The company has reported a net interest margin of 3.19% for the first quarter of 2025, marking a 26 basis point improvement from the fourth quarter of 2024. This positive trend was accompanied by an increase in tangible book value per share, which rose to $67.97, up from $66.32 at the end of the previous quarter.

Key capital ratios have also improved. The common equity tier 1 (CET1) ratio is now at 11.6%, an increase from 11.4%, while the tier 1 capital ratio climbed to 13.1% from 12.8%. The total capital ratio saw a rise to 15.6% from 15.4%, and the leverage ratio increased to 11.8% from 11.3% as of March 31, 2025.

Rob Holmes, CEO, highlighted the strategic advantage of the company's diversified product suite and robust balance sheet as key factors in supporting client goals. Holmes emphasized the significant year-over-year improvements in financial and operating metrics, reinforcing their commitment to achieving financial targets for the latter half of the year.

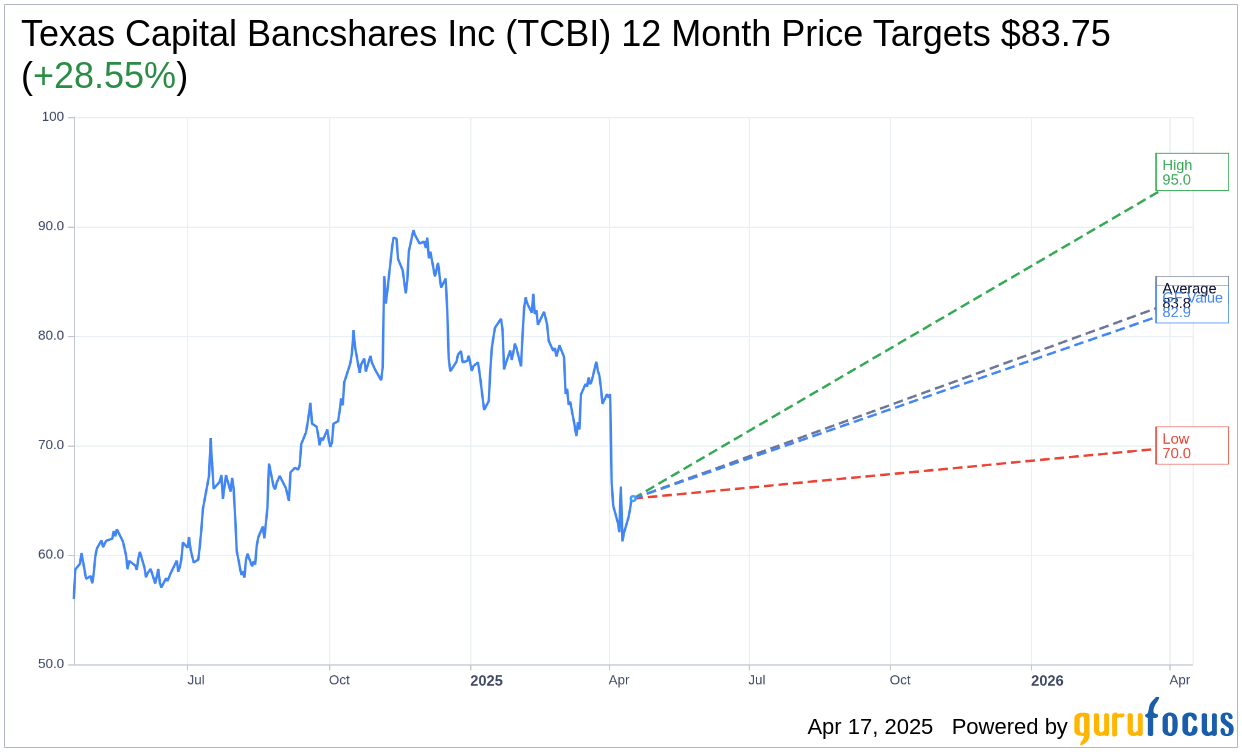

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for Texas Capital Bancshares Inc (TCBI, Financial) is $83.75 with a high estimate of $95.00 and a low estimate of $70.00. The average target implies an upside of 28.55% from the current price of $65.15. More detailed estimate data can be found on the Texas Capital Bancshares Inc (TCBI) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Texas Capital Bancshares Inc's (TCBI, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Texas Capital Bancshares Inc (TCBI, Financial) in one year is $82.89, suggesting a upside of 27.23% from the current price of $65.15. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Texas Capital Bancshares Inc (TCBI) Summary page.