29.2B, surpassing expectations.

- Analyst consensus rates TSM as "Outperform" with a notable upside potential.

Taiwan Semiconductor's Robust Performance

Taiwan Semiconductor (TSM) has captured investor attention with a noteworthy 5% rise in its share price. This surge reflects the company's impressive 60% year-over-year profit increase for the first quarter, primarily fueled by heightened demand for AI chips. Looking ahead, Taiwan Semiconductor projects that its second-quarter revenue will exceed expectations, ranging from $28.4 billion to $29.2 billion. This strategic foresight indicates potential robust revenue growth over the upcoming years.

Wall Street Analysts’ Predictions

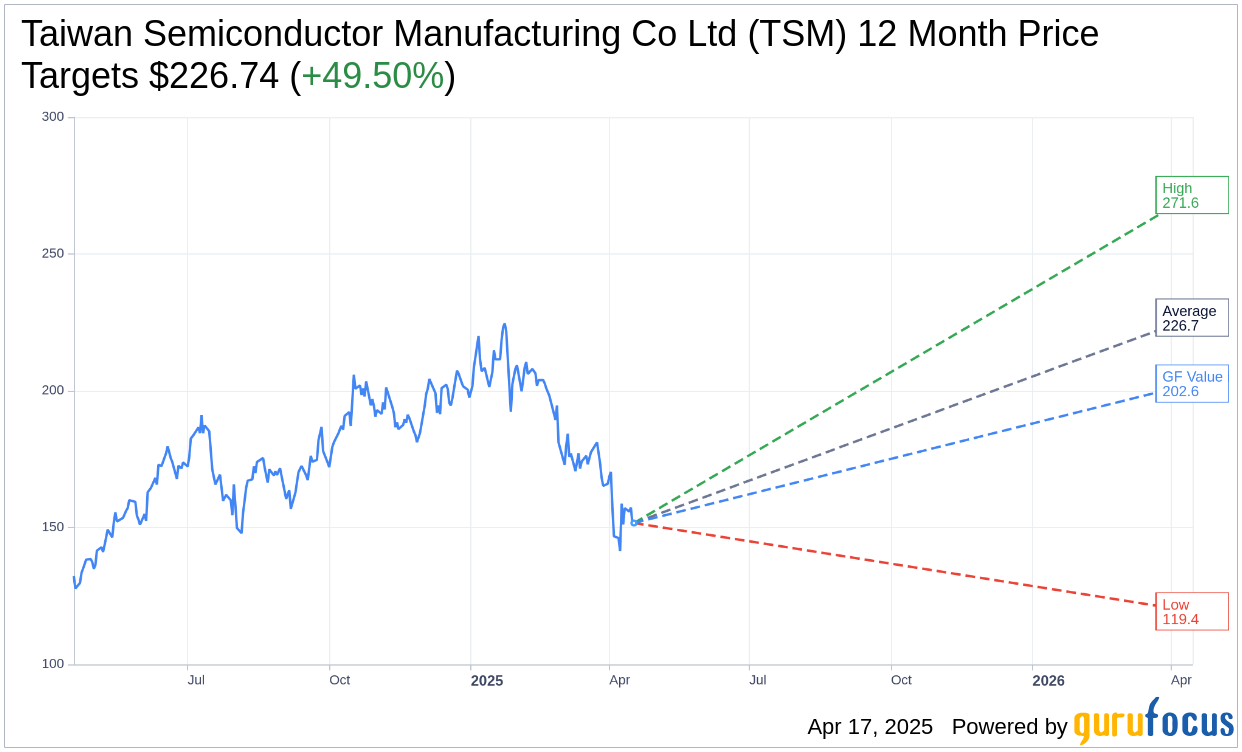

Wall Street analysts are optimistic about Taiwan Semiconductor's prospects. Based on one-year price targets from 16 analysts, the average target price for TSM is expected to hit $226.74. The projections vary, with the highest estimate reaching $271.55 and the lowest at $119.37. This average target suggests a potential upside of 49.50% from the current market price of $151.67. For more in-depth estimate data, visit the Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) Forecast page.

Analyst Recommendations

The consensus among 18 brokerage firms places Taiwan Semiconductor at an average recommendation of 1.6, signifying an "Outperform" rating. It's important to note that the rating scale ranges from 1 to 5, where 1 indicates a Strong Buy and 5 signifies a Sell. This favorable rating underscores analysts' confidence in TSM's future potential.

Estimations from GuruFocus Metrics

According to GuruFocus estimates, the projected GF Value for Taiwan Semiconductor in one year stands at $202.63. This suggests a projected upside of 33.6% from the current price of $151.67. The GF Value metric is GuruFocus' assessment of the stock's fair trading value, calculated based on historical trading multiples, past business growth, and future performance projections. For additional detailed data, refer to the Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) Summary page.